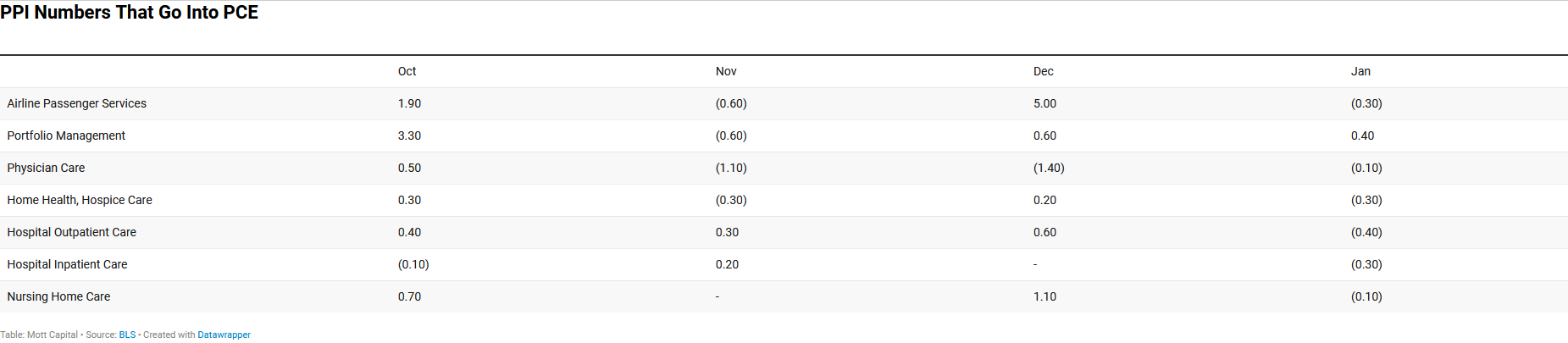

Stocks finished the day higher as bond yields fell following the PPI report. The key data points in the data suggested that core PCE will likely not come in as hot as the core CPI report left investors feeling worried about. That sent rates lower on the day and revered yesterday’s rate rise.

PPI Numbers That Go Into PCE

This sent the

10-year rate

down by almost 10 bps on the day and back to where we started before yesterday's CPI report. It is hard to say how much of today's move is about positioning and those looking for a hotter PPI report. The core PCE is still likely to be around 0.3% in January.

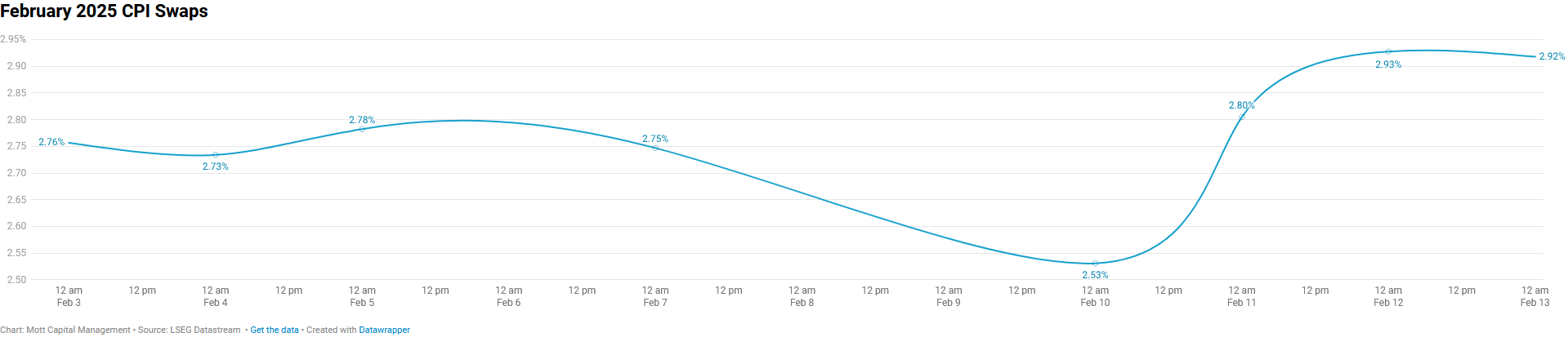

Inflation swaps, which tend to be forward-looking, took a different view on the subject of inflation because today, 1—swaps traded higher on the day, and 2-year swaps were down slightly.

Additionally, swaps for February are now pricing at 2.9%, following the hotter-than-expected CPI report yesterday. That is up from 2.7 to 2.8% before the report.

February 2025 CPI Swaps

More importantly, though, was that December 2025 Fed Fund futures finished lower by five bps today, and stayed above that 4% mark. It would lead one to believe that moving lower rates today was probably somewhat overdone and probably had more to do with positioning than anything else.

In the meantime,

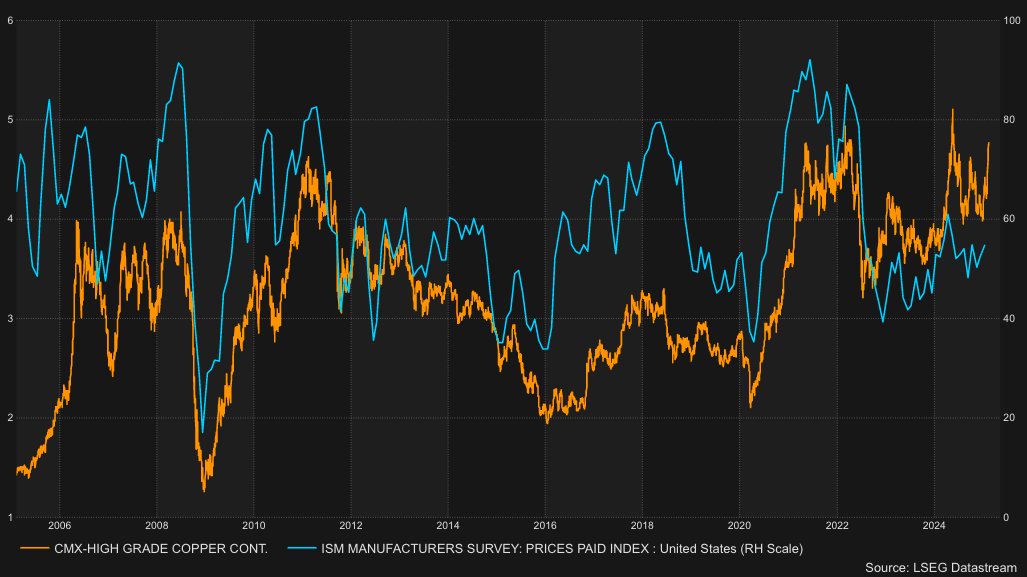

copper

prices rose sharply today, another 1.5% on top of the 12.25% rise they had seen since February 3. To say that copper is an essential point in the road is an understatement because if it goes higher its next stop is likely not to be until around $5.25

It is highly correlated with measures such as the ISM manufacturing prices paid index for copper.

For the stock market, it is hard to say precisely why things went as they did. But more importantly was the bizarre action seen in the VIX 1 day, which may tell us a lot about what happened. Typically, during the day we see the VIX 1 day rise throughout the day, but today, we saw that VIX 1 day rise until 1:45 PM, which was when Trump, of course, was talking about tariffs, and clearly, the market liked the part when Trump said the EU lower its tariff to 2.5%.

The VIX 1-day dropped pretty much the rest of the day.

Today was similar to a Fed day, such as January 29, when the market leaves hedges in place until Jay Powell finishes his prepared remarks and the VIX 1 day goes down. Today, it was the Trump version.

This is not to say that the buying in the market wasn't actual or to diminish its value, but it explains what could be the why, and the why is very important to understand. Just remember that tomorrow is a Friday heading into a three-day weekend, and the market may decide to put hedges back on heading into a long weekend, given the unpredictable and fast-paced nature of the news flow these days

Original Post