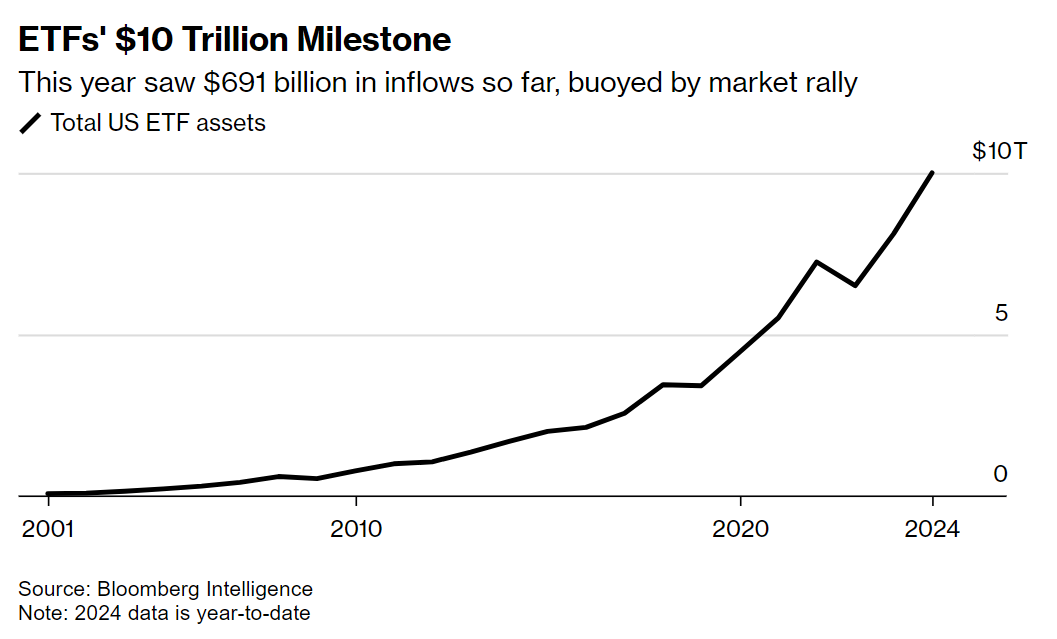

Total assets in United States exchange-traded funds (ETFs) surpassed $10 trillion for the first time on Sept. 27, propelled in part by inflows of more than $20 billion into cryptocurrency ETFs in 2024, according to data from Bloomberg Intelligence and fund researcher Morningstar.

Investors have poured approximately $691 billion into US ETFs so far in 2024, according to Bloomberg. Crypto ETFs accounted for almost 3% of those total inflows.

“We predict [ETFs] will hit $25T in next ten years,” Eric Balchunas, Bloomberg’s senior ETF analyst, said in a Sept. 27 post on the X platform.

“Normally they double assets every 5yrs but this time it only took 3.7yrs,” he added.

Related:

Leveraged MicroStrategy ETFs break $400M as ‘hot sauce arms race’ heat up

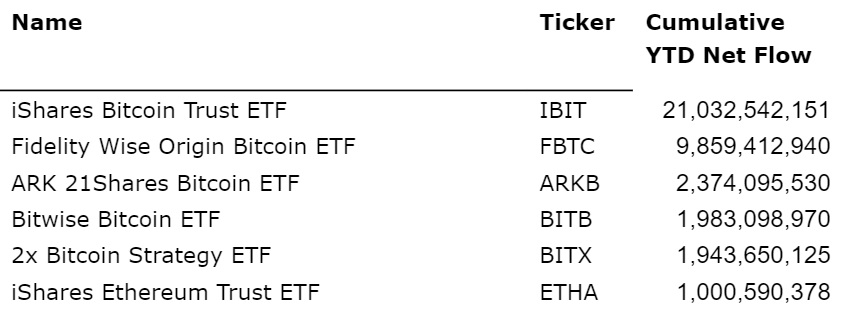

Among crypto funds, BlackRock’s iShares Bitcoin Trust led with more than $21 billion in inflows since January, Bryan Armour, director of passive strategies research at Morningstar, told Cointelegraph.

In second place, the Fidelity Wise Origin Bitcoin ETF notched net inflows of nearly $10 billion, according to data from Morningstar.

At upward of $1 billion in net gains, the iShares Ethereum Trust ETF has also been a top performer. Spot Ether

ETH$2,193

Ethereum

Change (24h)

3.49%

Market Cap

$264.18B

Volume (24h)

$18.13B

View More

ETFs launched in July, around six months after spot Bitcoin

BTC$89,686

Bitcoin

Change (24h)

4.86%

Market Cap

$1.77T

Volume (24h)

$46.02B

View More

ETFs.

The Grayscale Bitcoin Trust ETF — which launched in 2013 and listed as an ETF in January — partly offset the asset class’s net gains, clocking outflows of nearly $20 billion in the same period. The older fund’s management fees of 1.5% are far higher than rivals’.

In addition to spot crypto funds, ETFs using derivatives to offer leveraged exposure to various assets accounted for approximately 80% of new ETF issues in 2024, Bloomberg reported.

Leveraged MicroStrategy exchange-traded funds (ETFs) broke $400 million in net assets this week as retail investors continue to pour into the ultra-volatile BTC plays.

Asset manager Vanguard — which has intentionally avoided launching crypto ETFs — has accounted for roughly a third of net inflows in 2024, Bloomberg said.

Investment managers expect the United States debut of options on spot BTC ETFs to accelerate institutional adoption and potentially unlock “extraordinary upside” for spot BTC holders.

On Sept. 20, the US Securities and Exchange Commission greenlit Nasdaq’s electronic securities exchange to list options on BlackRock’s iShares Bitcoin Trust ETF. It marked the first time the regulator approved options tied to spot BTC for US trading.