Key Takeaways

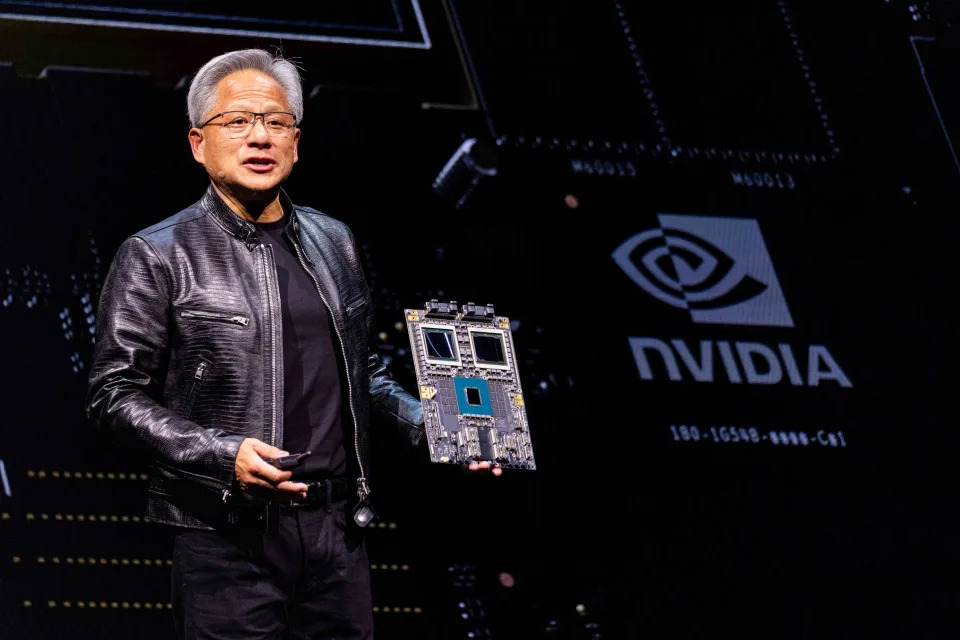

Nvidia ( NVDA ) Chief Executive Officer (CEO) Jensen Huang will deliver the opening keynote at a major consumer electronics show on Monday, with many analysts viewing the event as a potential growth catalyst for the chipmaking giant.

All but one of the 21 analysts covering the company who are tracked by Visible Alpha maintain a “buy” or equivalent rating, with analysts at Morgan Stanley, Bank of America, and Bernstein recently naming it a "top pick." The consensus price target is about $177, a roughly 28% premium over the chipmaker’s intraday Thursday level.

When Huang delivers the keynote address on Monday, the spotlight will be on Nvidia’s Blackwell GPUs , which are used to power generative artificial intelligence (AI) processes like large language models (LLMs) .

Citi Analysts Point to High Demand for Blackwell

Analysts at Citi said in late November that they expect Nvidia to raise sales expectations for Blackwell as the company works to meet what Huang has called “insane” demand . On Nvidia’s earnings call in November, Huang said Nvidia expects to deliver more Blackwell platforms in the current quarter than previously estimated.

Citi also expects Huang to discuss a demand inflection in artificial intelligence (AI) robotics “around warehouses, manufacturing, and humanoid AI robots.” The company may also discuss Rubin , a successor to Blackwell chips that Huang unveiled in June and said would release in 2026.

CES comes after Nvidia’s stock wrapped up a stellar 2024. Despite shares entering correction territory last month, Nvidia stock surged about 170% in 2024 as Big Tech customers—including Microsoft ( MSFT ), Meta Platforms ( META ), and Alphabet’s ( GOOGL ) Google—beefed up their AI data-center and cloud computing infrastructure. Last year's big gain for Nvidia came on the heels of a 240% stock-price increase in 2023.

Read the original article on Investopedia