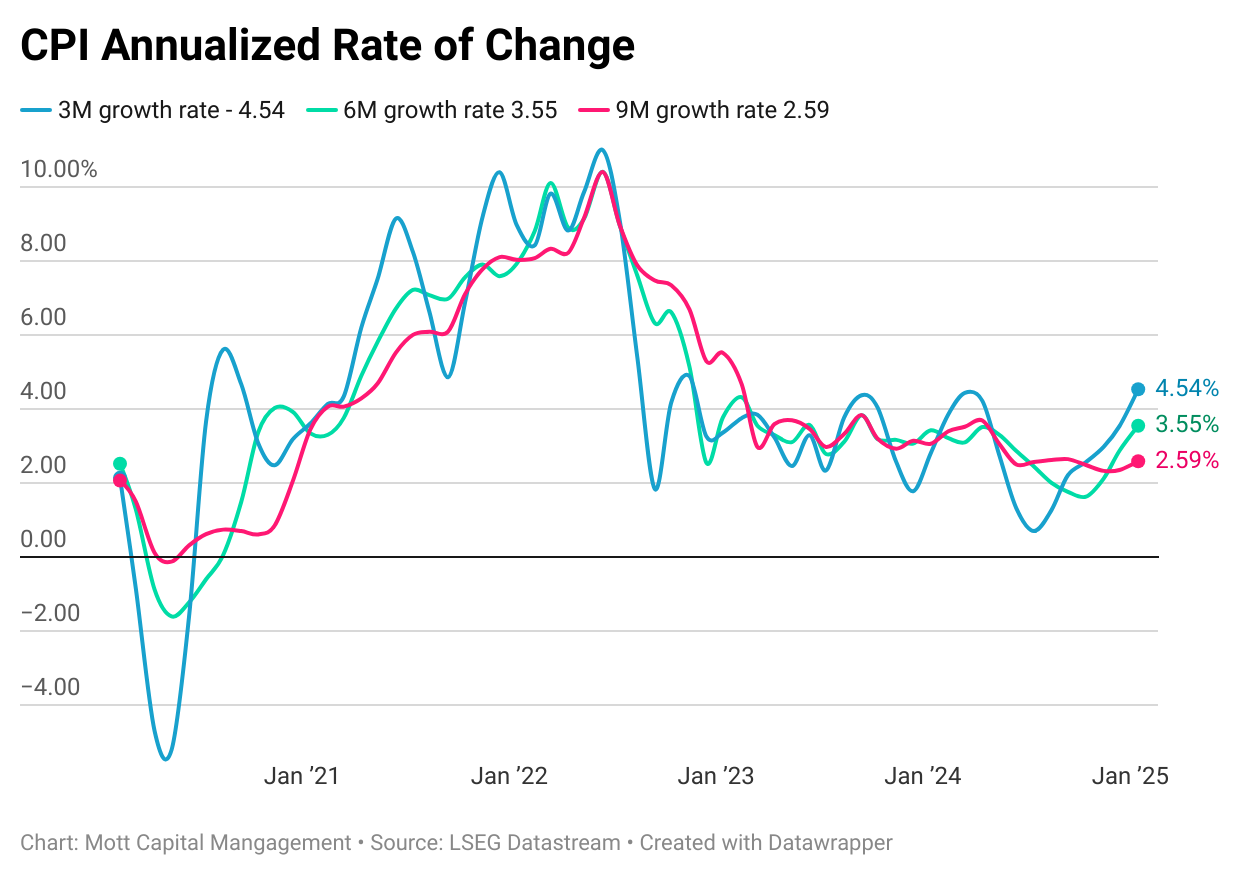

Yesterday's CPI came in much hotter than expected, and the impacts were felt throughout the bond market and the US dollar complex.

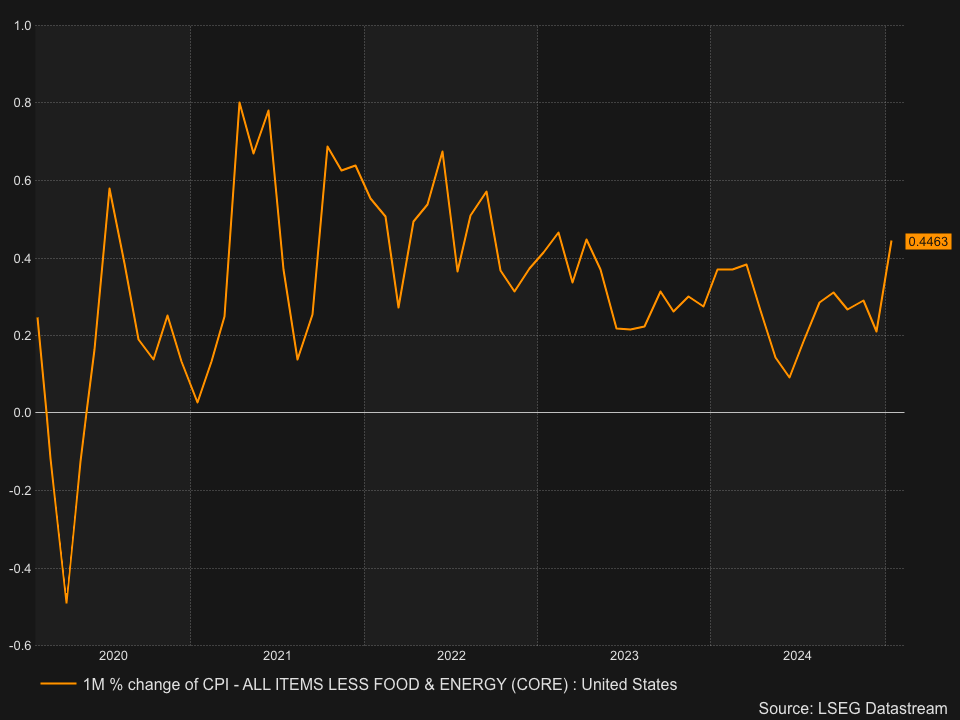

Core CPI

came in at 0.4% - hotter than the 0.3% m/m estimates. Meanwhile,

year-on-year

increased by 3.3% much hotter than the estimates for 3.1%. It actually just missed rounding up to 0.5% M/M, printing at 0.4463%.

Headline

CPI

rose by 0.5% versus 0.3% m/m and by 3% y/y versus the estimate of 2.9%. This will put a lot of emphasis on today's

PPI

numbers because those, combined with CPI, will give us an idea of where

Core PCE

will be.

Inflation swaps traded higher on the day, with the 2-year CPI Swap easily breaking out, and it appears to be well on its way back to around 2.85% if the current trend stays in place. Of course, tomorrow’s PPI report will have a big say in what happens next.

10-year rates

have jumped sharply, rising about 10 basis points today. Resistance is around 4.65%, but the broader uptrend remains intact. It also looks like that potential head-and-shoulder pattern has failed, reinforcing the bullish trend. If this breakout holds, we could see rates push past 4.80%.

The

2-year yield

could break higher toward 4.50% if the PPI is hotter than expected tomorrow. It stopped today at resistance, so one can only imagine what will happen if the data holds up in the coming days.

The yen has broken above its downtrend, and if it surpasses 154.40, it could move toward 156.50. At this point, the

USD/JPY

follows US 10-year rates, and if those rates move higher, then the USD/JPY will weaken.

The

S&P 500

finished the day down by around 30 bps, and it mostly looked like it was a volatility reset that kept the index together. The

VIX

initially spiked on the CPI report but later faded, contributing to market stabilization and the S&P 500 rebounding. Once the VIX stopped falling, the S&P 500 just went sideways.