- Microsoft, Tesla, Meta Platforms, Apple, Alphabet, and Amazon are scheduled to report their respective earnings in the next couple of weeks.

- With an average revenue growth forecast of 10.3% year-over-year and strong analyst sentiment, these reports will provide crucial insights into tech sector health and broader economic trends.

- Investors will particularly focus on how these mega-cap companies are balancing growth investments with operational efficiency, especially in areas like AI development and cloud infrastructure.

- Looking for more actionable trade ideas? Subscribe here for 50% off InvestingPro!

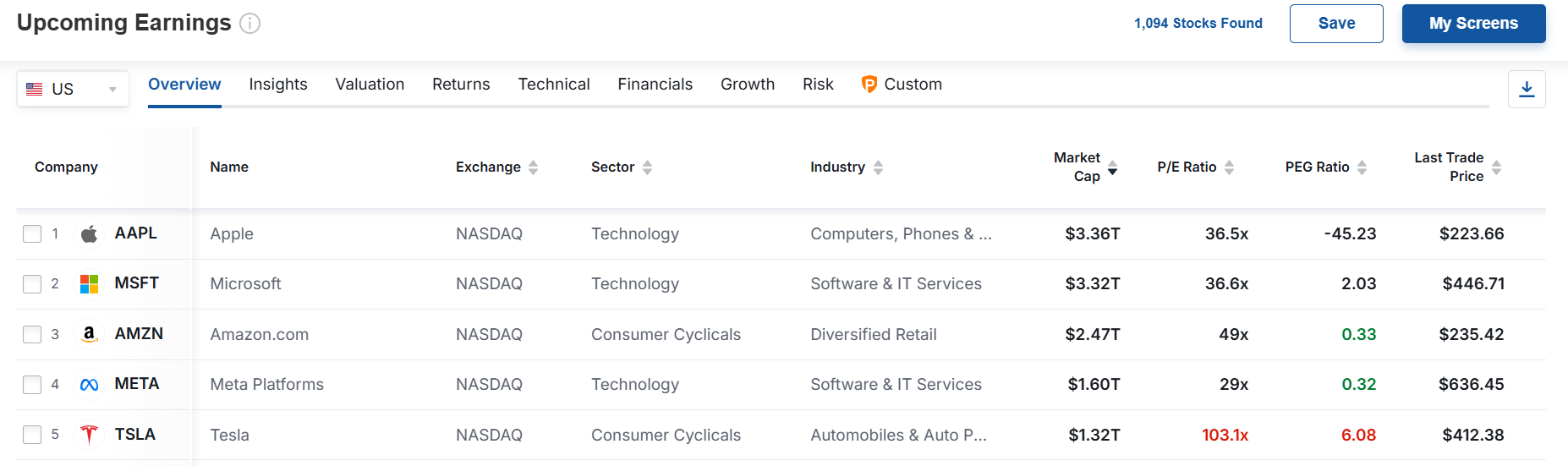

The upcoming earnings reports from six of the ‘Magnificent 7’ giants—Microsoft (NASDAQ:

MSFT

), Meta Platforms (NASDAQ:

META

), Tesla (NASDAQ:

TSLA

), Apple (NASDAQ:

AAPL

), Alphabet (NASDAQ:

GOOGL

), and Amazon (NASDAQ:

AMZN

)—hold immense sway over investor sentiment, given their collective market cap of an astonishing $14.5 trillion

These mega-cap titans will not only showcase their financial performance but also offer critical insights into economic and technological trends.

Company Highlights

- Microsoft (Wednesday, Jan. 29 - 4:05 PM ET): Expected EPS of $3.13 (+6.6% YoY) and revenue of $68.82B (+10.9% YoY).

- Tesla (Wednesday, Jan. 29 - 4:05 PM ET): Predicted revenue of $27.07B (+7.5% YoY) but a sharp EPS drop to $0.76 (-66.7% YoY).

- Meta Platforms (Wednesday, Jan. 29 - 4:05 PM ET): Anticipated EPS of $6.73 (+30.7% YoY) and revenue of $46.96B (+17.2% YoY).

- Apple (Thursday, Jan. 30 - 4:30 PM ET): Revenue is forecast at $124.1B (+4.0% YoY) and EPS at $2.35 (+8.4% YoY).

- Alphabet (Tuesday, Feb. 4 - 4:00 PM ET): EPS is projected at $2.12 (+30.5% YoY) and revenue of $96.6B (+12.0% YoY).

- Amazon (Thursday, Feb. 6 - 4:00 PM ET): Estimated revenue of $187.3B (+10.2% YoY) and EPS of $1.48 (+50.4% YoY).

As investors prepare for these market-moving events, several interconnected themes emerge across these tech leaders.

Artificial intelligence remains at the forefront, with each company expected to detail their AI monetization strategies and infrastructure investments. Enterprise adoption rates of Microsoft’s Copilot and Meta's AI infrastructure spending will be particularly scrutinized, as will Google’s progress in the rollout of its Gemini AI platform.

Cloud computing growth continues to be a critical focus, especially for Microsoft’s Azure, Amazon's AWS, and Alphabet's Google Cloud, as enterprises globally accelerate their digital transformation efforts.

Meanwhile, the digital advertising landscape, crucial for Meta, Alphabet, and Amazon, will provide insights into broader economic conditions and marketing spending trends.

Margin management has become increasingly important as these companies balance growth investments with profitability. This is particularly relevant for Tesla amid pricing pressures and Apple's hardware margins in a competitive market.

The international market performance will also be closely watched, especially in China, where Apple faces increasing competition and Tesla navigates market share challenges.

Looking ahead, the broader economic environment, including interest rates and consumer spending patterns, will likely feature prominently in forward guidance across all companies.

Company Health Scores & Fair Value

|

Company |

Financial Health Score |

Current Price |

Fair Value |

Fair Value Upside |

|

Microsoft |

3.01 |

$446.71 |

$434.04 |

-2.8% |

|

Tesla |

2.85 |

$412.38 |

$307.35 |

-25.5% |

|

Meta |

3.28 |

$636.45 |

$550.34 |

-13.5% |

|

Apple |

2.63 |

$223.66 |

$188.22 |

-15.8% |

|

Alphabet |

3.32 |

$197.98 |

$192.12 |

-3.0% |

|

Amazon |

3.20 |

$235.42 |

$215.76 |

-8.4% |

As can be seen above, Alphabet leads with the highest Financial Health Score of 3.32, while Apple shows the lowest Financial Health Score at 2.63.

Furthermore, all six companies are currently trading above their calculated fair values. Tesla shows the largest fair value gap at -25.5% and Microsoft is closest to its fair value with just -2.8% difference.

Note: Financial Health Scores range from 0-5, with higher scores indicating stronger financial health.

Market Impact

With these tech giants holding significant weight in major indices, their results will undoubtedly influence broader market trends.

Investors should be prepared for increased volatility, particularly in tech sectors tied to AI, cloud computing, and software spending, while also looking for post-earnings opportunities in stocks that demonstrate resilience and growth.

Common themes like cost management, AI monetization, and global performance will provide a roadmap for navigating opportunities and risks in the weeks ahead.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get 50% off all Pro plans with our New Year’s sale and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.