- Bitcoin’s consolidation at $92,400 support hints at the potential for renewed momentum toward $100K.

- Declining exchange reserves and strong blockchain trends underscore sustained investor interest.

- Institutional profit-taking could extend consolidation, creating opportunities in altcoins.

- Looking for more actionable trade ideas? Subscribe here for up to 55% off as part of our Bird Black Friday sale!

Bitcoin ’s 40% surge in November captured trader optimism, fueled by the so-called “Trump effect.” Yet, despite the rally, the cryptocurrency stalled just shy of the psychological $100K milestone, closing the month in consolidation mode. A profit-taking spree at $98,000 dampened momentum, leaving traders wondering if Bitcoin can overcome this key resistance.

The past week’s movements reveal a complex interplay between selling pressure from long-term investors and fresh buying activity. While whales have capitalized on the rally, selling significant portions of their holdings, blockchain data tells a bullish story. External wallets show growing Bitcoin reserves, while centralized exchanges report declining BTC balances—suggesting many market participants remain optimistic despite temporary headwinds.

$92,400 Support Holds Firm Amid Shifting Market Flows

Selling pressure from profit-takers pushed Bitcoin to test the $92,400 support zone, but a robust bounce at this level indicates the correction might be contained. Meanwhile, institutional flows are reshaping Bitcoin’s short-term trajectory. Spot Bitcoin ETFs saw record monthly inflows, but institutions began taking profits as month-end approached, redirecting gains into altcoins.

This shift highlights a broader market trend. Bitcoin’s dominance dropped from 60% to 57%, as altcoins like Ethereum outperformed. Ethereum posted a 6% weekly gain, dwarfing Bitcoin’s 2% decline, signaling growing investor interest in the broader crypto market.

Macro ) Winds Favor Bitcoin, But Catalysts Remain Scarce

Macroeconomic developments have added a subtle tailwind to Bitcoin. Last week’s weaker U.S. dollar , spurred by dovish inflation data and shifting sentiment around proposed Trump tariffs, provided fresh support. As the DXY index faltered, Bitcoin buying picked up from key support levels.

However, a lack of major catalysts could weigh on momentum. With the holiday season ahead, thinner trading volumes might lead to subdued volatility, leaving Bitcoin in a holding pattern unless a significant driver emerges.

Key Levels to Watch

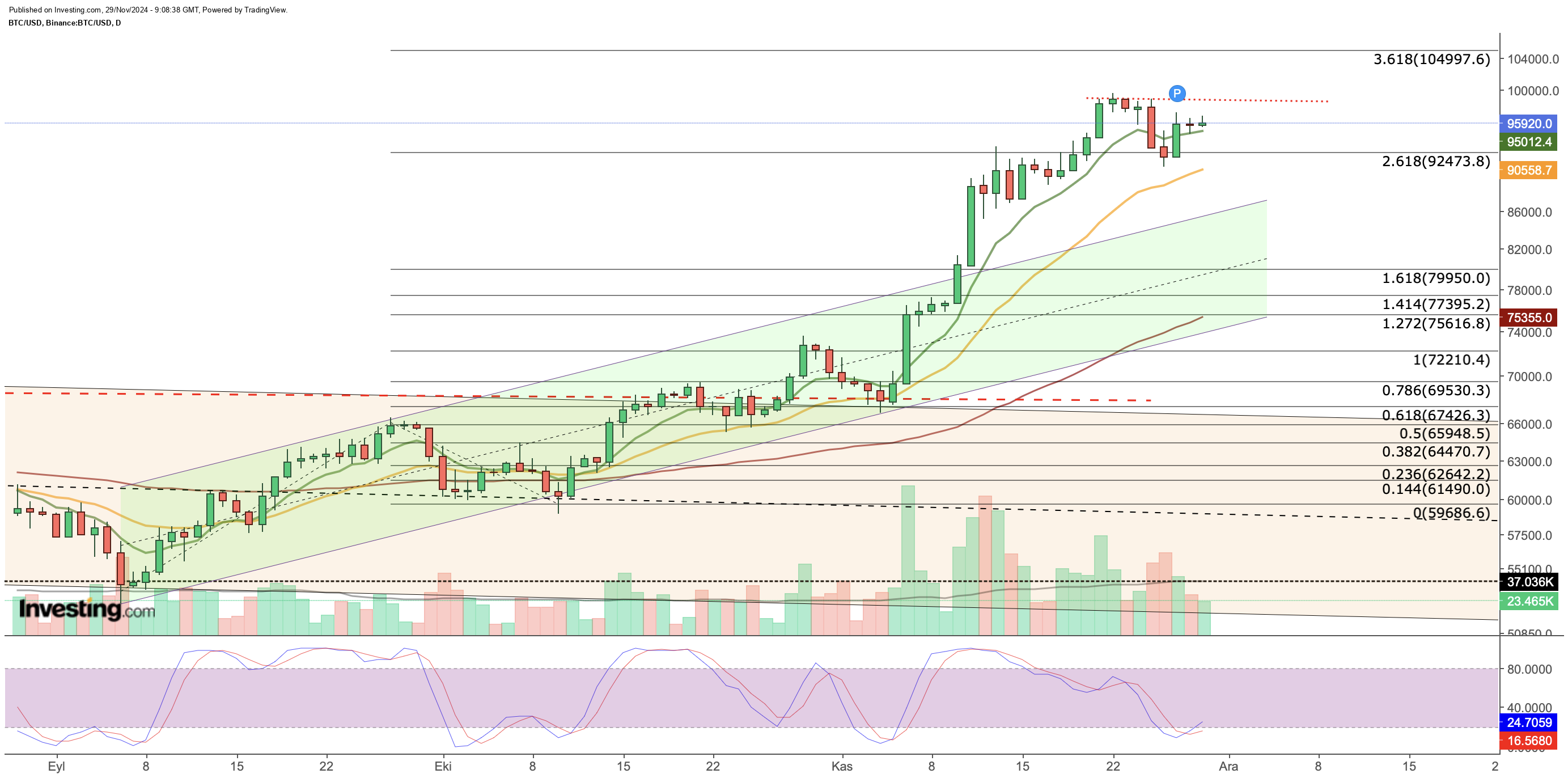

Bitcoin’s technical outlook remains bullish despite recent consolidation. The $92,400 support, aligned with the Fib 2.618 level of September’s rally, has proven resilient and now serves as a key floor. To the upside, $99,000 looms as the next critical resistance. A daily close above this level could open the door to reclaiming $100K and possibly targeting $105K, guided by Fibonacci projections.

Short-term support rests at the 8-day EMA near $95,000, which has consistently held during pullbacks. On a broader scale, Bitcoin remains within a rising weekly channel. The upper boundary at $105K aligns with the Fib 2.618 extension, serving as a potential top for the next leg up.

Still, traders should remain cautious. Breaching the $92,400 support could signal a deeper correction, with $85,000 emerging as the next downside target. For now, all eyes are on Bitcoin’s ability to retake $100K and reignite the rally.

***

Ever wondered how top investors consistently outperform the market? With InvestingPro , you’ll unlock access to their strategies and portfolio insights, giving you the tools to elevate your own investing game.

But that’s not all—our AI-powered analysis delivers several stock recommendations every month, tailored to help you make smarter, faster decisions.

Ready to take your portfolio to the next level? !

***

Disclaimer: This article is for informational purposes only and does not constitute financial advice or a recommendation to invest. Cryptocurrencies are inherently volatile, and any investment decision carries risk. Always conduct thorough research and consult a financial advisor when necessary.