Looking back on industrial machinery stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including 3D Systems (NYSE:DDD) and its peers.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, generating new demand for industrial machinery and components. Companies that innovate and create digitized solutions can spur sales and speed up replacement cycles while those resting on their laurels can see dwindling market positions. Like the broader industrials sector, industrial machinery and components companies are also at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 59 industrial machinery stocks we track reported a slower Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.3% below.

In light of this news, share prices of the companies have held steady as they are up 3.8% on average since the latest earnings results.

3D Systems (NYSE:DDD)

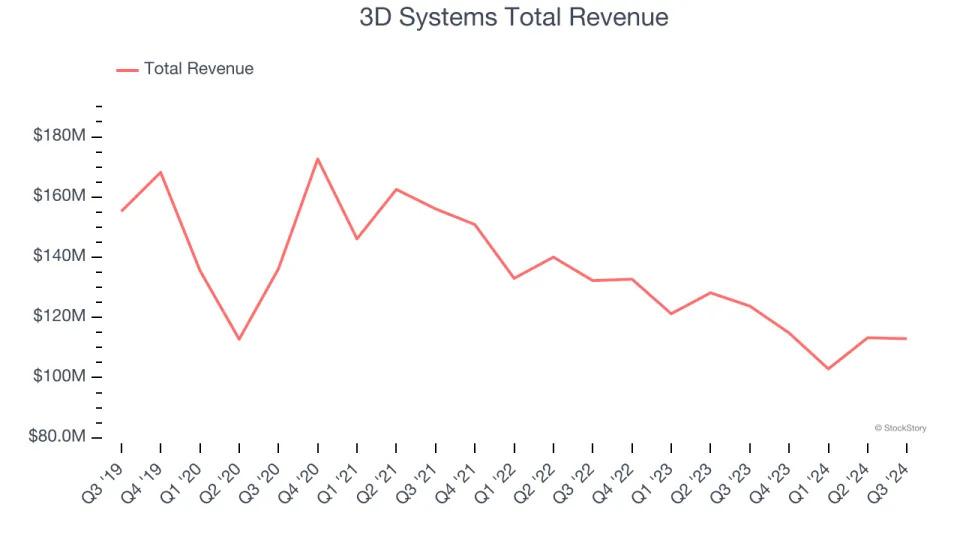

Founded by the inventor of stereolithography, 3D Systems (NYSE:DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

3D Systems reported revenues of $112.9 million, down 8.8% year on year. This print fell short of analysts’ expectations by 1.7%. Overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Commenting on third quarter results, Dr. Jeffrey Graves, president and CEO of 3D Systems said, “As recently shared, our third quarter revenues continued to be impacted by sluggish capital investments by our customers for new production capacity, particularly in the Industrial markets, impacting the sale of new printing systems.”

The stock is up 12.7% since reporting and currently trades at $3.82.

Read our full report on 3D Systems here, it’s free .

Best Q3: Luxfer (NYSE:LXFR)

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE:LXFR) offers specialized materials, components, and gas containment devices to various industries.

Luxfer reported revenues of $99.4 million, up 2.1% year on year, outperforming analysts’ expectations by 15.9%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Luxfer pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 6.4% since reporting. It currently trades at $13.57.

Is now the time to buy Luxfer? Access our full analysis of the earnings results here, it’s free .

Weakest Q3: Mayville Engineering (NYSE:MEC)

Originally founded solely on tool and die manufacturing, Mayville Engineering Company (NYSE:MEC) specializes in metal fabrication, tube bending, and welding to be used in various industries.

Mayville Engineering reported revenues of $135.4 million, down 14.4% year on year, falling short of analysts’ expectations by 13.2%. It was a disappointing quarter as it posted a miss of analysts’ Commercial Vehicle revenue estimates and full-year revenue guidance missing analysts’ expectations significantly.

Mayville Engineering delivered the weakest full-year guidance update in the group. As expected, the stock is down 29.1% since the results and currently trades at $15.42.

Read our full analysis of Mayville Engineering’s results here.

Watts Water Technologies (NYSE:WTS)

Founded in 1874, Watts Water (NYSE:WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Watts Water Technologies reported revenues of $543.6 million, up 7.8% year on year. This print was in line with analysts’ expectations. Overall, it was a satisfactory quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates.

The stock is up 5.2% since reporting and currently trades at $207.71.

Read our full, actionable report on Watts Water Technologies here, it’s free.

Energy Recovery (NASDAQ:ERII)

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Energy Recovery reported revenues of $38.58 million, up 4.2% year on year. This number beat analysts’ expectations by 2.5%. It was a stunning quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 20.9% since reporting and currently trades at $14.14.

Read our full, actionable report on Energy Recovery here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .