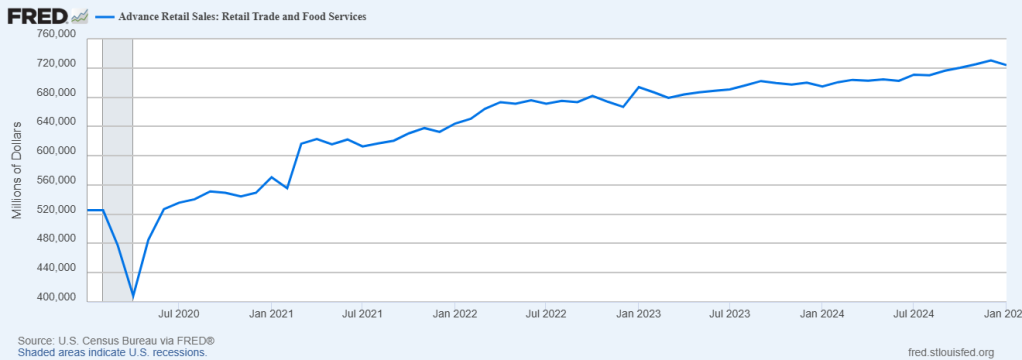

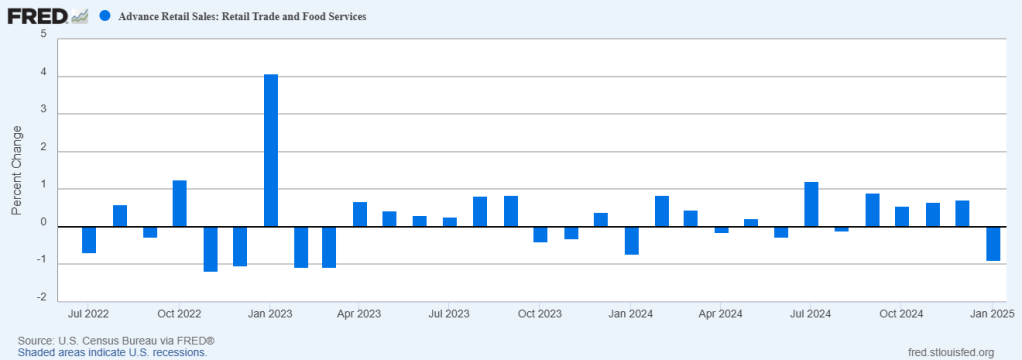

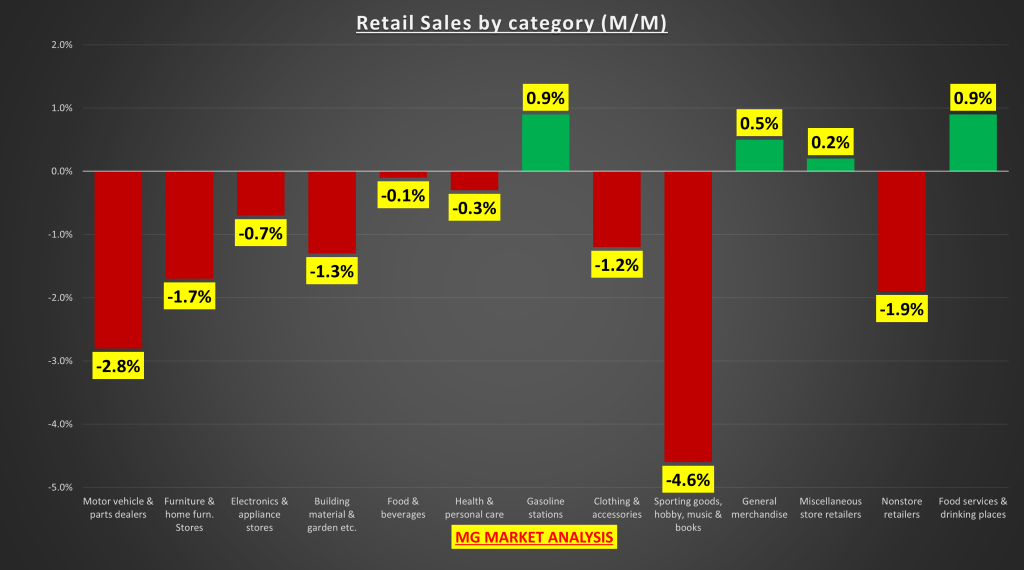

Total retail sales for January came in at $723.9 billion, a decline of -0.9% for the month. The street was expecting a decline of only -0.2%.

This was the biggest one-month decline since March 2023. Although December was revised higher, from +0.4% to +0.7% monthly gain.

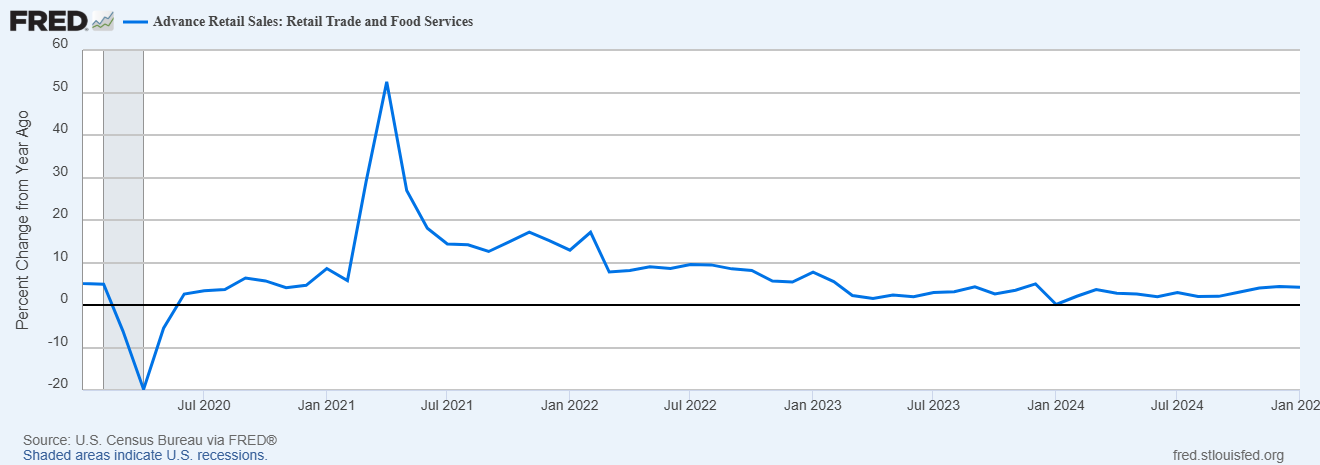

Total) retail sales are up 4.2% over the last 12 months. After the major spike during COVID, sales have settled within a 3-4% annualized pace.

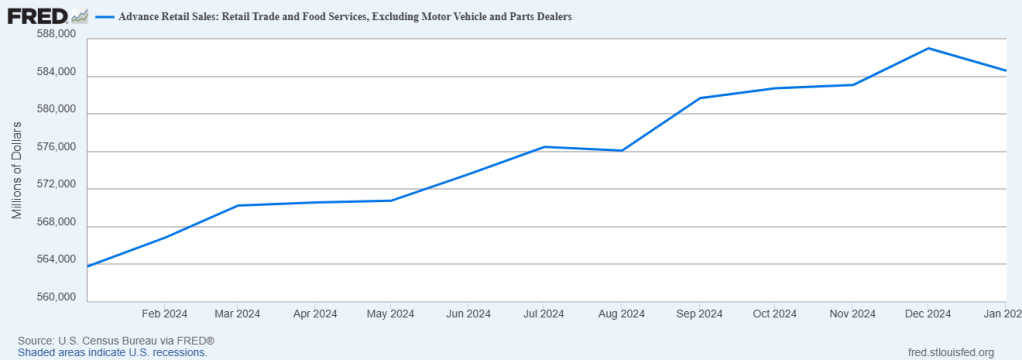

Retail sales minus autos (or core retail sales) also disappointed; coming in at $584.6 billion. A decline of -0.4% for the month, when the street was expecting a gain of 0.3%. Core sales are still up 3.7% over the last 12 months.

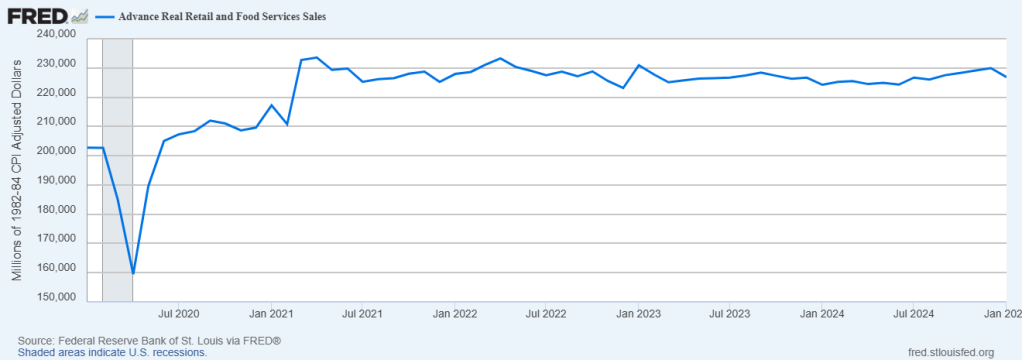

Retail sales adjusted for inflation (or real retail sales) haven’t gone anywhere for 4 years and still remain below the January 2021 highs. Real sales declined 1.3% for the month, but are up 1.2% over the last 12 months.

Breaking down the retail sales report by category, we can see the declines were broad-based among categories. With only 4 of 13 categories positive for the month. Even nonstore retailers (online) posted a decline in January.

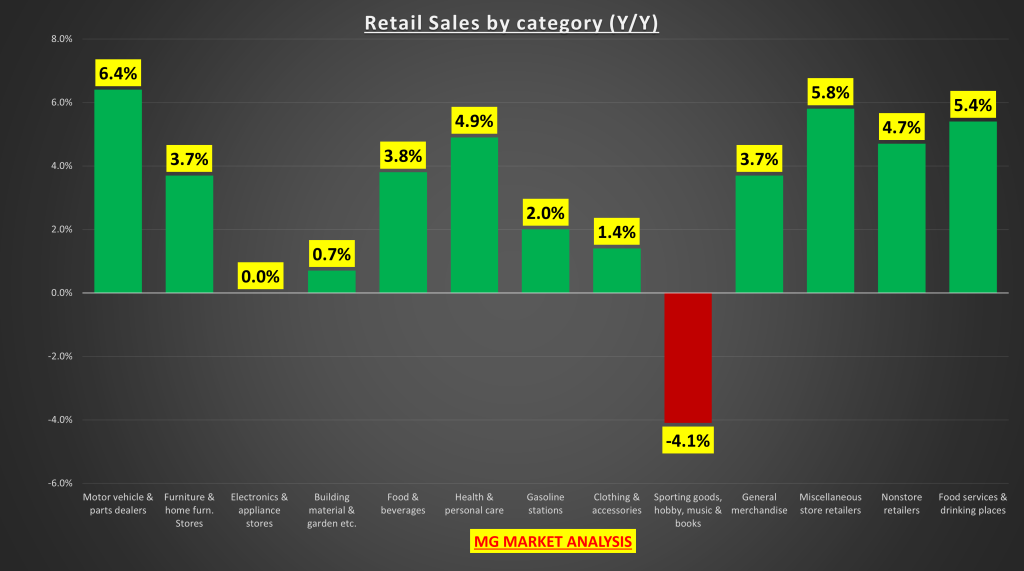

While over the last 12 months, all but 2 categories are still holding onto gains.

Another disappointing retail sales report. After the better-than-expected manufacturing PMI, I was interested to see if it would have an effect on retail sales. Obviously, it hasn’t carried over yet. In response to COVID, consumers were stuck in their homes and stocked up on goods. This caused an initial surge in the sale of goods, but as the economy and world opened up again, we see this has normalized over the last few years.

The only reason why total retail sales have moved higher is because of the increase in prices of the goods that are sold (as depicted in the real retail sales chart). The level of demand has not increased. While today's report is a disappointment, if we look at the bigger picture (annualized data): as follows:

Total (EPA:

TTEF

) retail sales: +4.2% y/y

Core retail sales: +3.7% y/y

Real retail sales: +1.2% y/y

…we can see that sales are still growing at a pace that corresponds to 2-3% economic growth.