Cryptocurrency-friendly neobank Revolut said it has prevented millions of dollars in potential customer losses from fraudulent crypto transfers over the past three months

Revolut said on Oct. 7 that it blocked up to $13.5 million worth of “potentially fraudulent crypto transfers” between June 1 and Sept. 1, 2024, according to an announcement sent to Cointelegraph.

“The company’s proactive approach has seen it significantly enhance its crypto-specific security measures recently, which has led to an increase in the amount of potential fraud it has prevented,” Revolut said.

Revolut claims it saved customers over $590 million from potential fraud in 2023

Revolut estimated it saved customers more than $590 million in potentially fraudulent transactions in 2023, according to Woody Malouf, the company’s head of financial crime and fraud.

Malouf elaborated that such potential fraud cases include schemes like celebrity endorsement scams, deepfakes and artificial intelligence-generated scams.

“We mean it when we say we take security seriously — and that absolutely includes crypto,” the exec stated. He specified that Revolut’s security measures include monitoring patterns of suspicious activity, two-factor authentication and “award-winning support” that is available 24/7.

How does Revolut’s crypto anti-fraud tool work?

Revolut’s cryptocurrency anti-fraud mechanism aims to protect investors by signaling potentially suspicious transactions to users.

When customers initiate a crypto transfer, Revolut’s in-house tools, including artificial intelligence-based algorithms, monitor the transfer in real time.

“In our pursuit of being the most secure app in the crypto industry, Revolut will occasionally perform extra checks if its systems spot something unusual,” a spokesperson for Revolut told Cointelegraph. The platform uses data from multiple sources to feed the algorithms and make the optimal decision on the transaction, the representative noted.

After detecting suspicious activity, Revolut requests additional information from a customer about an incoming or outgoing transfer as part of a review. If such data is not provided, the transfer will be reverted. “There is usually no impact on the customer’s account if this happens,” Revolut stated.

If Revolut establishes that the transfer isn’t genuine or that the customer is likely the victim of fraud, the transaction will be canceled to protect the funds.

In very rare circumstances, such as illegal activity, Revolut may restrict or close customers’ accounts, which is “always taken as a last resort,” according to the firm.

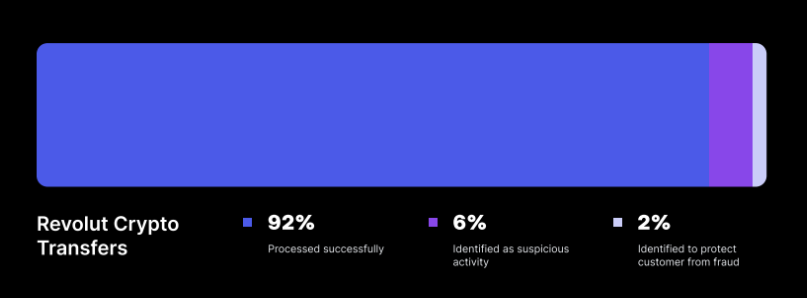

Revolut says it processes 92% of crypto transactions without additional checks

“Revolut’s system is designed to handle genuine transfers efficiently,” the firm said, adding that the platform completed 92% of all crypto transactions without requiring any additional information from the user.

“For the remaining 8%, additional reviews have been necessary to ensure compliance with fraud prevention, Anti-Money Laundering regulations and other safeguards,” Revolut stated, adding:

“Only 1 in 5,000 transfers leads to account closure after further review — that’s less than 0.02%.”

Related: Crypto phishing scams drained $46M in September

Emil Urmanshin, director of crypto and new bets at Revolut, said the platform has been “constantly fine-tuning” its transfer process since launching crypto withdrawals and deposits. He stated:

“We follow strict financial regulations to create a secure environment for all of our customers’ crypto transactions. This starts from the second they sign up — from monitoring patterns in suspicious activity to identity checks and using two-factor authentication.”

Revolut also provides a bonus layer of biometric protection with its “Wealth Protection” feature. Disabled by default, the feature allows users to only proceed with withdrawals requiring a selfie verification.

Criticism of Meta’s fraud prevention efforts

Revolut’s latest update on crypto anti-fraud efforts came shortly after the company called on Mark Zuckerberg’s Meta to share the cost of compensating fraud victims and criticized its fraud prevention efforts.

Revolut claimed that Meta platforms “remain the main source of all scams” reported to Revolut in the first quarter of 2024, accounting for 62%.

Bloomberg reported in September that Revolut came under fire in 2024 due to a surge in fraud complaints, with some investors suffering up to $14,000 in losses due to scams through their Revolut accounts.

The Guardian also reported in April 2024 on an investor who lost 40,000 pounds ($52,300) on Revolut due to a scam, with Revolut rejecting a refund.

Magazine: Suspicious arrest of crypto scam reporter, Japan’s pro-crypto PM: Asia Express