Asset manager Grayscale Investments launched a new investment fund for Aave’s governance token, AAVE, according to an Oct. 3 announcement.

The Grayscale Aave Trust “offers investors the opportunity to gain exposure to AAVE, the governance token for Aave’s platform,” Grayscale said .

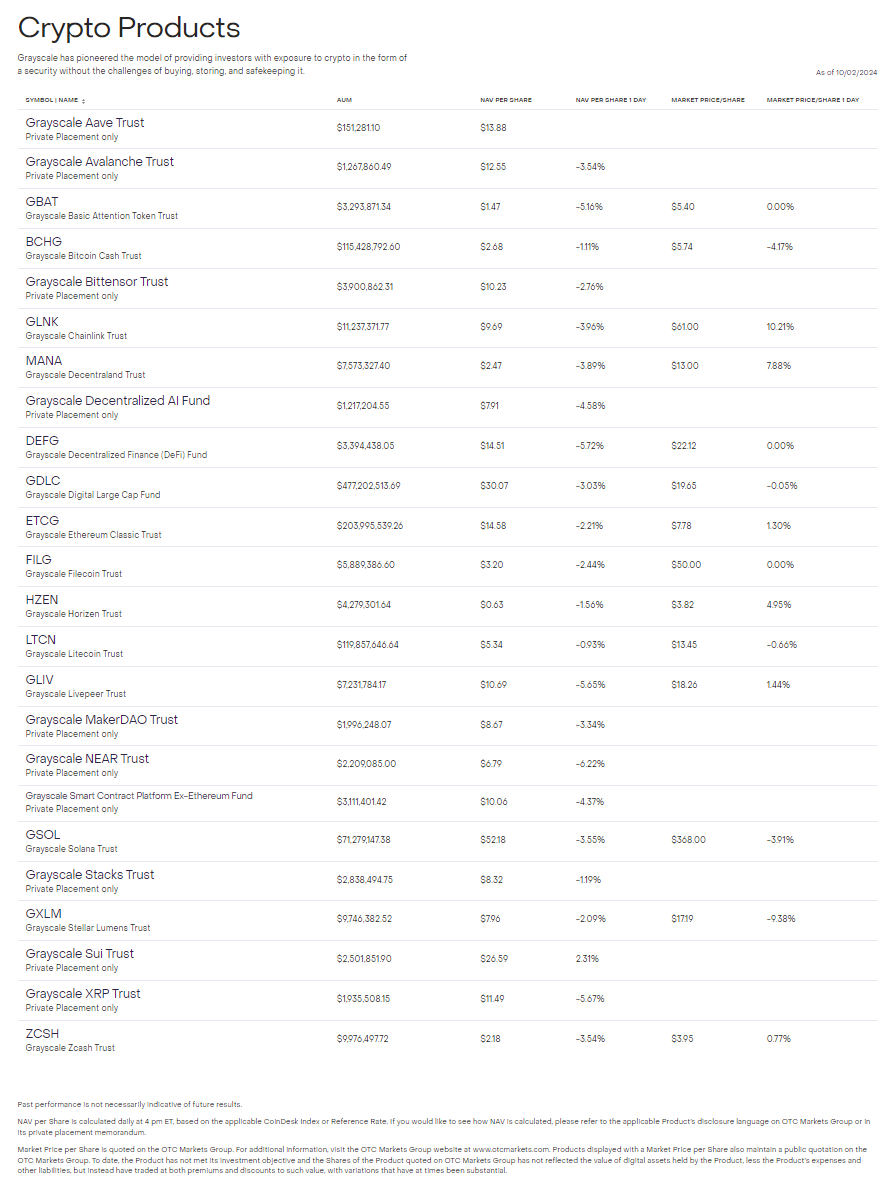

The fund, which is only available to qualified investors, adds to Grayscale’s suite of single-asset crypto investment products. In August, Grayscale launched three trusts to invest in the native protocol tokens of Sky (previously MakerDAO), Bittensor and Sui, respectively.

Related: Grayscale launches investment fund for MakerDAO token

Aave is a decentralized finance (DeFi) platform “designed to help facilitate transparent, decentralized borrowing and lending by using self-executing smart contracts instead of traditional intermediaries,” Grayscale said.

Grayscale is the world’s largest crypto fund manager, with approximately $21 billion in assets under management as of Oct. 2, according to Grayscale.

