Tether, the operator of the world’s largest cryptocurrency pegged to the United States dollar, is confident in its relationship with the US government, partly due to its significant holdings of US debt used to back its USDt stablecoin.

As Tether approaches its 10-year anniversary, Cointelegraph talked to its CEO Paolo Ardoino about the factors that have made Tether a major player in the cryptocurrency industry.

In the discussion, Ardoino welcomed competition in the stablecoin market, highlighted Tether’s focus on developing countries, and emphasized the company’s strong ties with the US.

A brief history of Tether USDt

Tether’s USDt

The goal was to create a stablecoin that maintained a 1:1 peg to the US dollar, providing stability in the volatile cryptocurrency market.

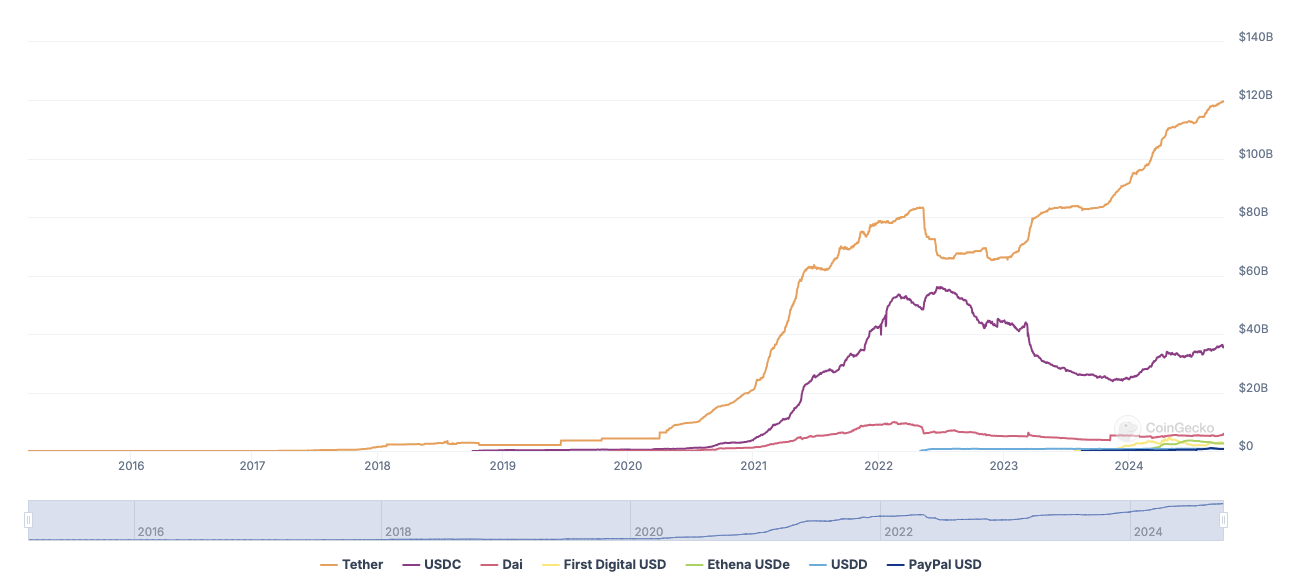

Three years after its launch, USDT’s market capitalization reached $1 billion for the first time, and the stablecoin’s market value has been rising ever since.

By July 2020, it surpassed $10 billion, rising around 900% in roughly three years. In March 2024, it hit a $100 billion market value milestone, leaving competitors like USD Coin

Today, USDT has a $120 billion market, and Tether is a major industry player, with profits surpassing those of BlackRock in 2023.

Ardoino believes that Tether grew at such an incredible pace because USDT’s model was simple and understandable to the average person.

“So you send us dollars, we send you the same amount of USDT. You send back the USDT tokens, and we send back the dollars. Then, we invest the reserves in Treasury Bills and a few other safe assets. As simple as that,” Ardoino explained.

Referring to more challenging projects like algorithmic stablecoins , Ardoino said the industry often tends to make things very complex. “Only simple things will work in the long term. And that’s what we did compared to anyone else,” he added.

What has Tether done right and wrong since it launched?

Apart from simplicity, Ardoino highlighted two key things that helped Tether beat its competition in a significant way.

First, Tether has remained focused on stablecoins through the past 10 years, not getting distracted by trends like the initial coin offering (ICO) boom in 2017 or the rise of non-fungible tokens in 2021.

