Asset manager Canary Capital has filed registration documents for a spot Litecoin

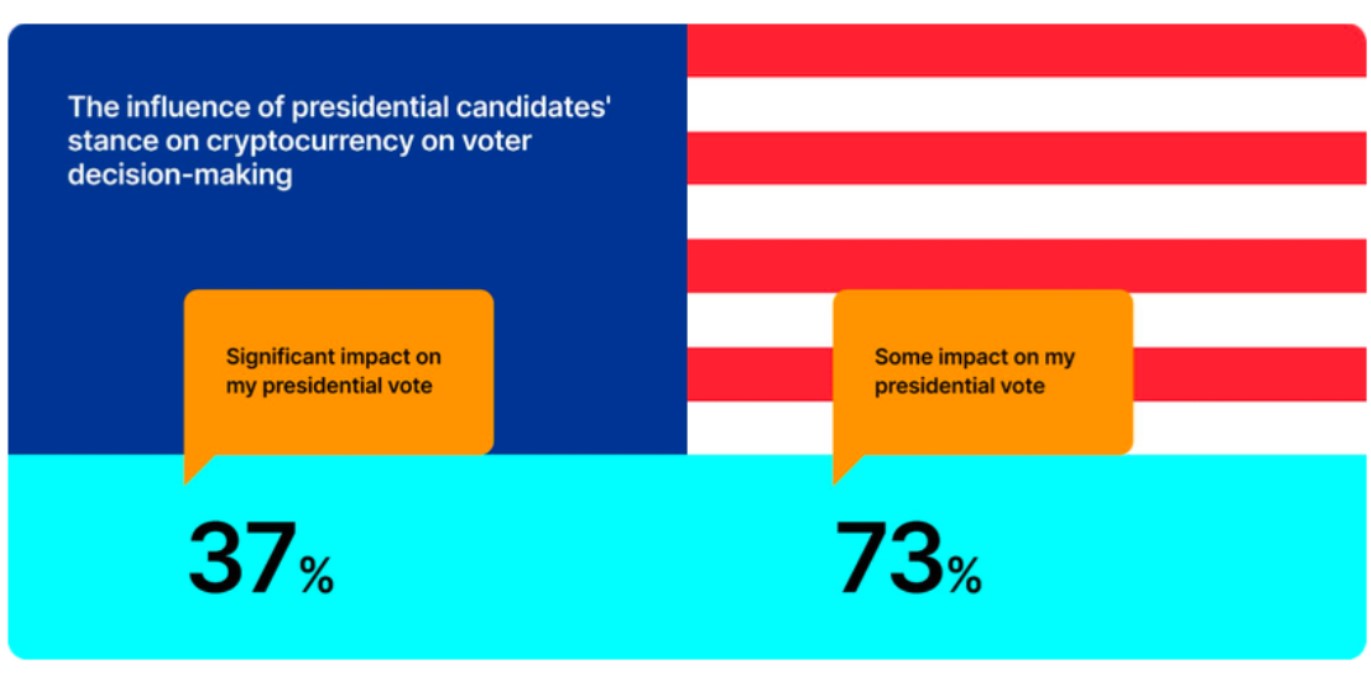

The filing is the latest in a proliferation of proposed ETFs holding alternative cryptocurrencies ahead of the US presidential election in November.

Canary’s proposed ETF aims to hold spot LTC and closely track the performance of the CoinDesk Litecoin Price Index (LTX), according to the filings .

Litecoin is a decentralized peer-to-peer digital currency often pegged as a faster, lower-cost alternative to Bitcoin

Related: Canary Capital follows Bitwise in filing for spot XRP ETF

Canary files for XRP ETF as well

On Oct. 9, Canary filed an S-1 for a proposed spot XRP

“In short-term, this is likely [a] call option on November election,” Nate Geraci, president of financial advisory The ETF Store, said in a post on the X platform.

“Politics clearly matter here in short-term, but I think this is all inevitable over time,” Geraci said.

The XRP token was issued by crypto payments protocol Ripple in 2012.

In 2020, XRP became the subject of a hotly contested lawsuit brought by the SEC, which alleged the token launch amounted to an unregistered securities offering.

Filing the S-1 registration form is the first step toward launching an LTC ETF, but Canary must still wait for the SEC to review the documents.

The SEC needs to authorize a rule change permitting at least one national securities exchange to list the proposed ETF.

United States Vice President and presidential candidate Kamala Harris is friendlier toward cryptocurrency than her boss, President Joe Biden, but not as pro-industry as rival and former President Donald Trump, Galaxy Research said on Oct. 14 .

Under Biden, a Democrat, the SEC has taken an aggressive regulatory stance toward crypto, bringing upward of 100 regulatory actions against the industry.

In July, Trump promised to “fire” Gary Gensler, who currently heads the SEC.

Starting in September, Harris began to up her crypto game, listing blockchain technology among several emerging sectors where she wants the US to “remain dominant.”

Galaxy said “behind the scenes conversations […] suggest Harris is targeting a slightly more constructive approach” than Biden.

Magazine: Blockchain games aren’t really decentralized… but that’s about to change