Last week the market said that it has a new #1 concern, and it’s not inflation.

It is, however, one of the most effective remedies for inflation, but also one of the least popular among consumers and investors.

Fortunately, the Fed may be able to lend a helping hand here should the situation get serious.

The concern I’m referring to is slowing economic growth, and to make matters more serious, it’s consumer-led slowing growth.

Before you dismiss the idea that the market is worried that the economy is slowing, consider this…

- The market looks out 6 to 12 months, so it can respond to things that don’t feel real yet.

- The market may be “wrong,” but it could still be the reason it’s selling off right now, and it’s prudent to know why it’s moving up or down to determine what it may do next.

- Economic growth can slow down without leading to a recession, just like the stock market indexes can correct without leading to a bear market.

Buy The Dip?

For the last several weeks, the market has had positive news in solid earnings reports to provide it with the “growth” factor that investors can lean on to justify higher prices.

With earnings in the rearview mirror, the market will turn its attention to the other area it looks for growth – the economy.

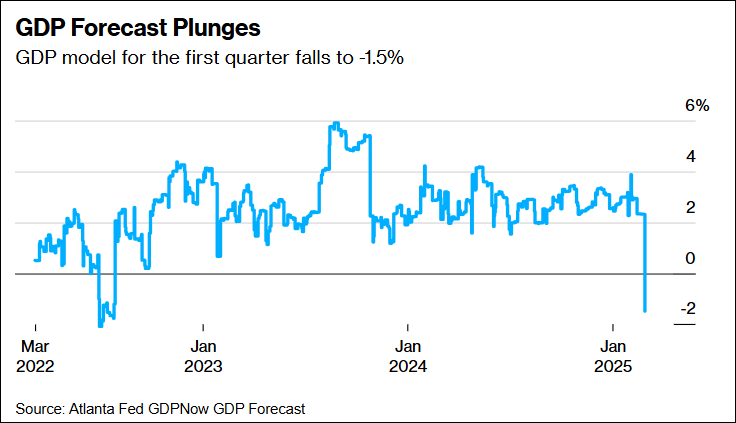

Unfortunately, as you can see in the chart below, on Friday, the Federal Reserve Bank of Atlanta’s latest GDPNow forecast plunged to a level that represents GDP declining to a -1.5% annualized rate, which is down from a range of 2% to 3%, which it has held for over a year.

What’s Happening?

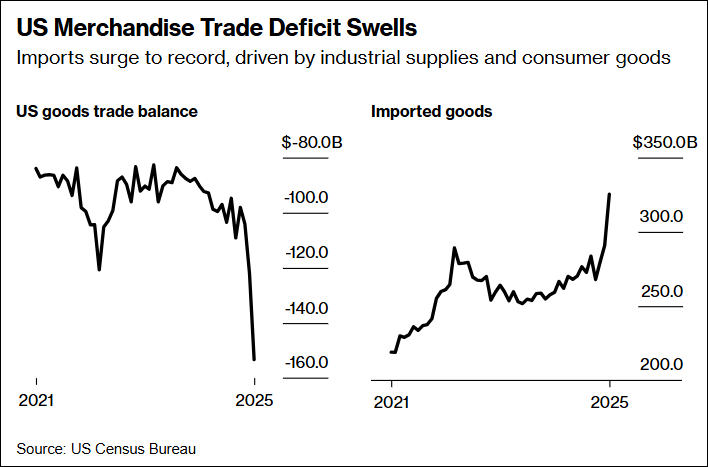

A large part of the calculations that led to the sudden drop can be attributed to two areas – a record trade deficit instigated by the tariff threats and a record decline in inflation-adjusted personal spending.

The chart below shows how imports shot up (right chart) which causes the trade deficit to decline (left chart). The sudden rise in imports represents companies trying to front-run the effect of proposed tariffs.

The significance of this for the average but savvy investor is to see that the chaos of the current tariff policies has and will continue to have unintended and unexpected consequences. Although this example should not come as a surprise to economists.

