2025 is going to drive a lot of investors crazy with frustrating market behavior and fear. The fear will be real because the source of the investors’ frustration will be grounded in you, the consumer. It’s already here, and it’s getting more obvious in the data.

How Is The Consumer Coping With Higher Prices?

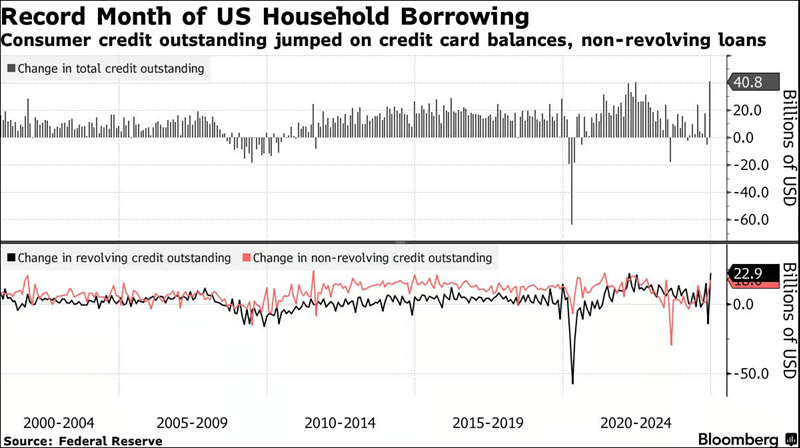

The data below highlighting the huge jump in consumer debt wasn’t a market mover this week, and it’s not the focus of this week’s Market Outlook.

However, I suspect the markets will be focusing on this sooner rather than later if the trend continues.

A consumer who is unhappy with higher prices may complain in a survey. The consumer who can’t afford the higher prices tends to use a credit card to cover the problem. High credit card interest rates exacerbate this problem.

The U.S. consumer is resilient. Regardless, accelerating credit card debt will be a hot topic for investors in the future if the data that rattled markets on Friday doesn’t prove to be more than just transitory, especially considering the condition of last year’s hottest sector which has turned cold and is driven by the consumer spending as you’ll read below.

The Market’s Balancing Act

Friday’s economic news and market reaction reinforced the primary themes that frighten and reward investors in 2025. These themes will rarely feel in synch and often appear to be at odds with one another. This will be frustrating without the use of objective analysis based on the messages in the market’s price action.

The bulls and bears are in a lively debate between positive trends in economic and earnings growth versus the fear of persistent inflation expectations and fading hopes for more accommodative Fed Funds rate cuts, all in an environment of historically high PE valuations and volatile domestic fiscal policy initiatives.

For the disciplined discretionary trader, predictable uncertainty has and will continue to create pockets of volatility in durable trends, which provide swing trading opportunities.

For the tactical algorithmic trader, it’s an environment that will demonstrate the value of disciplined risk management that provides the confidence to maintain exposure with limited drawdowns, so you’re able to participate on the upside without the need to engage in discretionary market timing. See the Algo Trading Systems section below.

Growth vs. Inflation

Friday’s “news” was expected to center around the monthly nonfarm payrolls, unemployment, and related data points, but that didn’t happen.

As it turned out, the report did little more than provide a modest nudge upward in the morning. Investors even shrugged off the potentially inflationary higher-than-expected increase in average hourly earnings (0.5% vs. expectations of 0.3%).

While this higher-than-expected, inflation-sensitive, number made for good media attention, you can see in the chart below that the data is volatile. Additionally, Goldman Sach’s chief economist Jan Hatzius, who has been vocal about wage inflation, commented that he was not concerned or focused on this number because it needs to be considered along with other factors like average hours worked, which fell, and seasonal distortions that tend to revert after January.

The Market’s Biggest Fear (Currently)

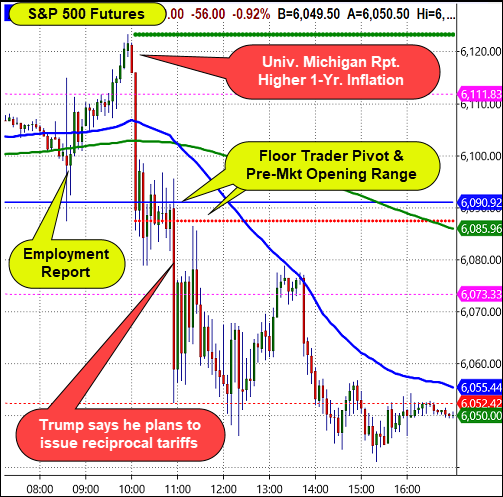

As shown in the intraday chart of the S&P 500 futures below, after the data release at 8:20, the S&P 500 drifted higher until the Univ. Michigan Consumer Sentiment Survey revealed that year-ahead inflation expectations spiked to 4.3%, a sharp jump from 3.3%.

