- Apple’s earnings tonight will show if its recent bounce can continue.

- Analysts expect a beat, but iPhone sales and China competition will be key.

- With trade tensions and valuation concerns, here's what investors should watch in the report.

- Are you looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners using this link .

Apple (NASDAQ: AAPL ) will release its earnings after the market closes today, adding to a wave of high-profile reports from the Magnificent 7, including Microsoft (NASDAQ: MSFT ), Meta Platforms (NASDAQ: META ) (NASDAQ: META ), and Tesla (NASDAQ: TSLA ) earlier this week.

After reaching a record high of $260.10 on December 26, Apple saw a sharp correction, plummeting over 15.6% to a low of $219.38 by January 21. Yet, the stock has since bounced back, rising nearly 10% in just six sessions to close near $240 on Wednesday.

What stands out is that Apple has been one of the few major tech stocks unaffected by the recent panic sparked by China’s DeepSeek AI. As investors look ahead to tonight’s earnings report, all eyes are on whether Apple can continue this upward momentum and deliver a positive surprise that will drive the stock even higher

What are analysts forecasting for Apple's results?

In terms of consensus forecasts, EPS is expected to be $2.35, up 7.8% year-on-year, on sales of $124 billion, up 3.7% year-on-year.

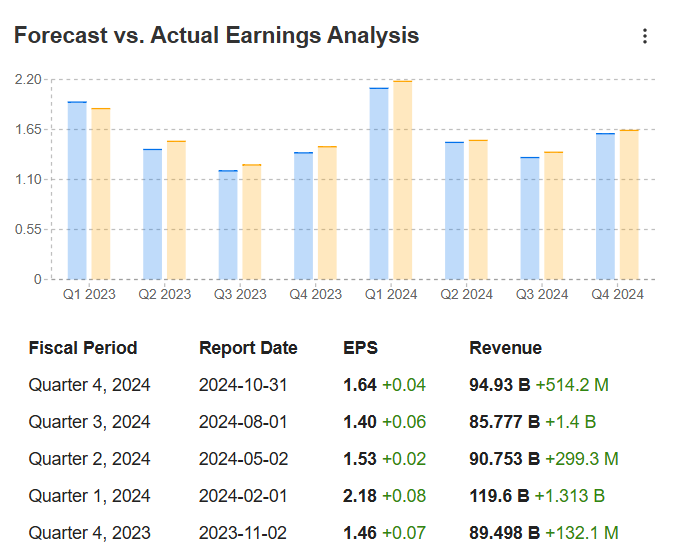

However, data available on InvestingPro show that the company has exceeded expectations in terms of earnings and sales for the last 5 consecutive quarters:

Beyond the results themselves, several other details of tonight's earnings release could prove influential on Apple shares. iPhone sales, growth in services business, and gross margin will undoubtedly be among the most sensitive secondary data.

Other potentially influential details

We'll also be interested in the clues the company provides about its outlook for the current quarter and beyond, even though it hasn't provided precise forecasts for several years now. The deployment of AI functions in its devices could justify ambitious forecasts.

Activity in China, especially iPhone sales, will be another focal point in tonight's earnings release. Apple lost its position as the country's largest smartphone manufacturer last year and now faces heightened competition from local brands. Any commentary on this will be closely scrutinized, as it could offer insights into how Apple plans to navigate this increasingly competitive landscape.

With Donald Trump escalating the threat of tariffs, including against China, Apple's investors will likely be eager for insights on how the company plans to respond. China is home to many of Apple's key suppliers, so any comments on potential tariff impacts will be crucial. Expect Apple to outline its strategies to reassure investors that it is prepared for any actions Trump may take against Beijing, ensuring stability amid growing trade tensions.

Apple shares remain overvalued according to valuation models

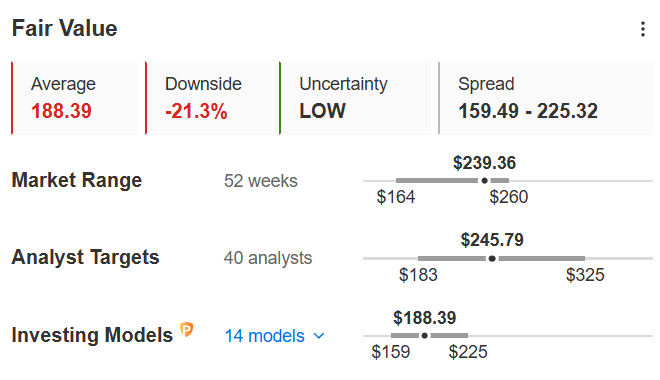

Ahead of Apple’s earnings release, it’s wise to examine analysts' forecasts and valuation models to gauge the potential impact on the stock.

These insights can provide a clearer picture of expectations and help investors position themselves effectively as they anticipate how the results might influence Apple’s share price.

From the analysts' point of view, Apple's shares are correctly valued. They have an average target of $245.79 according to InvestingPro data, compared with a closing price of $239.36 on Wednesday evening.

InvestingPro Fair Value, which synthesizes several recognized financial models, considers Apple to be significantly overvalued. It values the stock at $188.39, more than 21% below the current price.

Conclusion

In conclusion, Apple has outperformed many of its Big Tech counterparts this week, but tonight’s earnings report holds the key to whether its upward momentum can continue. Positive surprises in both the results and forward guidance will be essential for sustaining the recent gains and pushing the stock higher in the weeks to come.

***

Looking to grab undervalued gems after earnings?

InvestingPro gives you the tools to find them. Get exclusive access to elite investment strategies, 100+ AI-powered stock picks each month, and a powerful Pro screener designed to uncover high-potential stocks before the market catches on.

Start your search now .

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.