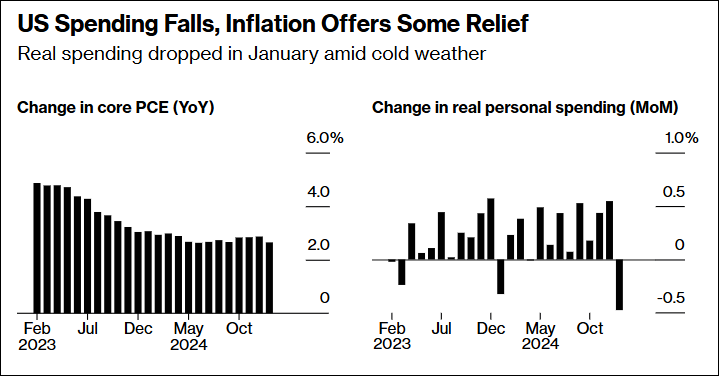

More concerning is the negative news from Friday’s PCE report.

This report’s “Change In core PCE (YoY)” shown below (chart on the left) is known as the Fed’s preferred measure of underlying inflation. As a result, its decline and the fact that the majority of its related data points were reported as being in line with expectations should have been good news for stocks.

Maybe it was, but…

Unfortunately, other data in the report, “Change real personal spending (MoM)” (the chart on the right) was surprisingly weak.

The weak or hesitant consumer was the same theme that sank stocks in the prior week.

Recall that, as earnings season wound down, on Thursday, February 20th, Walmart’s stock dropped 6% after its earnings beat expectations, but the forward guidance disappointed investors with news of slower growth and recognition that tariffs would create issues for them.

Walmart (NYSE: WMT )'s guidance is particularly significant as it is the nation’s top grocer and is often viewed as a barometer of consumer health.

The next day, Friday February 21st, the market sold off significantly in response to Michigan Consumer Sentiment data that was weaker than expected and cut across groups by age, income, and wealth. This, too, was attributed to worries about higher prices driven by tariff actions.

Listen To The Market, Not The Economists

Is the consumer in trouble, or just pausing, pulling back?

The S&P 500 has two consumer sector ETFs, Discretionary ( XLY ) and Staples ( XLP ), and these can tell you what the market thinks of the consumer. XLY is considered a risk on sector while the XLP is considered risk off, or defensive.