With this news, the market dropped from the high to the low of the day.

Traders familiar with the MarketGauge framework for trading intra-day price action will find the day’s pattern familiar. The condition of consolidation near both the Floor Trader Pivot and the Opening Range Low, followed by a breakdown, is a reliable trend day (down) pattern. Friday, the breakdown was a response to Trump announcing that he plans to issue additional reciprocal tariffs

As we’ve discussed in this column for several months, the stock market is currently just as likely to respond to credible changes in inflation expectations as it is to respond to actual. inflation data.

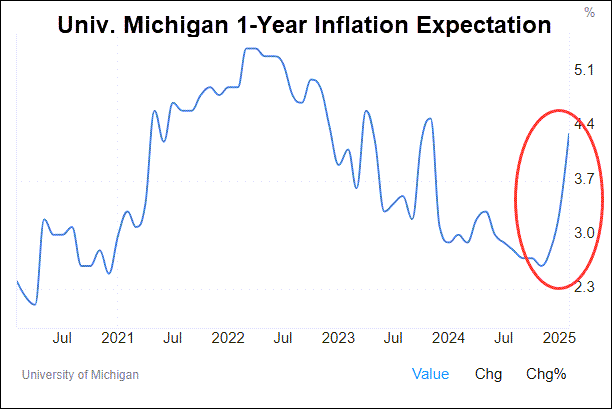

As you can see in the chart below, the spike to 4.3% is a sharp jump from 3.3%, and it follows a substantial jump in the prior month.

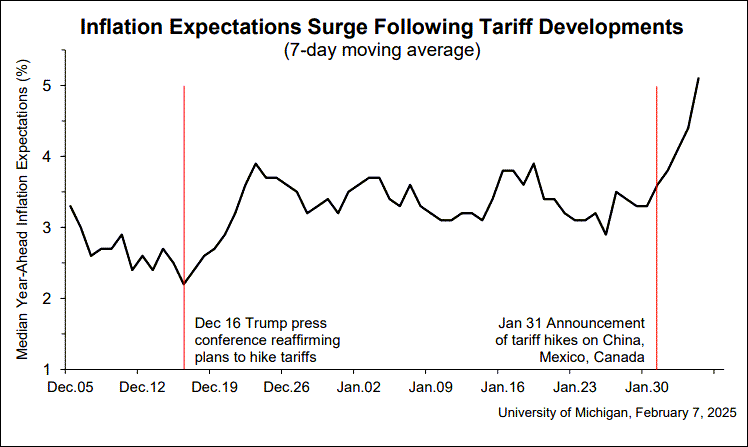

While there is some debate over the extent to which tariffs will impact the inflation data. It’s hard to argue against the belief that tariff announcements will increase inflation expectations.

The red lines in the chart below indicate when tariffs were announced.

What About My Rate Cuts?

With a strong, reassuring employment report and higher inflation expectations, there will naturally be pressure on the Fed to further delay cutting the Fed Funds Rate.

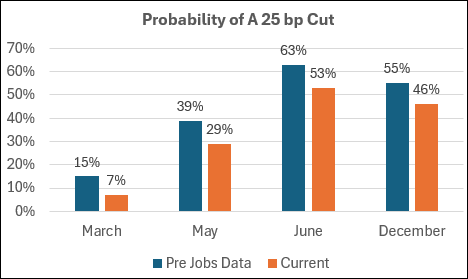

Looking at the odds of rate cuts based on the Fed Funds Futures market (below) this certainly appears to be the trend in investor sentiment.

Earnings

As Fed rate cuts get pushed further into the future, the need for earnings growth to become the fuel of the bull market becomes more important.

Fortunately, corporate America has continued to deliver.

According to FactSet…

- Earnings Scorecard: For Q4 2024 (with 62% of S&P 500 companies reporting actual results), 77% of S&P 500 companies have reported a positive EPS surprise and 63% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Growth: For Q4 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is 16.4%. If 16.4% is the actual growth rate for the quarter, it will mark the highest (year-over-year) earnings growth rate reported by the index since Q4 2021.

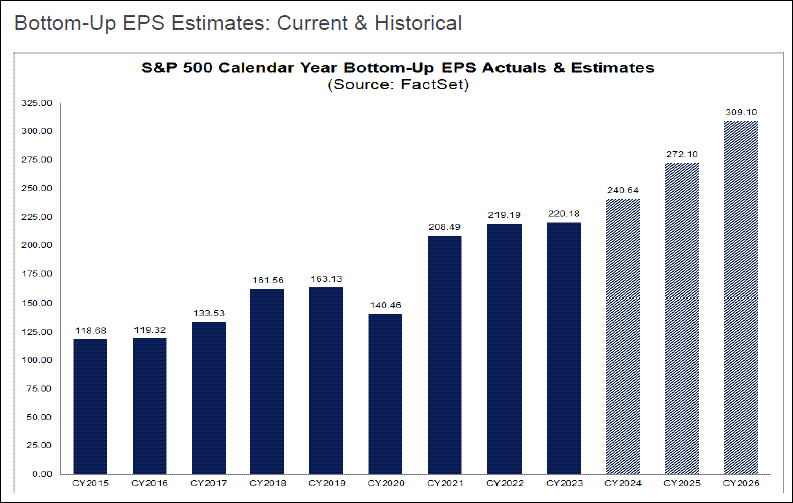

The chart below shows the growth and expected continued growth on a calendar year-over-year basis for 2024, 2025, and 2026.

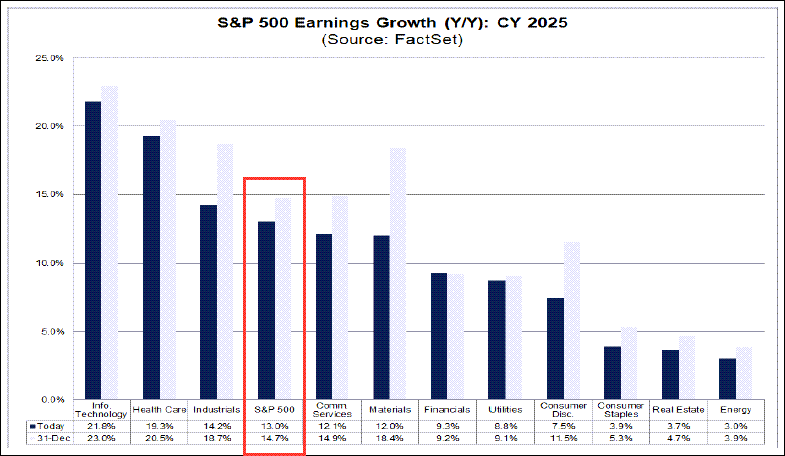

When you look at a more granular level of 2025 by sectors, below, you can see several insightful trends.

These notable trends as they relate to the market action include the following (you can find the charts below on the Big View Sector Summary page here):

-

The growth has slowed in every sector except the Financials since Dec 31st

- The tech sector ( XLK ), which has been a leader in price action. XLK and XLF are the only sectors to have reached a new all-time high in 2025. It is also leading the earnings chart.

3. Health care (

XLV

) languished in price action in 2024, but has become a top performer relative to the January Trend trade. It’s the second-best performer YTD behind XLF, and the second-best in the earnings chart.

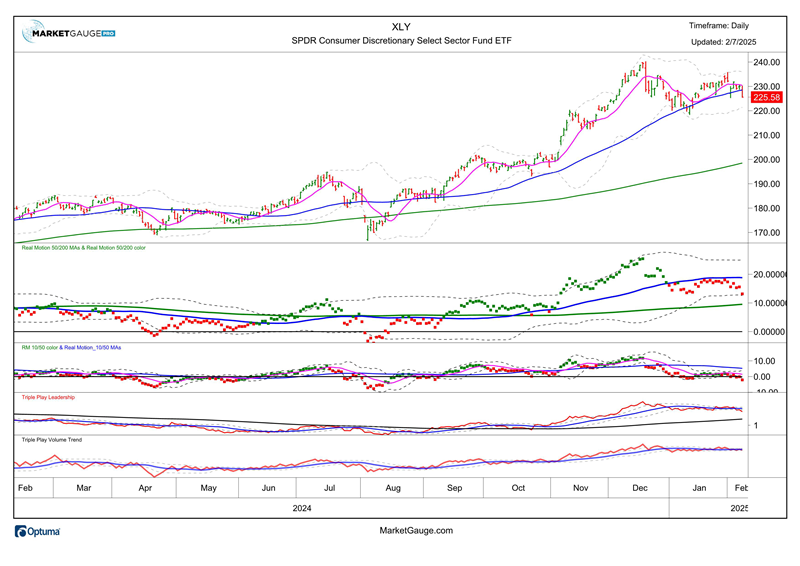

4. Consumer Discretionary ( XLY ), has seen one of the largest slowdowns by this earnings measure.

Perhaps this explains why this sector, which was one of the top price performers in 2024, is currently the worst performer year to date.

When we look to the same earnings perspective for 2026 (shown below) there are some additionally noteworthy trends.

These notable trends as they relate to the market action include the following (you can find the charts below on the Big View Sector Summary page here):

- Six of the eleven sectors show an improved outlook vs. Dec. 31. The S&P 500 also shows an improvement.

- Energy ( XLE ) is at the top of the chart, which is a remarkable change from being dead last in the 2025 chart. After a strong start in early January 2025, its price action YTD has pulled back into its January Calendar Range.

3. Tech ( XLK ) and Industrial ( XLI ) remain on the left side of the index which represents the fact that they are outperforming and leading in terms of earnings growth.

Both (XLI below, and XLK above) had a strong start in early January 2025, but their price action YTD has pulled back into their January Calendar Ranges.

4. Consumer Discretionary (

XLY

) and Materials (

XLB

) are both leading sectors and showing improvement vs. Dec. 31 in 2026. This represents a bullish trend in BOTH sectors and in these conditions relative to the 2025 chart. XLB (shown below), had a strong move in late January but has since stalled within a longer-term bearish phase. Both sectors need to make new YTD highs to confirm a durable trend for 2025.

In summary, the market’s price action seems consistent with a bull market that is finding the strength from economic growth and the current earnings season to withstand bearish news like tariffs, and consumer inflationary concerns that provoke inflationary fears and declining probability or accommodation from the Fed.

However, as you’ll see in Keith’s weekly video and read in the Big View bullets, there are signs that the market may be getting heavy.

As shown above, there is substantial sector rotation underway (i.e. early moves up in Energy, and Healthcare), and credible leadership (i.e. financials).

As is often the case, rotation can lead to general market consolidation which can set the stage for a new advance or breakdown leadership and begin a correction.

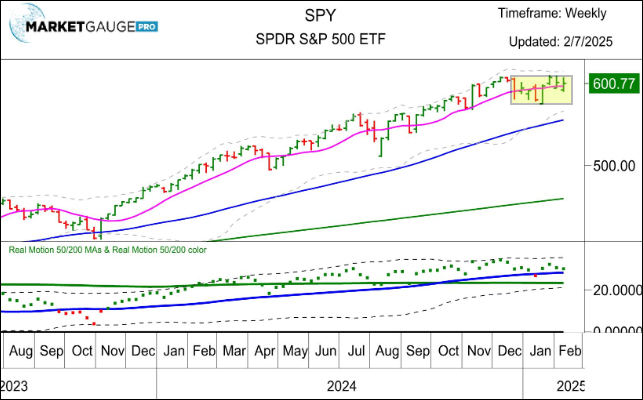

Stepping back to the weekly perspective shown in the SPY chart below. The yellow box states the obvious condition of consolidation.

Here and in our live mentoring, we talk about the January Calendar Ranges for as long as they are relevant because they offer a more granular way than the yellow box above to identify the inflection points that will trigger the next acceleration or reversal of the trends in the market, sectors, stocks or any other market.

This year, these ranges are very relevant, and we’ve outlined the basic application of this trading tactic in this column in prior weeks as well as in Mish’s Daily. If you’d like more information on how to use them to improve your market insight and timing of trades, contact [email protected] (www.marketgauge.com/call)

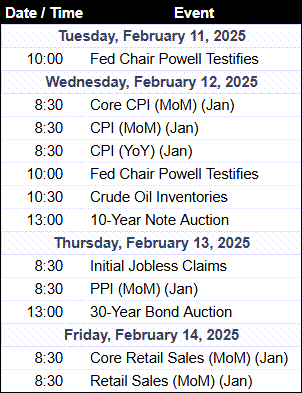

Look Out

Next week’s key economic data includes inflation! The schedule is below. If you’ve been reading this column, you should know how to interpret what the market has to say about it. If you’d like more help, contact us!

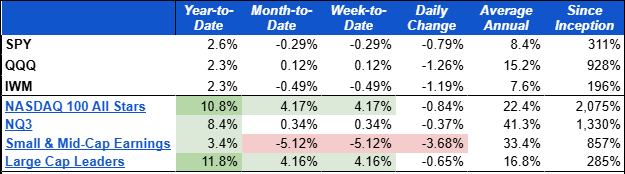

Earnings season is often rewarding for our trading systems and this season has been a good example. All of our stock-focused models (shown below) are outperforming and most by a wide margin.

Only one of our models (Small and Mid-Cap Earnings Growth) targets earnings as a factor, but historically our momentum-based algorithms have positioned us in stocks that tend to have positive reactions to earnings reports such as PLTR , TEAM, TPR, EAT, and more.

Three of the models hold PLTR with entry points at different times and as a result its success has had varied impacts on the models ranging from 8% to over 40% gains.

This week’s weakness in the Small Caps model giving back gains on big winners like EAT and continued weakness in names dragged down from concerns related to the Deepseek news.

Our sector model is also outperforming (+4.7%) with exposure to Tech, Financials and Consumer Discretionary. The model has not made any changes toward exposure to gold , but if current trends continue, that could happen in the near future.

Summary: While ending the week largely flat, waning momentum and weak seasonal patterns hang over this market.

Risk On

- On a shorter-term basis, Value stocks continue to lead growth, pointing to a potential important rotation. It is critical that they both maintain their bullish phases. (+)

- Foreign equities improved significantly on the week, particularly compared to the S&P, and are right at their 200-Day Moving Averages. (+)

- Copper also had a significant breakout, bouncing strongly off of critical lows and going into a recovery phase. (+)

- The weekly charts in the four indexes are giving a positive read assuming the lows in January hold. (+)

- The long end of the Yield Curve eased this week putting the long bond ( TLT ) in a recovery phase and assuming we aren’t going into a recession this could be bullish for equities (+)

Neutral

- Market internals, as measured by the McClellan Oscillator are at neutral-to-slightly negative reading. (=)

- Gold closed at new all-time highs due to both political uncertainty globally and inflationary pressures persisting. (=)

- Three out of the four indexes were basically flat on the week after giving up most of their gains on Friday. Looking at pure price action, we have to concede things are looking a bit toppy when factoring in the waning momentum on our Real Motion indicators. (=)

- Soft commodities have been holding up well and is in a little bit of a compression range. If it can breakout of the recent highs, that would be a significant technical improvement. (=)

- Eight of the fourteen sectors we track were up on the week, which is slightly positive. The biggest standout, Consumer Discretionary (XLY) was the weakest, while Gold Miners (GDX (NYSE: GDX )) and the long bond (TLT) were both up. (=)

- The modern family points to an important rotation, with strength in Transports and Regional Banks, while the rest weakend significantly by Friday’s close. (=)

- Volatility readings rallied on Friday, though it could be viewed as a potentially muted response and is currently sitting on both its 50 and 200-Day Moving Averages. (=)

Risk-Off

- Volume patterns remain weak, especially in the Russel 2000 and Nasdaq. (-)

- The 52-week new high new low ratio has flipped negative. (-)

- Except for the Nasdaq on a short-term basis, the color charts are either neutral or negative in the other indexes and timeframes. (-)

- Risk Gauge went to 100% risk-off as both gold and bonds firmed while the key U.S. stock indexes lost relative strength. (-)

- The percentage of stocks over their key moving averages rolled over on a short and intermediate-term basis. (-)

- Seasonal patterns in the market are negative for February. (-)

- The TSI has flipped to a negative reading for The Russell 2000 (-)