As Tesla (NASDAQ: TSLA ) prepares to release its fourth-quarter earnings report today after the bell, all eyes are on the company for a potential catalyst to reignite the stock.

With investors eager for fresh momentum, the results could offer key insights into Tesla’s growth trajectory and its path forward in an increasingly competitive market.

The Elon Musk-led company is a significant player in the electric vehicle market and engages in various sectors including energy solutions, artificial intelligence, and autonomous driving.

It has recently reached the production of its 7-millionth vehicle, demonstrating its capacity for large-scale manufacturing.

The company's market share has fluctuated, experiencing declines in the US and Europe, while growing significantly in China, highlighting diverse regional dynamics.

Recent updates to Tesla's Full Self-Driving software, particularly version 13, have shown substantial improvements, raising prospects for safety and functionality.

Analysts estimate that AI and autonomous driving opportunities could be valued at up to $1 trillion, emphasizing the potential long-term growth drivers beyond vehicle sales.

The energy and storage segment is expected to contribute about 5% to Tesla's overall valuation, indicating a growing diversification of revenues.

The stock has realized impressive gains of over 116% in the past year. However, a beta of 2.3 suggests it is significantly more volatile than the overall market.

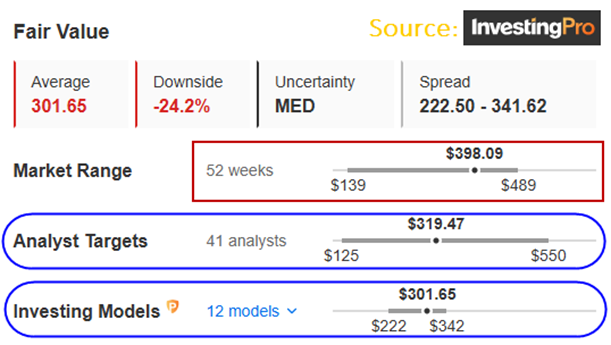

Meanwhile, such a strong surge has seen the stock wander into overvalued territory, and we were able to spot this thanks to InvestingPro's Fair Value tool.

The tool currently shows a 24.2% downside for the stock ahead of earnings, providing key insight that a miss - or earnings below expectations - could trigger a correction.

It’s insights like these that make this tool invaluable, especially as earnings season heats up.

This is how InvestingPro's tools can empower investors to stay one step ahead, identifying overvalued stocks, especially ahead of a critical earnings report.

And here’s the best part: during our New Year sale, you can access all these insights for up to 50% off by clicking on this link .

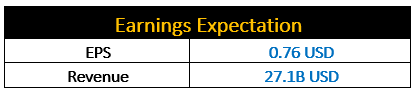

What to Expect From Tesla in Q4?

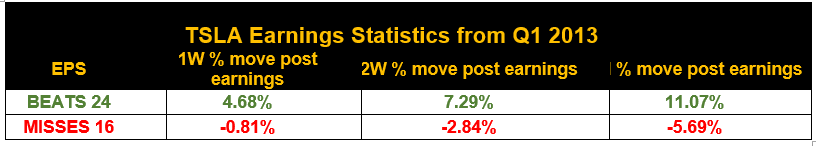

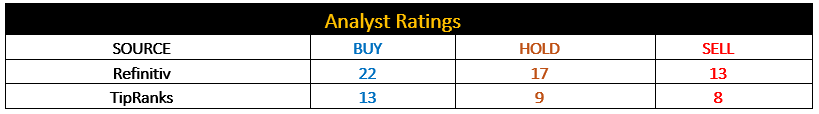

Tesla will release its Q4 2024 earnings today after the closing bell. Since Q1 2013, the company has posted 24 earnings beats and missed expectations 16 times since Q4 2014.