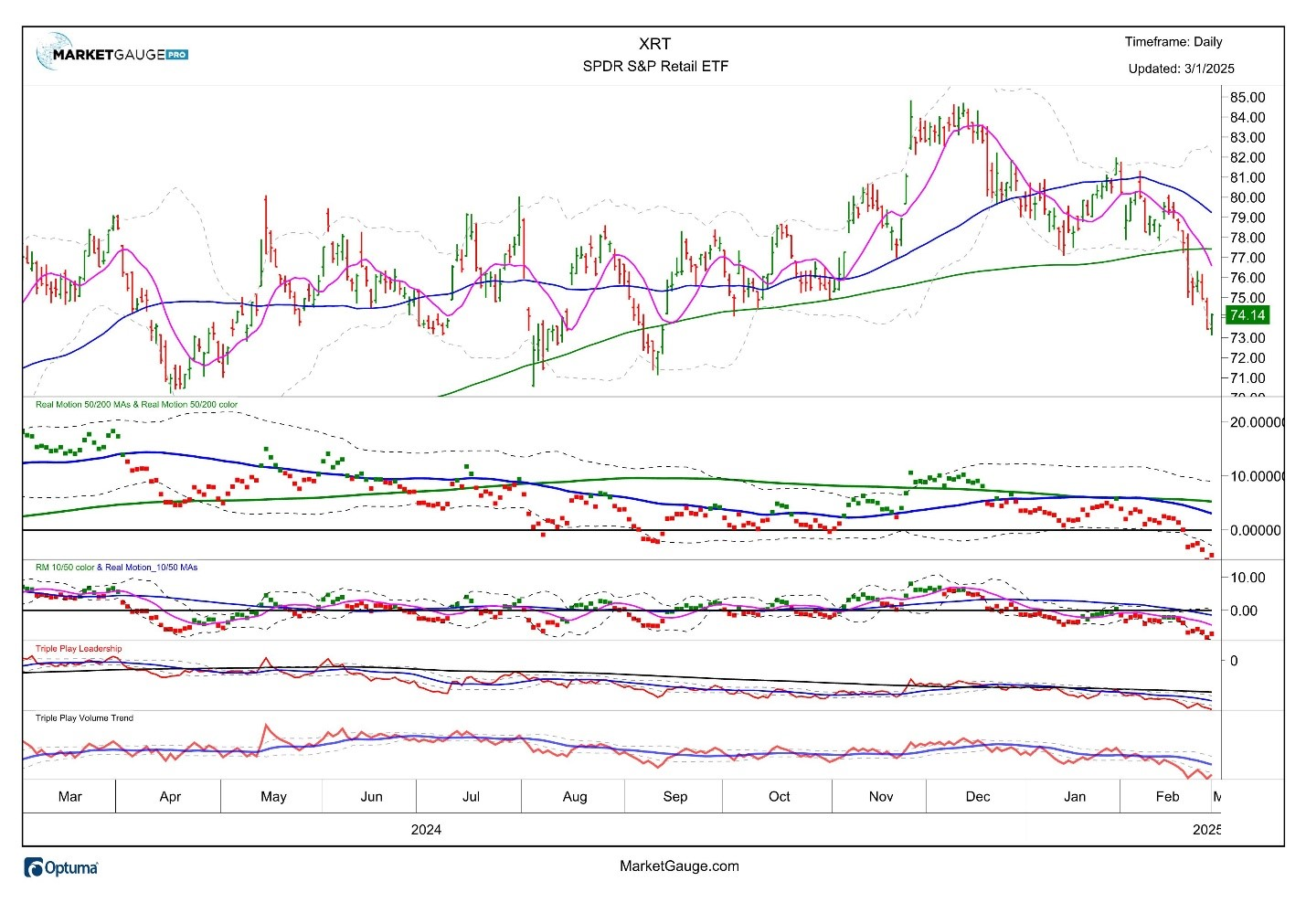

Another consumer ETF is the SPDR Retail ( XRT ) which is part of Mish’s Modern Family. XRT trades in a very correlated way with XLY, although XLY has been significantly stronger over the last year.

When XLY and XRT are in a bullish mode, it is typically a good indicator for the market ( SPY ).

In a recent Mish’s Daily, Mish described how to look at XRT to measure market’s sentiment towards the consumer.

Below you’ll find the XRT chart you can find on the Big View Sector Summary page. As you’ll see, it’s below its 200-day moving average and below its January low. Repeating the advice of Mish’s article – until it clears both of these levels (around $77), it’s in a bearish mode.

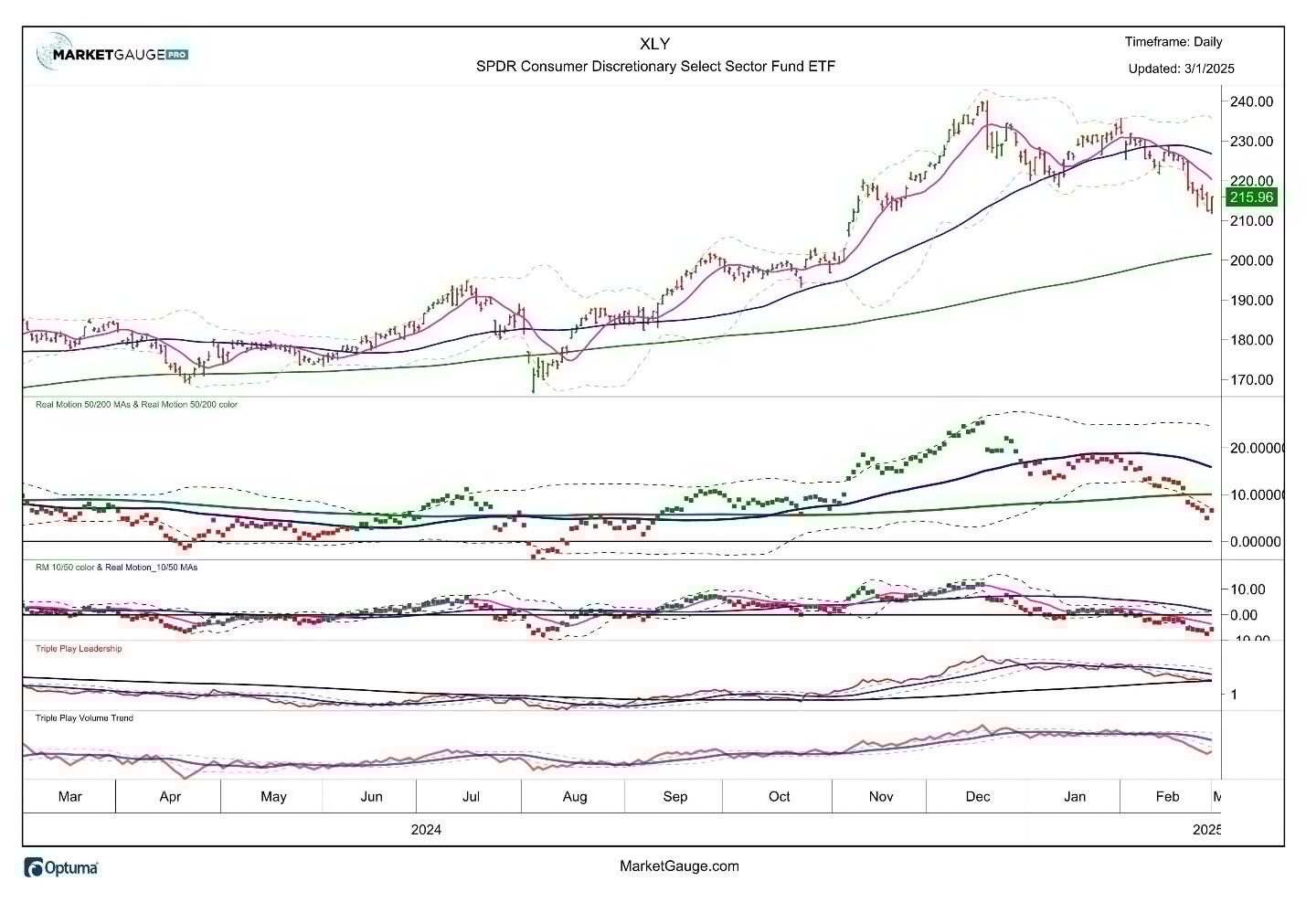

The chart of XLY below is also from our Sector Summary page. As you can see it’s below its 50-day but above its 200-day. It’s also below its January low. Like the analysis of XRT, the key level for XLY to get above to demonstrate that its correction may be over is its January low, which is roughly $220.

When the risk-on consumer sectors of XRT and XLY are weak, they represent bearish investor sentiment toward the consumer. However, the Consumer Staples sector (XLP) can represent a consumer that is just defensive, not tapped out.

