Tax preparation company H&R Block (NYSE:HRB) reported Q4 CY2024 results beating Wall Street’s revenue expectations , but sales were flat year on year at $179.1 million. The company expects the full year’s revenue to be around $3.72 billion, close to analysts’ estimates. Its non-GAAP loss of $1.73 per share was 8.6% below analysts’ consensus estimates.

Is now the time to buy H&R Block? Find out in our full research report .

H&R Block (HRB) Q4 CY2024 Highlights:

"We are reaffirming our fiscal 2025 outlook, and are well prepared to deliver this tax season and in the second half of the fiscal year," said Jeff Jones, President and Chief Executive Officer.

Company Overview

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE:HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

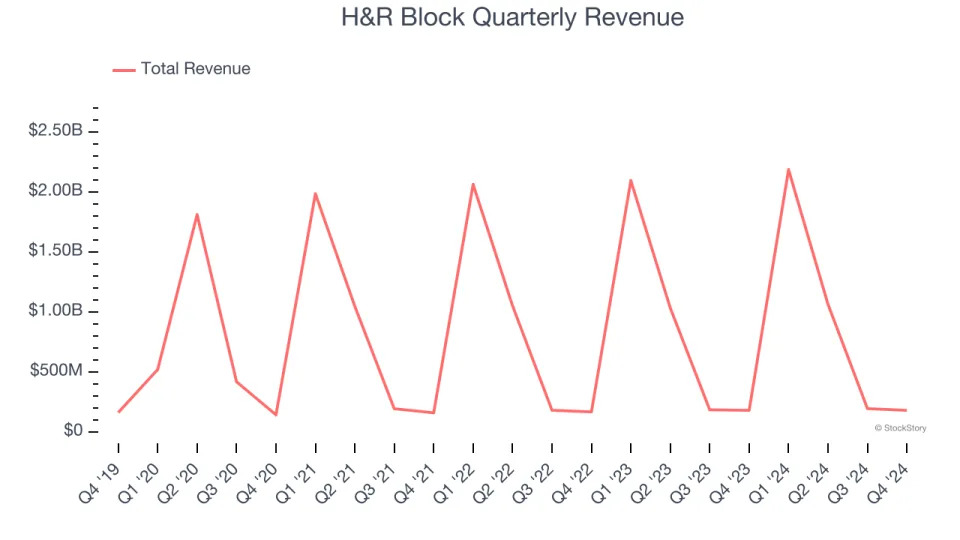

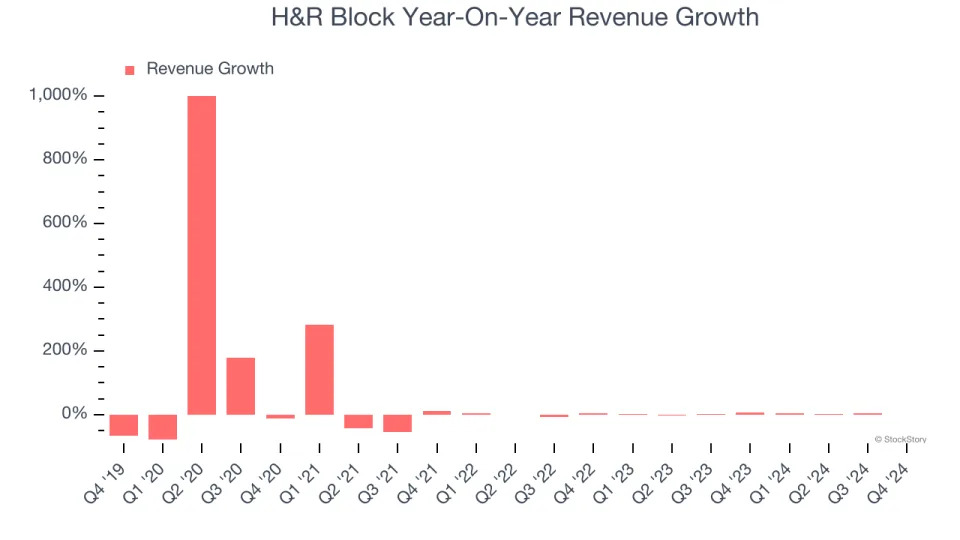

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, H&R Block grew its sales at a sluggish 5.3% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector, but there are still things to like about H&R Block. We note H&R Block is a seasonal business because it generates most of its revenue during tax season, so the charts in our report will look a bit lumpy.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. H&R Block’s recent history shows its demand slowed as its annualized revenue growth of 2.3% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Tax Preparation, Financial Services, and Wave Financial, which are 54.9%, 12.5%, and 14.8% of revenue. Over the last two years, H&R Block’s Tax Preparation (DIY, assisted, add-on services) and Wave Financial (business software) revenues averaged year-on-year growth of 3% and 8.6%. On the other hand, its Financial Services revenue (Emerald Card, Spruce, interest income) averaged 9.3% declines.

This quarter, H&R Block’s $179.1 million of revenue was flat year on year but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

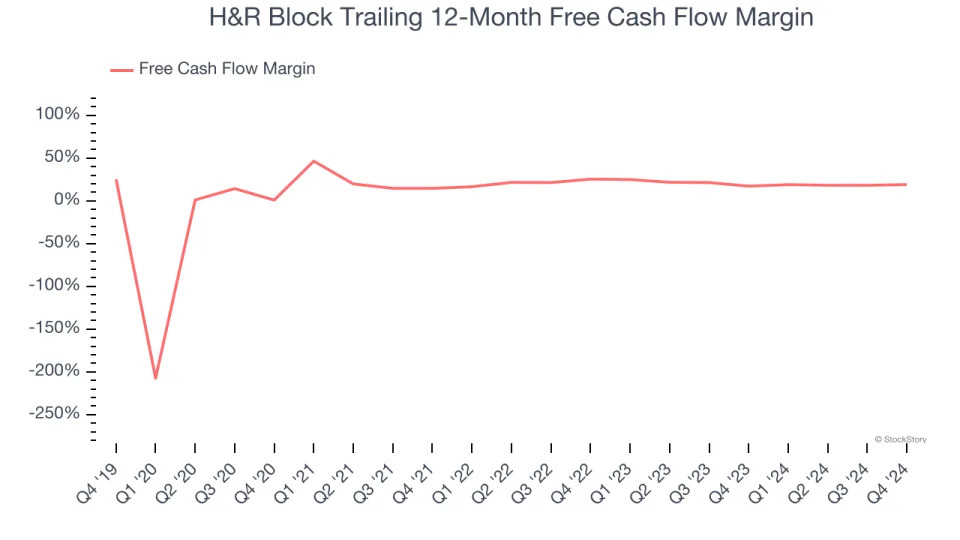

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

H&R Block has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.1% over the last two years, quite impressive for a consumer discretionary business.

Key Takeaways from H&R Block’s Q4 Results

It was good to see H&R Block narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS and EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.8% to $51.30 immediately following the results.

The latest quarter from H&R Block’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .