Investing.com -- Over the weekend, US President Donald Trump imposed stiff 25% tariffs on neighboring Mexico and Canada's exports coming into the US, sparking a market rout of about $1 trillion as of this writing in pre-market trading.

Both Mexico and Canada were quick to respond with retaliatory measures against US-imported goods, putting in danger the continuation of one of the world's largest free-trade experiments in the history of the world, the NAFTA agreement.

Economics Nobel Laureate Paul Krugman warned:

"You're basically throwing sand in the gears of global commerce and manufacturing,"

Trump also imposed an extra 10% tariff on China's goods, adding to the pressures that started back in his former administration in 2020 and threatened to impose similar measures on the European Union in the coming days.

For US consumers, tariffs are likely to have a deep impact on inflation, possibly changing the prospect of Fed rate cuts this year. As a matter of fact, our Fed rate monitor tool is currently pricing in no rate cuts over the next two Fed meetings and gradually lowering the possibility of a rate cut in June.

The US currently imports around $466 billion from Mexico and $377 billion from Canada, including 75% of US crude oil imports from Canada in 2024. Tariffs are commonly paid for by the company that acquires the product, not the exporter country, which would imply an increase in price to the final consumer to keep the margins healthy.

Tariffs are also projected to hit corporate earnings, mainly due to the higher cost of the current supply chain and the disruptions surrounding the rearrangement of manufacturing networks. The perspective of fewer rate cuts and lower risk/returns from the corporate side has pushed the US dollar upward while sinking both the USD/CAD and MXN/USD .

Is this the time to panic? What to do now

While this is a far-reaching event for the global economy, unlike black-swan events like the COVID crash or the Global Financial Crisis, tariff war 2.0 implies a multi-faceted, long-term shift in economic projections.

Hence, rather than panicking, investors are advised to adapt their portfolios according to a shifting risk-return corporate proposition. Understanding the long-lasting impacts of these measures might be far more important than reacting swiftly.

Our AI-powered analyst, Warren AI, Investing.com's state-of-the-art ChatGPT for financial markets, can prove a powerful ally in this process.

We've asked it how to react at this time, and here's what it said:

What should I know about my investments according to Trump tariffs ?

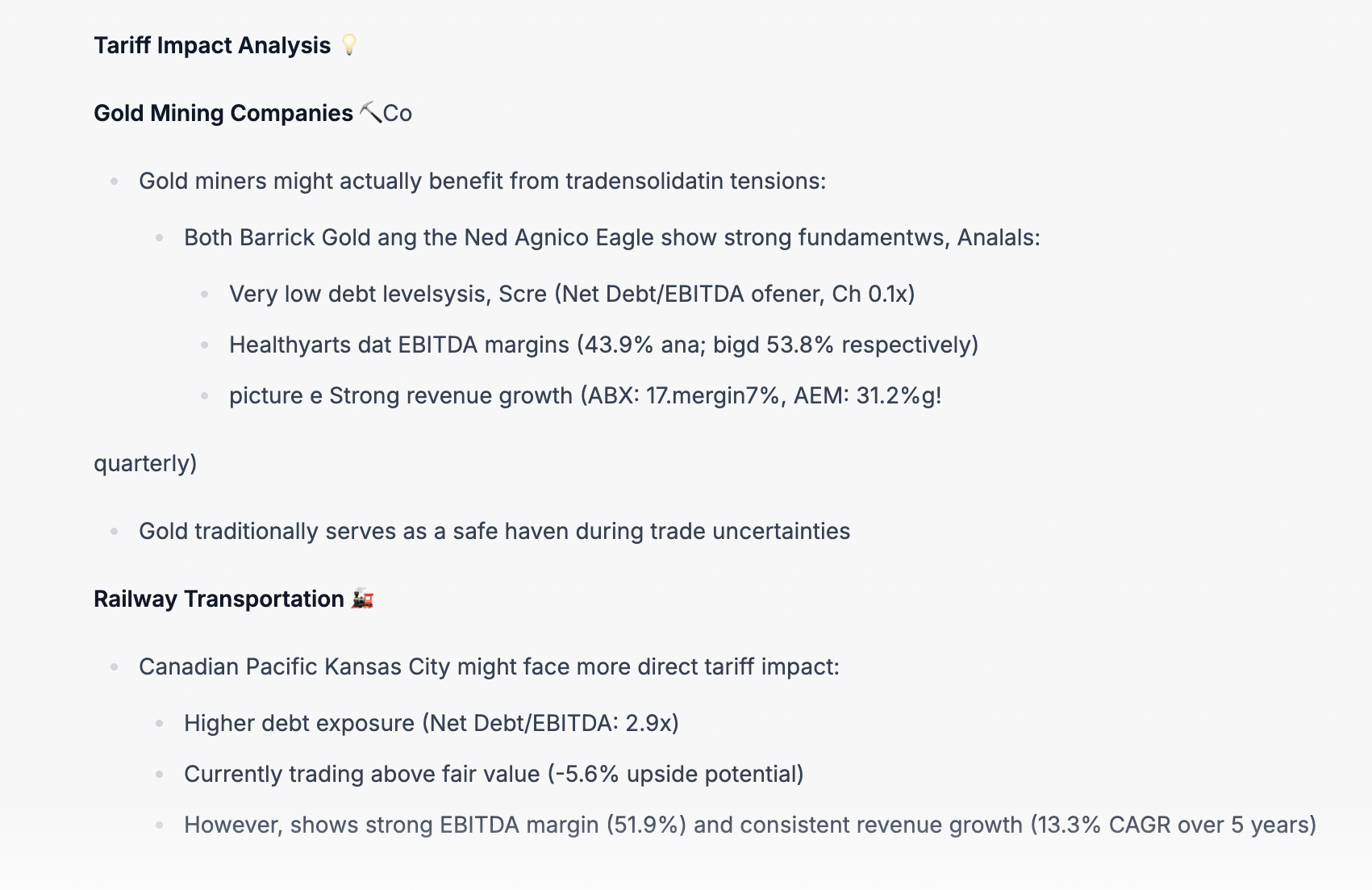

We've also asked Warren which sectors to buy/sell in the face of Trump's tariffs , and here's its response on one to buy/one to sell:

(Click on the links above to view the full response).

Investors are also advised to adapt their geographic stock allocation into markets likely to fill the void from higher costs in Canada/US.

For that, ProPicks AI deep dives into 25+ years of historical data, 50+ financial metrics, supply chain exposure, and geographic revenue distribution to send our premium members a monthly list of stocks to buy in 12 different markets.

Our list of global picks for February is out now. Subscribe for less than $9 a month, and check them out now .

*Already a member? Then jump right to picks here .

US-focused investors can also check out our screener on stocks, which are more likely to do well in the face of higher inflation/lower economic growth here .

Investors are also advised to check out our list of the most undervalued and most overvalued stocks globally to understand where to position their portfolios for the long run. Change the edition to view the list for any stock market in the world!

Bottom Line

While there is still a lot to play out concerning tariffs, the shifting de-globalizing economic perspective implies a deep rearranging of supply chains and global trade projections in the long term.

So, regardless of whether the tariffs are reversed or expanded to other countries, the sheer risk of greater global economic disruptions/rearrangement warrants smart portfolio management.

Differently from last year's market, in which every investment had a great chance of success, the long-term wealth creation game will be much more challenging, yet rewarding, to those able to step up their games accordingly.

If you're still investing using your sheer gut feeling, don't ignore the signs. Up your game with the latest financial tools in the market before it's too late.

Subscribe to InvestingPro now for less than $9 a month and significantly increase your long-term gains .