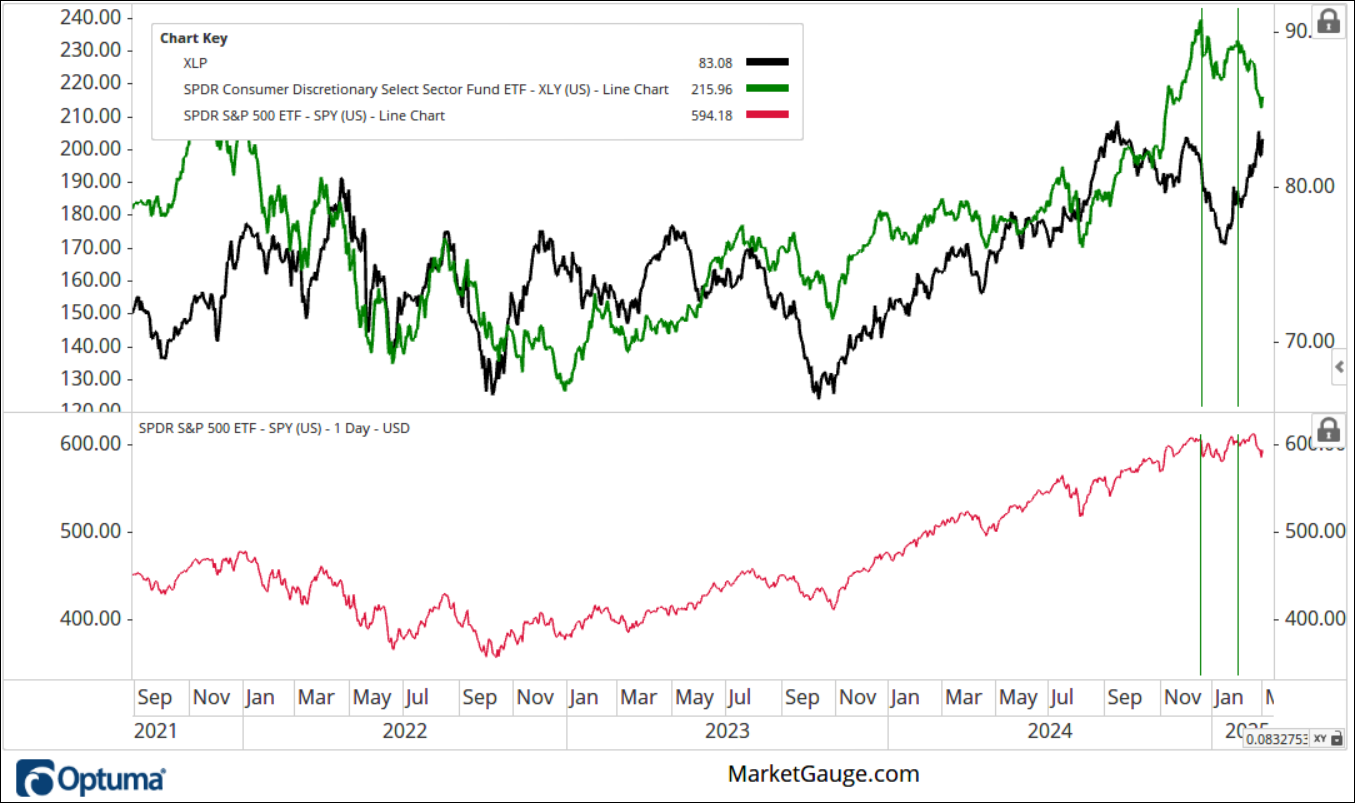

In the chart below, you’ll find a weekly view of the XLY (green) and XLP (black) displayed over the SPY (red). You may notice the following pattern - the SPY tends to follow the XLY generally, but the SPY correlates very closely with the consumer sectors when they are BOTH going in the same direction.

The vertical line in Nov. 2024 is an example of a time when XLY turned down to create the condition of both XLY and XLP trending in the same direction – down. The vertical line in Jan. 2025 indicates the point at which XLY turned down. However, XLP continues to move higher, creating a divergent condition that should be closely monitored.

A turn lower by XLP with XLY still trending down would be very bearish.

On the other hand, a turn up in XLY followed by a move over $220 could indicate the end of the correction in the consumer sectors.

How Bad Is It – Recession?

Thinking recession at this point would be like calling the current market pullback the beginning of the next 20% bear market.

Most likely, the current environment is a temporary growth scare stirred up by the recoiling of overenthusiastic expectations of Trump 2.0 ‘pro-growth’ promises combined with the unexpected consequences of the chaotic tariff policies and DOGE related actions.

The takeaway should be that economic data points related to weakening growth or a weakening consumer may lead to increasingly more downside volatility.

The market is saying this in several ways. The consumer sector ETFs are just one way to monitor and measure it.