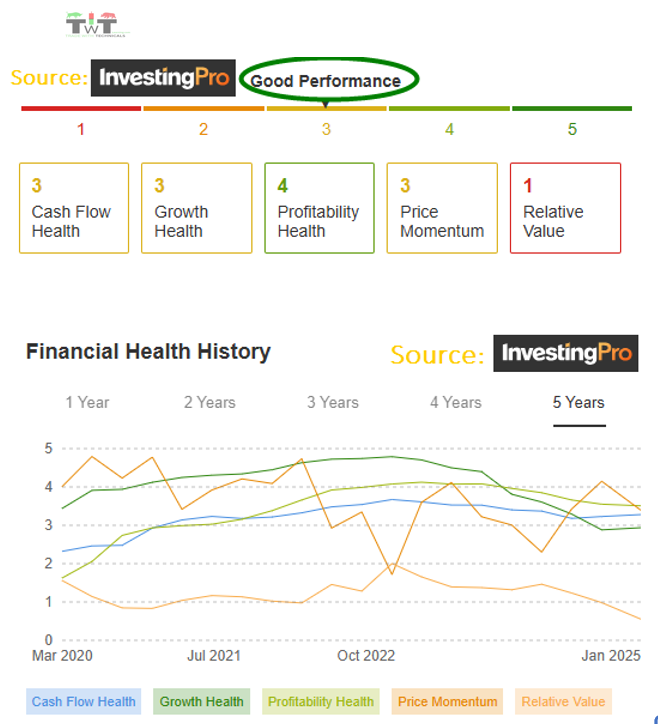

Tesla's financial health, as assessed by InvestingPro, is determined by ranking the company across more than 100 factors, comparing it to peers in the Consumer Discretionary sector and those operating in developed economic markets.

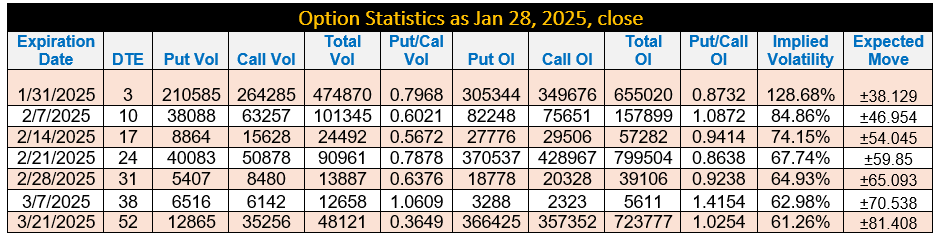

Option Statistics:

Put/Call ratio suggests the following three scenarios:

- With a Put/Call ratio between 1.0872 to 0.8638 for the next four upcoming expiries suggests that the overall option traders’ position is neutral to the range trade scenario.

- Lower earnings and guidance could trigger a gradual sell-off followed by a slow rise in the stock price.

- Better-than-expected guidance would trigger a sharp rally as the market believes that Tesla will benefit from CEO Elon Musk’s ties to the Trump administration, which may help in the company’s plans.

- The option market is showing a large net negative Gamma at 380 strike versus a large net positive gamma exposure at 500 strike over the spectrum of Jan 2025 to Jan 2027.

Technical Analysis Perspective:

- TSLA stock had a nice run post-US election from 238 to 488 in six weeks.

- Prices are consolidating those gains in the form of a triangle, ranging between 440 to 360 bands.

- A breakout on either side would lead trend direction post earnings.

- Generally, these triangles are a pause within the trend, which in this case is bullish.

- A strong break above 440/450 would pave the way for a bullish continuation-type move.

- Otherwise, a range trade between 440 to 360 is likely.

- A strong penetration below 360 support would pave the way for further decline.

Weekly Candlestick Chart

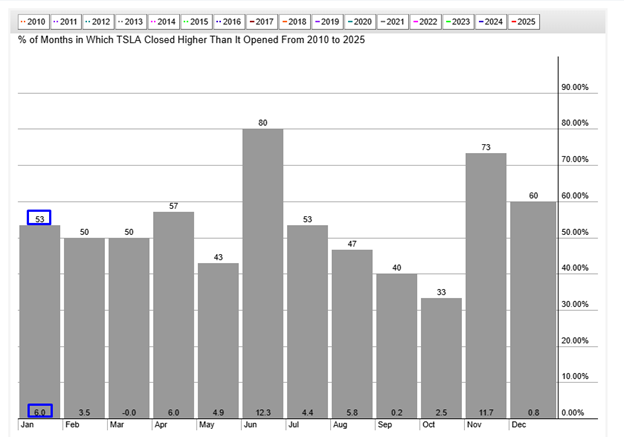

TSLA Seasonality Chart:

- TSLA closes 61% higher in January 53% of the time since 2010.

Conclusion:

TSLA is consolidating the US post-election tremendous rise. Prices are likely to range between 440 – 360 range. A strong move above 440 post earnings would eye 500, and a sustained breakout of 360 would target 310.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount .

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners, and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”