After the FOMC meeting , Jerome Powell said

“We need real progress on inflation or a weak job market to cut.”

While we see certain commodities flying: coffee , corn , cattle, wheat , soybeans , silver and sugar -most likely going higher (coffee could see an overbought correction)

We do see the high probability that employment can weaken.

Powell also said,

“We don't know what will happen with tariffs, with immigration, with fiscal policy, and with regulatory policy. I think we need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be. So, we are watching carefully.”

And these are all the reasons why employment might weaken, and inflation might strengthen.

If I could say anything to Powell it would be what I say to you all every day.

The price will dictate the narrative.

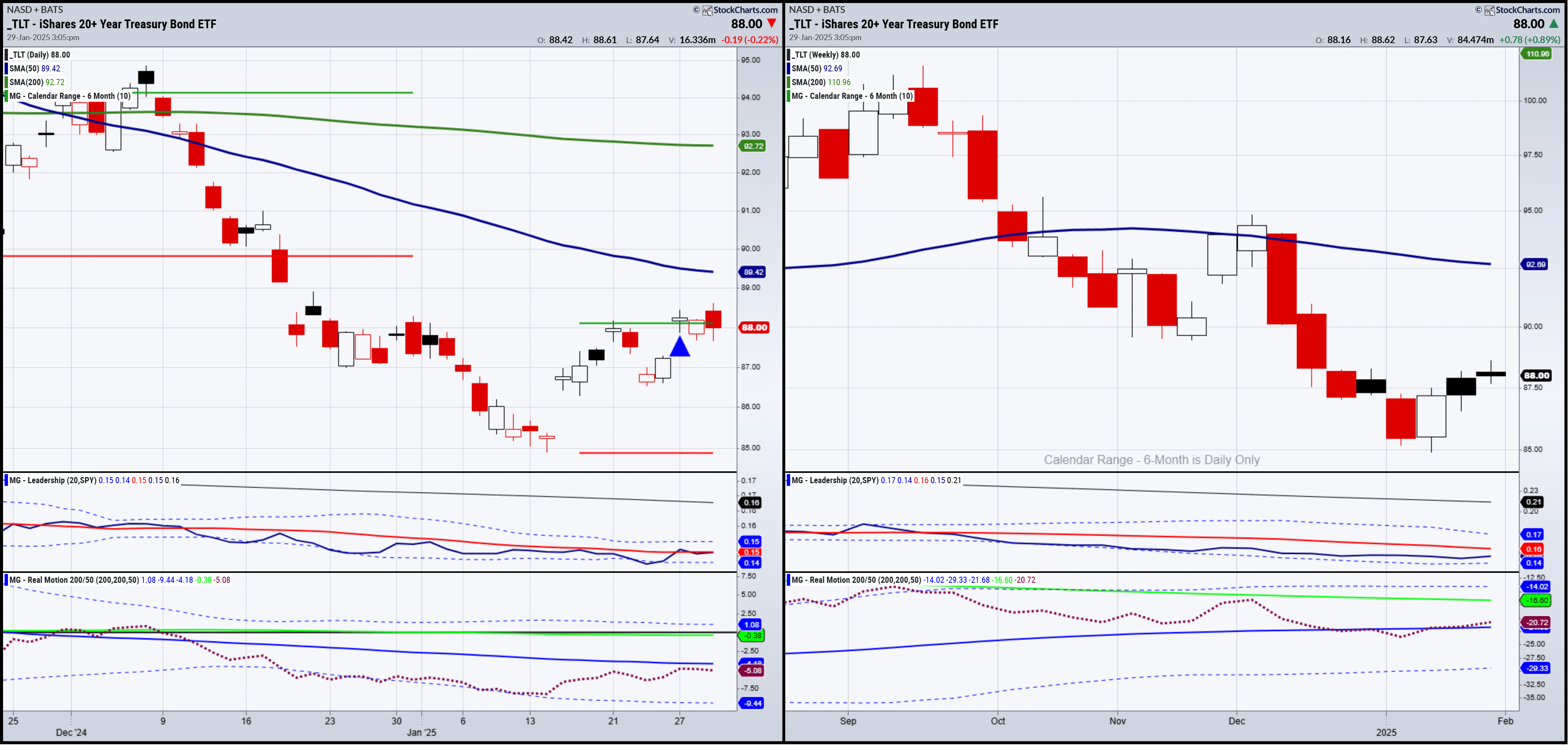

Looking at the bond charts, we draw some conclusions.

Momentum is one of my favorite indicators. Our Real Motion proprietary indicator is amazing.

During our many years on the commodities exchanges, you could see and hear momentum. Real Motion helps you achieve the “on the floor” feeling.

Momentum on the weekly chart of TLT shows a bullish divergence. Notice how far the price is from the 50-week moving average while momentum dots have cleared it.

On the daily chart, momentum is on par with price, both the red dots and the price trade below the 50-DMA.

We also see the January 6-month calendar range high. TLT price has been dancing around it.

Leadership is also interesting. Our market internals watch the ratio between SPY and TLT. While TLT is slightly underperforming, we will watch carefully for that to change.

Should the momentum we see on the weekly timeframe, and the leadership we see on the daily timeframe align-TLT rallies, then we will also see TLT clear the calendar range.

If price dictates the narrative, what will the charts tell us if should TLT rally after we heard Powell loud and clear?

Our interpretation would be that yields soften, the Fed goes more dovish, and again in the Outlook, I predict a rate cut in March.

Why? Food and precious metals rallying will pale to the central bank compared to their dealing with a softening economy and weakening labor market.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 600 now the support as this makes a great comeback

- Russell 2000 (IWM) 225-227 is key as an area to hold up

- Dow (DIA) 452 now the resistance to clear

- Nasdaq (QQQ) Confirmed the return to the bullish phase

- Regional banks (KRE) Over 64 this looks better

- Semiconductors (SMH) 237 needs to hold

- Transportation (IYT) 71.40 important to hold

- Biotechnology (IBB) 137 support 140 next place to clear

- Retail (XRT) Over 81, the risk is under 78 and we could see a move towards 84-85

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79.40 the calendar range support