Another way to see this is in the bond and Fed Funds markets.

Below, you’ll see an annotated chart of the TLT which points out the bond market’s transition from inflation concerns to growth concerns:

- The gap at the lows in the TLT which was related to a positive CPI report.

- The development of a bullish divergence in the 10 & 50-day Real Motion momentum indicator. This condition identifies bullish reversal areas.

- The breakout gap on Tuesday of last week related to weak consumer sentiment data and tariff concerns.

This does NOT mean that inflation is completely behind us. It only suggests that the market has a new serious concern, as reflected by the move in the bonds.

The concern is also confirmed by the move in the Fed Funds markets, which is now pricing in a 25 bps cut by the June 18th Fed meeting at 57% (up from 47% just a week ago).

Looking forward, the current environment appears to be one in which tariffs are increasing viewed as bearish for stocks in the short term, and bonds are reacting as a risk off alternative.

In our Wednesday live mentoring sessions, I often highlight when the market condition of “bonds rallying with stocks falling” is particularly risky for the bulls. We appear to be there now.

Likewise, a few weeks ago, bonds falling would have been a red flag for stocks to follow them lower. Stocks rallying with weak bonds may now be the best looking day, especially if the catalyst is positive economic news.

Summary: The market sold off hard this week and for the month of February, with a shift from growth into value, though market internals are holding up on a relative basis. We expect continued volatility and headline risk coming out of Washington which includes both tariffs and geopolitical stress.

Risk On

- The Dow Jones Industrial Average (DIA) closed back in a bullish phase on friday bucking the selloff in all the other key US Equity indexes.(+)

- Large Cap foreign equities (EFA) closed strong this week, remaining in a bullish phase (+)

Neutral

- Eight of the fourteen sectors we track were down, led by technology and semiconductors. Though we did see some strength in financials and healthcare. (=)

- Value remains in a bullish phase while growth fell into a warning phase. Value is outperforming growth on a relative basis now in both shorter and longer-term timeframes. (=)

- The color charts (moving average of the percentage of stocks above key moving averages) are giving a mixed read on Nasdaq with neutral longer and mid-term readings while more negative on the short-term. S&P 500 is somewhat reversed with more negative readings longer-term and shorter-term looking more positive. (=)

- The cash VIX is in a bullish phase but overbought. (=)

- Emerging markets broke down hard under its 200-Day Moving Average while more established foreign markets held up better on a relative basis. (=)

- Soft commodities ( DBA ) got hit hard and are back in a warning phase and look like they may have topped, a good thing for the economy if food prices come off. (=)

- Gold backed off of its all-time highs and is trading closer to support levels. (=)

- Seasonal patterns tend to show weakness in early March before a reversal and on average a positive March over the last 10 years. (=)

Risk Off

- Three out of the four indexes closed under key moving averages with QQQ and SPY in warning phases and IWM in a weaker distribution phase.Our Real Motion indicator is weak across the board on daily charts. Though QQQ, SPY, and IWM all reached oversold levels on our Real Motion indicator, indicating possible mean reversion opportunity. (-)

- With the sell-off over the last two weeks, we only have 6 accumulation days across all indexes with 16 distribution days, an extremely negative reading for volume and the Friday rally was on light volume. (-)

- Considering the steep market sell-off this week, market internals are holding up on a relative basis with the McClellan Oscillator only at a negative -25, though negative overall and worse in the Nasdaq. (-)

- Risk gauges remain fully risk-off. (-)

- The new high new low ratio is fully negative in stack and slope and not overdone on the downside (-)

- All members of the modern family are under pressure. Semiconductors broke down hard and no members are currently in a bullish phase. (-)

- Bitcoin which we consider a good risk- on indicator when its strong, got hammered, but held its 200-Day Moving average and bounced off the lows on Friday and still above its November breakout levels. (-)

- With gold and soft commodities selling off hard and pressure on the markets, bonds rallied. The Atlanta Fed is forecasting a negative GDP number for the first quarter. (-)