E-commerce florist and gift retailer 1-800-FLOWERS (NASDAQ:FLWS) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 5.7% year on year to $775.5 million. Its non-GAAP profit of $1.08 per share was 9.2% below analysts’ consensus estimates.

Is now the time to buy 1-800-FLOWERS? Find out in our full research report .

1-800-FLOWERS (FLWS) Q4 CY2024 Highlights:

“Our second quarter revenue declined 5.7%, showing year-over-year improvement, but not at the pace that we had been anticipating,” said Jim McCann, Chairman and Chief Executive Officer of 1-800-FLOWERS.COM,

Company Overview

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

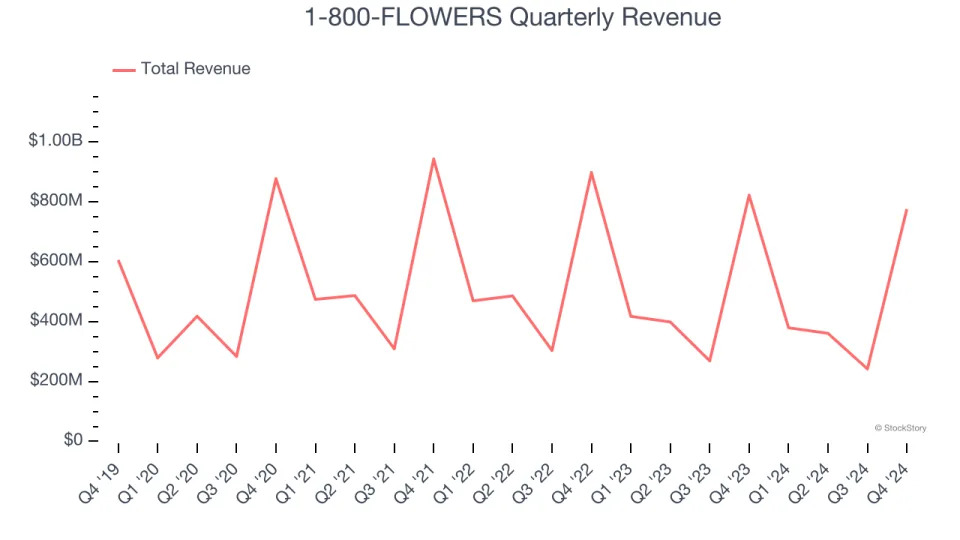

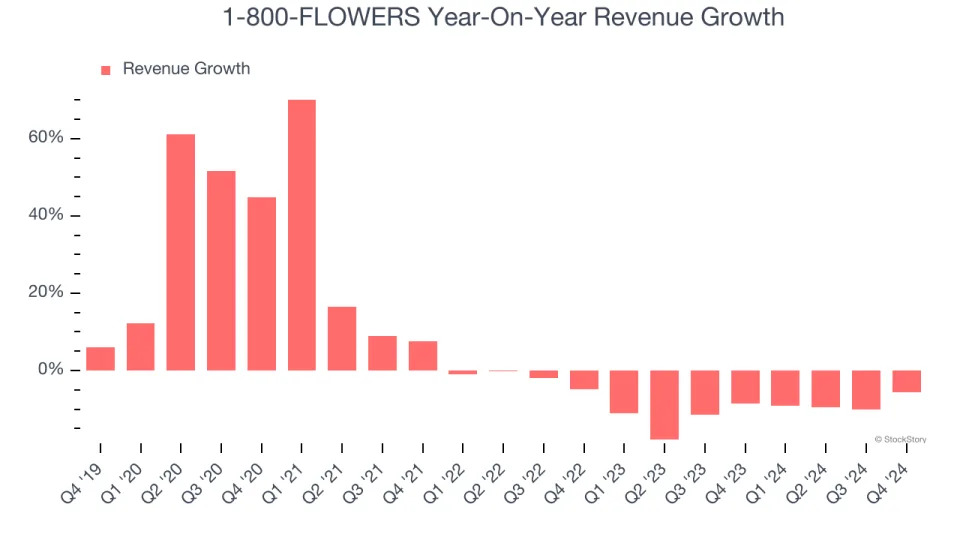

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, 1-800-FLOWERS grew its sales at a sluggish 6.2% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. 1-800-FLOWERS’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.7% annually.

This quarter, 1-800-FLOWERS missed Wall Street’s estimates and reported a rather uninspiring 5.7% year-on-year revenue decline, generating $775.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Cash Is King

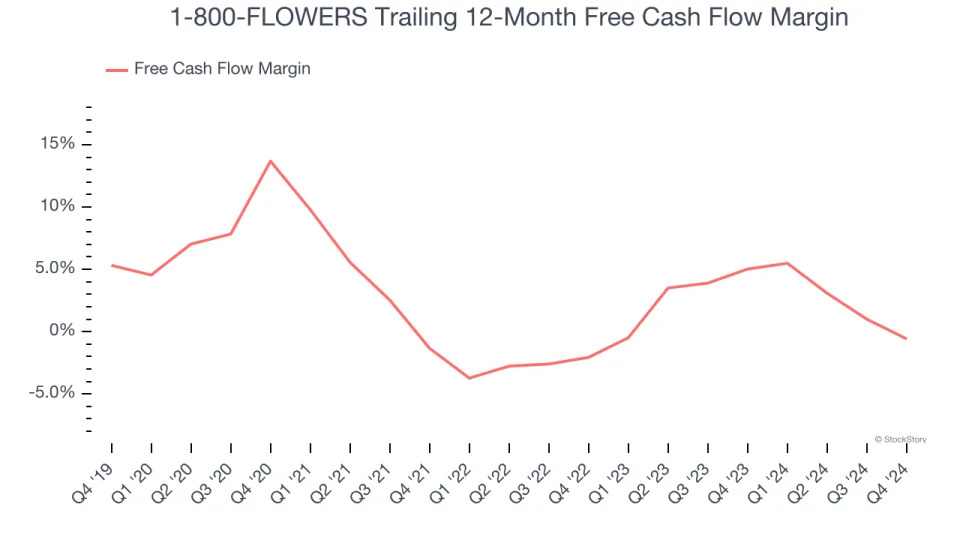

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

1-800-FLOWERS has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for a consumer discretionary business.

1-800-FLOWERS’s free cash flow clocked in at $317.6 million in Q4, equivalent to a 41% margin. The company’s cash profitability regressed as it was 1.1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict 1-800-FLOWERS’s cash conversion will improve. Their consensus estimates imply its breakeven free cash flow margin for the last 12 months will increase to 2.1%, giving it more optionality.

Key Takeaways from 1-800-FLOWERS’s Q4 Results

We struggled to find many resounding positives in these results. Its revenue and EPS in the quarter missed expectations. Adding to the bad news, the company's full-year EBITDA guidance missed Wall Street's estimates significantly. Overall, this was a weaker quarter with very few positives to hang your hat on. The stock traded down 15.1% to $7.48 immediately following the results.

The latest quarter from 1-800-FLOWERS’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .