Toy manufacturing and entertainment company (NASDAQ:MAT) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 1.6% year on year to $1.65 billion. Its non-GAAP profit of $0.35 per share was 73.9% above analysts’ consensus estimates.

Is now the time to buy Mattel? Find out in our full research report .

Mattel (MAT) Q4 CY2024 Highlights:

Ynon Kreiz, Chairman and CEO of Mattel, said: “2024 was a year of strong operational excellence for Mattel with topline growth in the fourth quarter. Our priorities for the year were to grow profitability, expand gross margin, and generate strong free cash flow and we achieved all three objectives, well ahead of expectations. As we progress through 2025, our 80th anniversary year, we look forward to growing both top and bottom line and continuing to successfully execute our multi-year strategy.”

Company Overview

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ:MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sales Growth

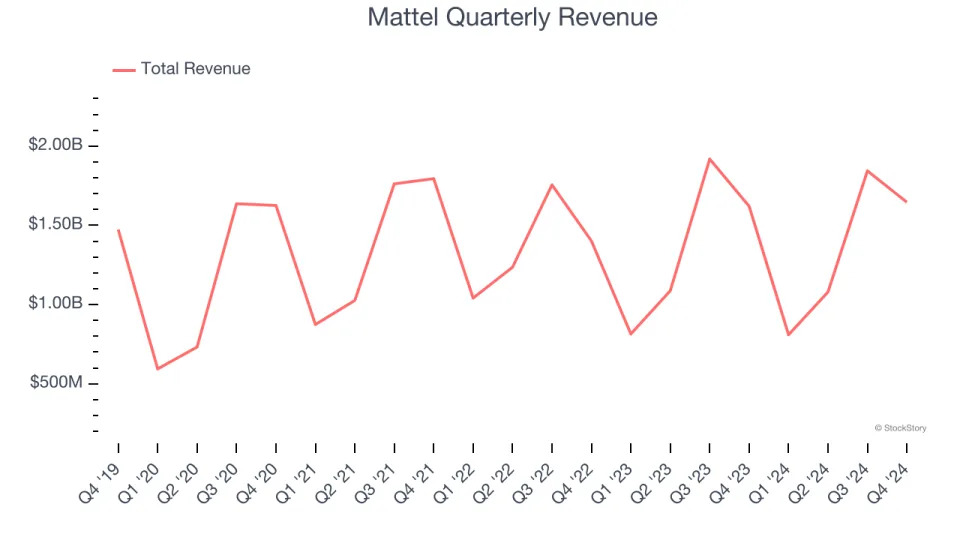

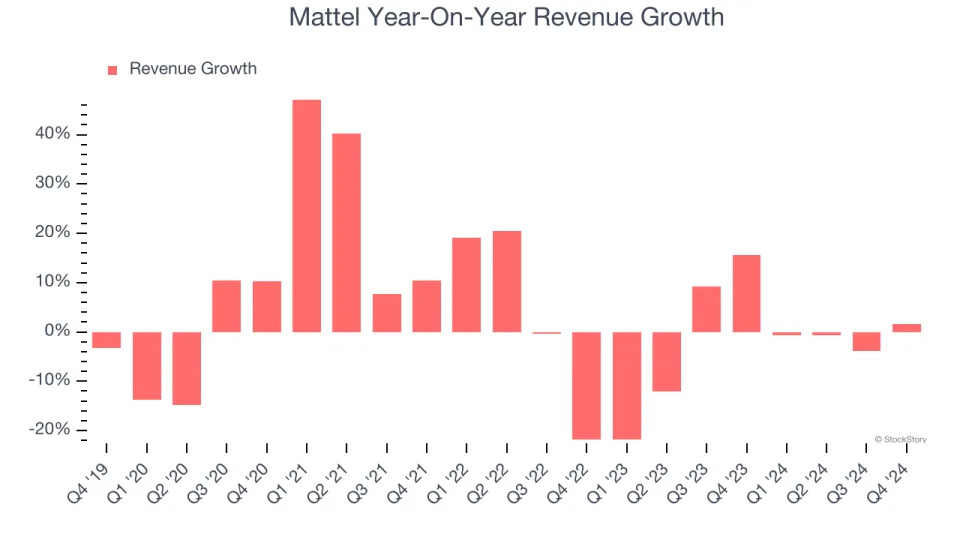

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Mattel’s sales grew at a sluggish 3.6% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Mattel’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Mattel reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Cash Is King

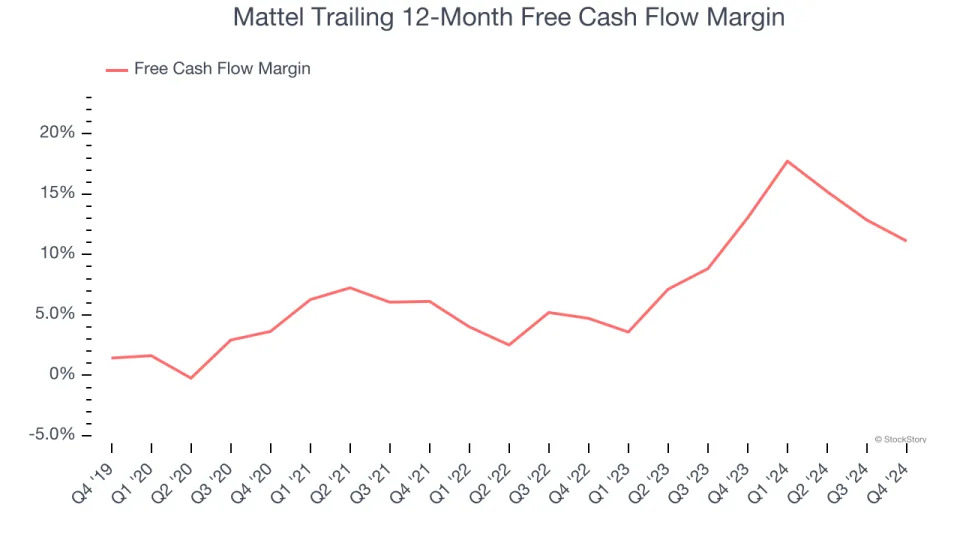

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Mattel has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.1% over the last two years, slightly better than the broader consumer discretionary sector.

Mattel’s free cash flow clocked in at $816.4 million in Q4, equivalent to a 49.6% margin. The company’s cash profitability regressed as it was 6.4 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Mattel’s Q4 Results

We were impressed by how significantly Mattel blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited its revenue and full-year EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 7.9% to $19.50 immediately after reporting.

Sure, Mattel had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .