Aerospace and defense company Mercury Systems (NASDAQ:MRCY) reported Q4 CY2024 results exceeding the market’s revenue expectations , with sales up 13% year on year to $223.1 million. On top of that, next quarter’s revenue guidance ($223.1 million at the midpoint) was surprisingly good and 5.3% above what analysts were expecting. Its non-GAAP profit of $0.07 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Mercury Systems? Find out in our full research report .

Mercury Systems (MRCY) Q4 CY2024 Highlights:

“We delivered solid results in the second quarter of fiscal 2025 that were once again in line with or ahead of our expectations, and I’m optimistic about our ongoing efforts to improve performance as we move through the fiscal year,” said Bill Ballhaus, Mercury’s Chairman and CEO.

Company Overview

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Sales Growth

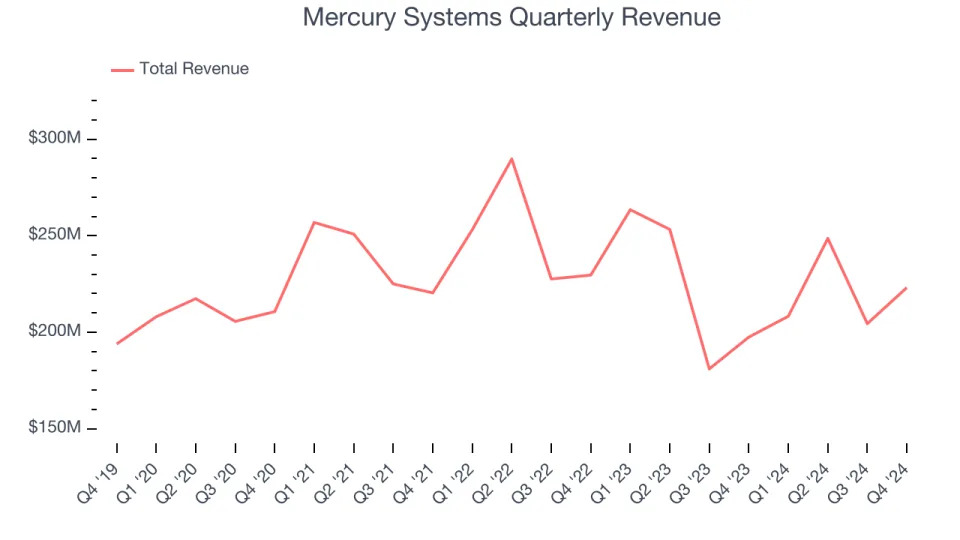

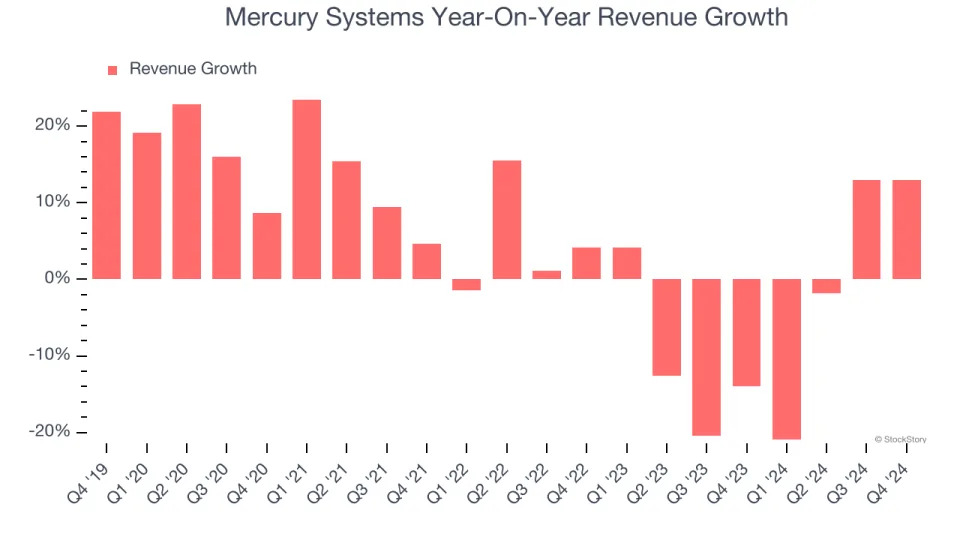

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Mercury Systems grew its sales at a sluggish 4.1% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Mercury Systems’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6% annually.

This quarter, Mercury Systems reported year-on-year revenue growth of 13%, and its $223.1 million of revenue exceeded Wall Street’s estimates by 23.9%. Company management is currently guiding for a 7.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 2.1% over the next 12 months. Although this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

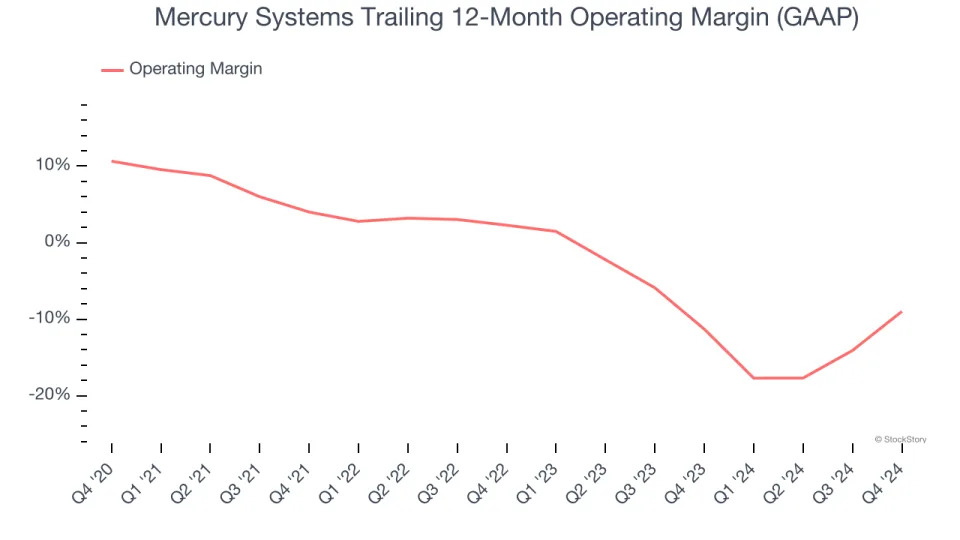

Adjusted Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Mercury Systems was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector.

Analyzing the trend in its profitability, Mercury Systems’s operating margin decreased by 19.6 percentage points over the last five years. The company’s performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Mercury Systems generated a negative 5.6% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

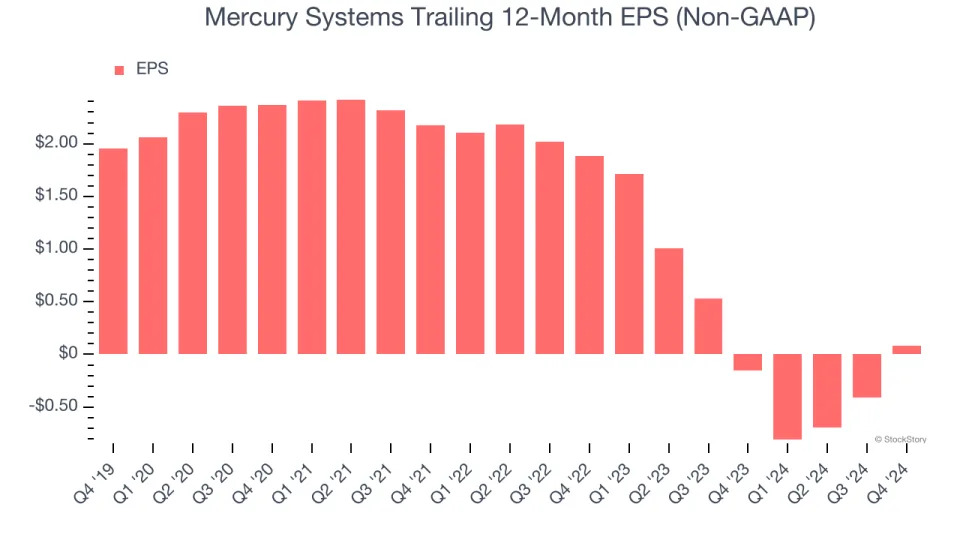

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Mercury Systems, its EPS declined by 47.2% annually over the last five years while its revenue grew by 4.1%. This tells us the company became less profitable on a per-share basis as it expanded.

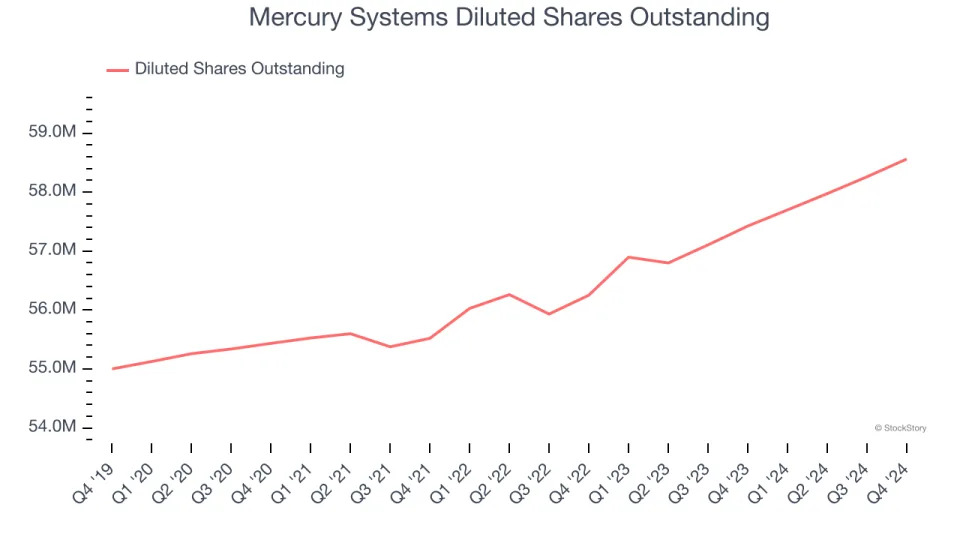

We can take a deeper look into Mercury Systems’s earnings to better understand the drivers of its performance. As we mentioned earlier, Mercury Systems’s operating margin improved this quarter but declined by 19.6 percentage points over the last five years. Its share count also grew by 6.5%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Mercury Systems, its two-year annual EPS declines of 79.4% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Mercury Systems reported EPS at $0.07, up from negative $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mercury Systems’s full-year EPS of $0.08 to grow 531%.

Key Takeaways from Mercury Systems’s Q4 Results

Revenue, EBITDA, and EPS all beat convincingly in the quarter. Revenue guidance for next quarter was also ahead of expectations. Zooming out, we think this was a very good quarter with some key areas of upside, especially considering the skittishness around the sector as a result of the new administration and potential headwinds to revenue from DOGE's efficiency efforts. The stock traded up 17.6% to $49.51 immediately after reporting.

Mercury Systems may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .