USDJPY at an Important Crossroads

The USDJPY is at an interesting point for a trader. 83.73 price is the line in the sand for a bearish outlook on the pair. So long as prices remain below this level, a multi-month triangle is likely play out to new lows. Therefore, a trader can place a stop just above at 83.85. This trade has a low percentage of success, but if it is successful, there would be several hundred pips of potential to the downside. This means a strong risk to reward ratio is present on the trade. The potential exists for new lows below 80.

(USDJPY Bearish Scenario)

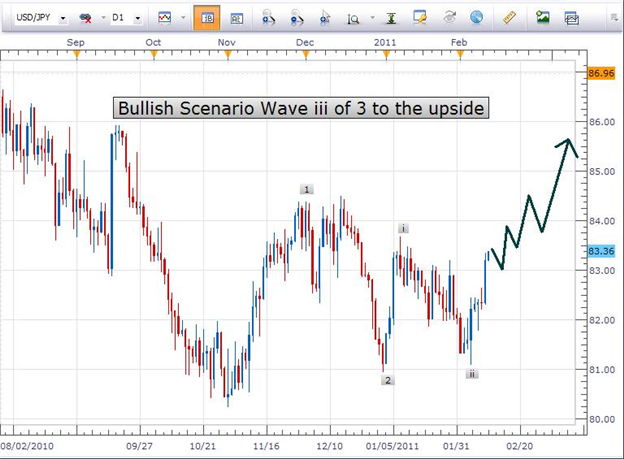

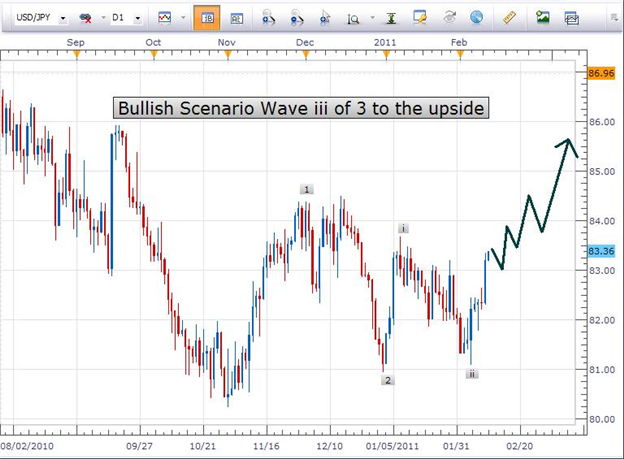

If the 83.73 line in the sand is broken, then it is possible the USDJPY is in the midst of a powerful wave iii of 3. (Wave 3's tend to be the strongest of the wave patterns.) This could carry the pair into the upper 80's at a minimum.

USDJPY Bullish Scenario

With an elevated SSI reading of 3.25 on the pair, I would be biased to the short side.

For more information on trading with Elliott Wave, log into DailyFX Plus (a live FXCM account username and password is required). Four on-demand videos explain how you can trade with Elliott Wave. Additionally, check out the archived videos in the webinar room inside DailyFX Plus for recordings of live webinars on Elliott Wave.