In our live webinar sessions each day we emphasize taking trades in the direction of the Daily trend as they will be the trades with a higher probability of success.

Simply because a trader sees a trading signal to take a trade against the trend, does not mean they should take it. Ideally, in an uptrend traders should only be looking for signals to buy the pair.

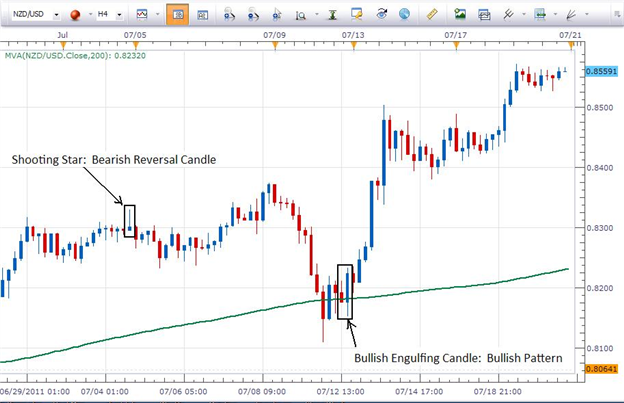

A good example of this is shown on the 4 hour chart of the NZDUSD pair below…

A Shooting Star candle, as seen above, at the top of a bullish move signals a reversal in price action…in other words, a move to the downside. When checking the Daily chart of this pair, however, there is a strong uptrend that is in place. Hence, a trader would ignore this “counter trend” signal.

The blue Bullish Engulfing candle on the chart, however, signals taking a buy position. In this instance the trader would take the trade since it signals a higher probability trade…one in the direction of the overall trend.

Once the Bullish Engulfing candle closes, the trader would enter the trade at the open of the next candle with a stop below the lower wick of Bullish Engulfing Candle.

If you are a live client and want to learn more about Candlestick interpretation, click HERE for access to our Trading Course. When prompted for a username and password, put in your live account login credentials and scroll down to the section on Candlesticks.