It is best known for its Bitcoin

Grayscale Aave Trust solely invests in the Aave

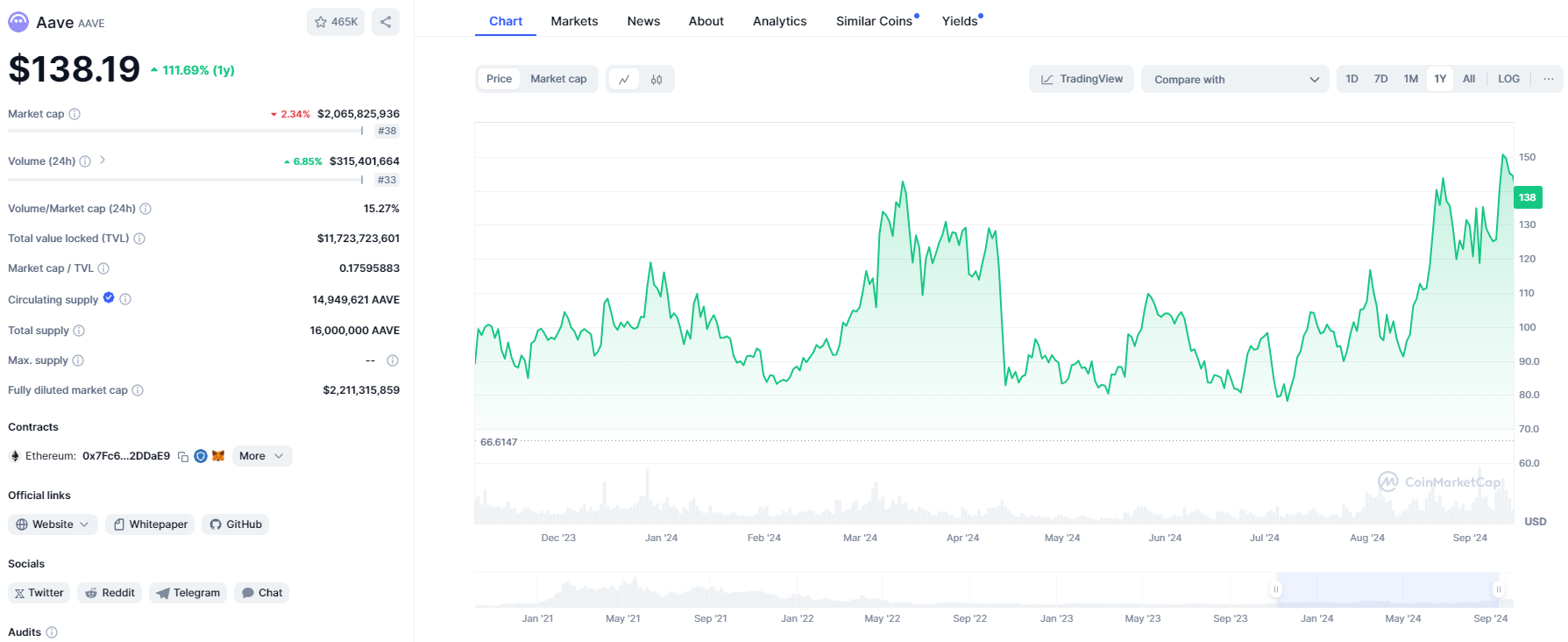

Aave is DeFi’s most popular lending protocol, with nearly $12 billion in total value locked (TVL), according to DefiLlama.

In July, Aave’s tokenholders endorsed a proposal to upgrade its tokenomics with a mechanism directing a portion of the protocol’s revenues to AAVE stakers.

Aave earns revenue from liquidations of loans, which are collateralized in cryptocurrency.

The AAVE token has gained more than 110% in the past 12 months, according to CoinMarketCap.

“By leveraging blockchain technology and smart contracts, Aave’s decentralized platform aims to optimize lending and borrowing while removing intermediaries and reducing reliance on human judgment,” Grayscale’s head of product and research, Rayhaneh Sharif-Askary, said in a statement.

In August, Dave LaValle, Grayscale’s global head of ETFs, predicted that the market for cryptocurrency ETFs will expand to encompass new types of digital assets and diversified crypto indexes.

“We’re going to see a number of more single-asset products, and then also certainly some index-based and diversified products,” LaValle said.

Magazine: Hamster Kombat tappers evolve with Swipe-to-Earn + Axie Pals Tamagotchis: Web3 Gamer