Shareholders of America's Car-Mart would probably like to forget the past six months even happened. The stock dropped 22.5% and now trades at $47.48. This may have investors wondering how to approach the situation.

Is there a buying opportunity in America's Car-Mart, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the cheaper entry price, we're cautious about America's Car-Mart. Here are three reasons why you should be careful with CRMT and a stock we'd rather own.

Why Is America's Car-Mart Not Exciting?

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

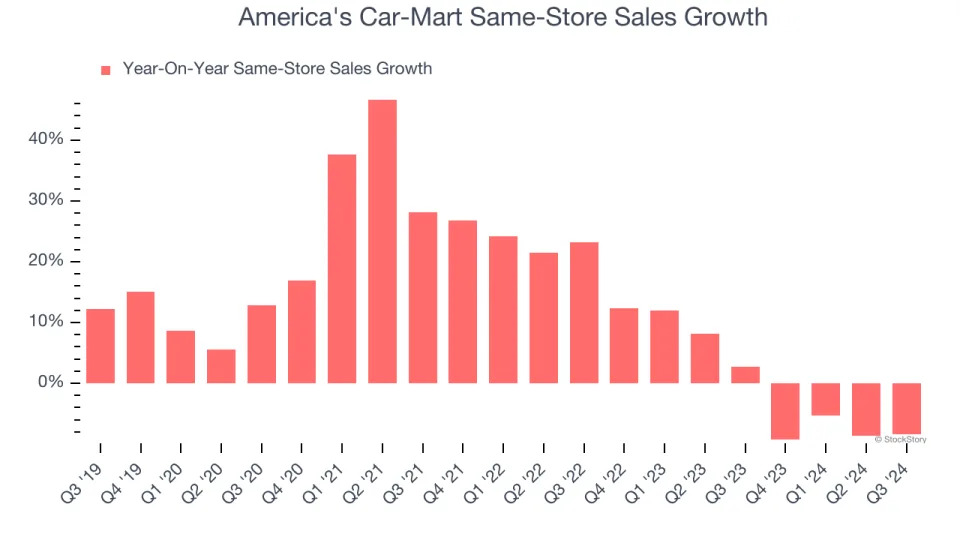

1. Flat Same-Store Sales Indicate Weak Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

America's Car-Mart’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

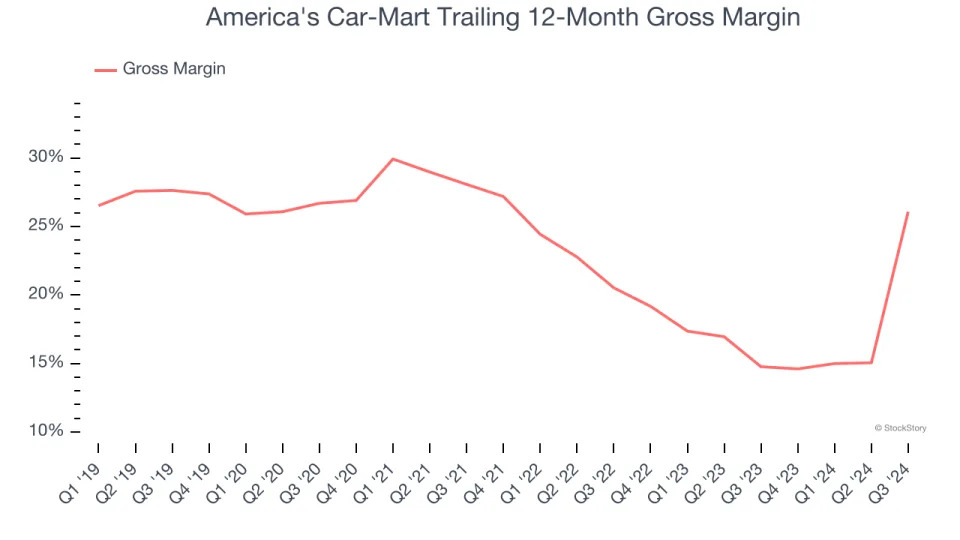

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

America's Car-Mart has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 20.3% gross margin over the last two years. Said differently, America's Car-Mart had to pay a chunky $79.74 to its suppliers for every $100 in revenue.

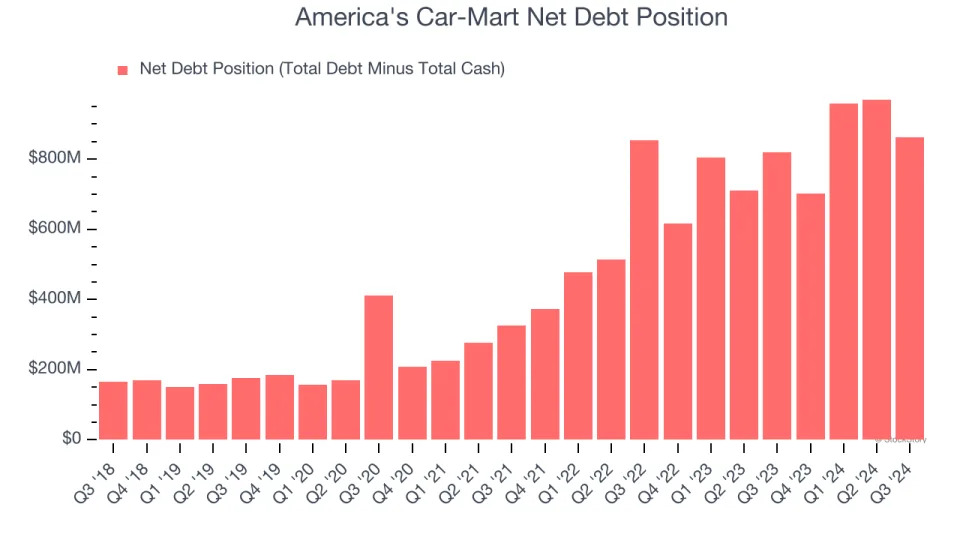

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

America's Car-Mart burned through $38.97 million of cash over the last year, and its $871.1 million of debt exceeds the $8.01 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the America's Car-Mart’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of America's Car-Mart until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

America's Car-Mart isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 47.9× forward price-to-earnings (or $47.48 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses .

Stocks We Would Buy Instead of America's Car-Mart

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .