Key Takeaways

Union Pacific ( UNP ) shares surged Thursday after the big freight carrier posted better-than-expected earnings as its costs for fuel declined.

The shipper reported fourth-quarter earnings per share (EPS) jumped 7% from a year ago to $2.91, exceeding analysts' expectations. Operating revenue fell 1% to $6.12 billion, slightly missing forecasts compiled by Visible Alpha.

Union Pacific's earnings growth came as fuel costs plunged 23% to $581 million, and the average fuel price per gallon consumed dropped 24% to $2.41. It was the fourth consecutive quarter of average fuel cost declines.

The company also said freight car velocity improved 1% to 219 daily miles per car, and workforce productivity grew 6% to 1,118 car miles per employee.

Union Pacific projected full-year EPS would be consistent with reaching its three-year compound annual growth rate (CAGR) in the range of a high-single-digit to low-double-digit percent. However, it warned volumes could be “impacted by mixed economic backdrop, coal demand, and challenging year-over-year international intermodal comparisons.”

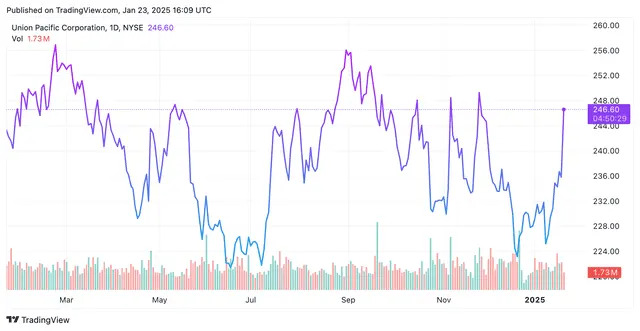

Shares of Union Pacific were up close to 5% in intraday trading Thursday and have gained over 8% since the start of the year.

Read the original article on Investopedia