“What Tether did very well was that it invented the stablecoin industry and was very much focused on the most important usage and use case for stablecoins,” Ardoino said.

Tether has never pushed the use of USDT in decentralized finance because it focused on helping people who “needed the most to have an alternative payment system,” the CEO said.

Ardoino believes that Tether’s second-best achievement is understanding who needs USDT the most.

According to the CEO, the biggest demand for stablecoins comes not from developed jurisdictions like those in Europe or the US but from developing countries like Argentina, Turkey and Vietnam, which always need access to the dollar.

“That’s what we realized before anyone else. That people want to hold that dollar, not in cash, but in a digital form because it’s much more convenient,” the CEO said. He stated:

“There is no point for us to compete in the US and Europe. Our focus has to be where we are needed the most.”

But there is something that Tether could have done better, and it relates to the way the company approached growing criticisms as USDT has progressed as one of the biggest stablecoins.

“We needed to be more forceful in explaining ourselves and being transparent with everything that we were doing,” Ardoino said, referring to a period between 2017 and 2021.

Ardoino said Tether had reacted actively to criticisms since 2021. The firm addressed them individually and proved that the facts did not support certain accusations.

Related: Tether USDT’s market share rises 20%, reaching 75% in two years

Ardoino stressed that Tether encourages competition in the stablecoin market, as there would be no stablecoin industry without competition. He added that there should always be at least three to six stablecoins that work very well globally.

Tether’s relationship with the US government

While focusing more on developing countries, Tether has not overlooked its ties with the US. According to Ardoino, Tether has a “very good relationship” with the US government that is “much better” than that of competitors due to its compliance efforts with local authorities.

“Tether is the only stablecoin that onboarded the Federal Bureau of Investigation and the United States Secret Service,” Tether CEO stated, mentioning that the company also has 180 law enforcement agencies across 45 countries.

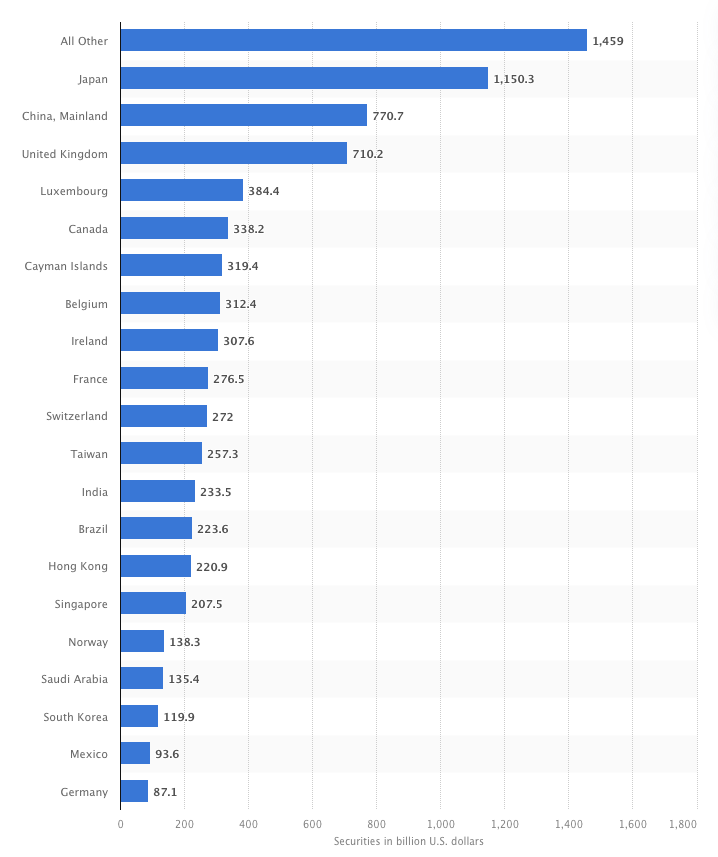

Tether also positions itself as a good friend of the US because it holds about $98 billion of US Treasury Bills , making it one of the largest US Treasury holders globally.

“I think that Tether is the best friend of the US government because we hold more US treasury securities than Germany, much more than any other competitor or any other financial institution in the world,” Ardoino stated. He added:

“We are happy to decentralize the ownership of the US debt, making the US much more resilient.”

Magazine: Chinese Tether laundromat, Bhutan enjoys recent Bitcoin boost: Asia Express