Range-Trading Confluence

By James B. Stanley

Traders will often say that they are looking for a ‘confluence,' of factors before entering a trade. This simply means that they want the trade to look like a good idea from more than one AI DataMind.

There may be a current currency pair exhibiting such behavior.

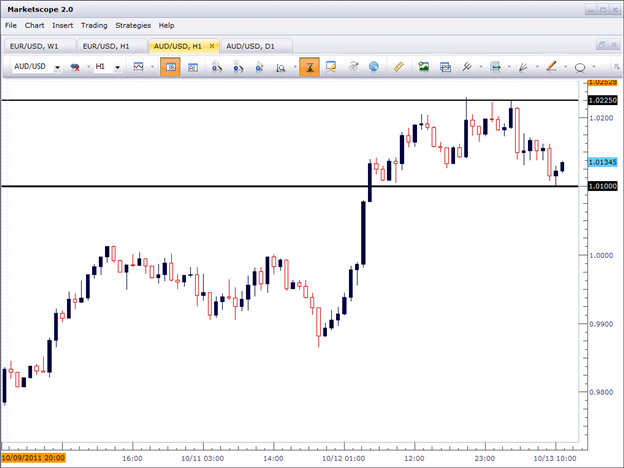

As the market swings like a pendulum waiting for its next motivation to strive to new support or new resistance; price has proven to be range bound. If viewed from the hourly chart, many of the major and commodity currency pairs are exhibiting this type of behavior (please see below).

(Created with Trading Station 2.0/Marketscope)

As you can see on this hourly chart of AUD/USD , price has recently reflected off of the 1.0100 psychological support level; which in and of itself, considering recent price action, could be enough motivation for the range trader to trigger a position.

But this is one of those areas in which confluence may be available. Using the 13x2 Range strategy that I had discussed in our previous article ( please click here to access ), there could be a pending potential opportunity on the pair.

The first part of the strategy seeks to ensure that previous price action has been showing range-bound behavior, and for that I use ADX, or the Average Directional Index. I look for readings of below 30 to identify ranges. As you can see from the hourly AUD / USD chart, ADX is currently reading below 30:

(Created with Trading Station 2.0/Marketscope)

If ADX is reading below 30, I can then move on to step 2 looking for a ‘trigger,' to initiate my position. For the trigger in this strategy, I use CCI, or the Commodity Channel Index. I simply look for crosses down and under +100 for short positions, or crosses up and over -100 to look for long positions.

CCI has recently crossed up and over -100, giving me a signal to look at potential long positions.

(Created with Trading Station 2.0/Marketscope)

This is confluence.

I now have 2 reasons that I like the trade, and I can then look to employ my money, trade, and risk management on this ranging opportunity.

To contact James Stanley, please email [email protected]. You can follow James on Twitter @JStanleyFX.

To join James Stanley's distribution list, please click here.