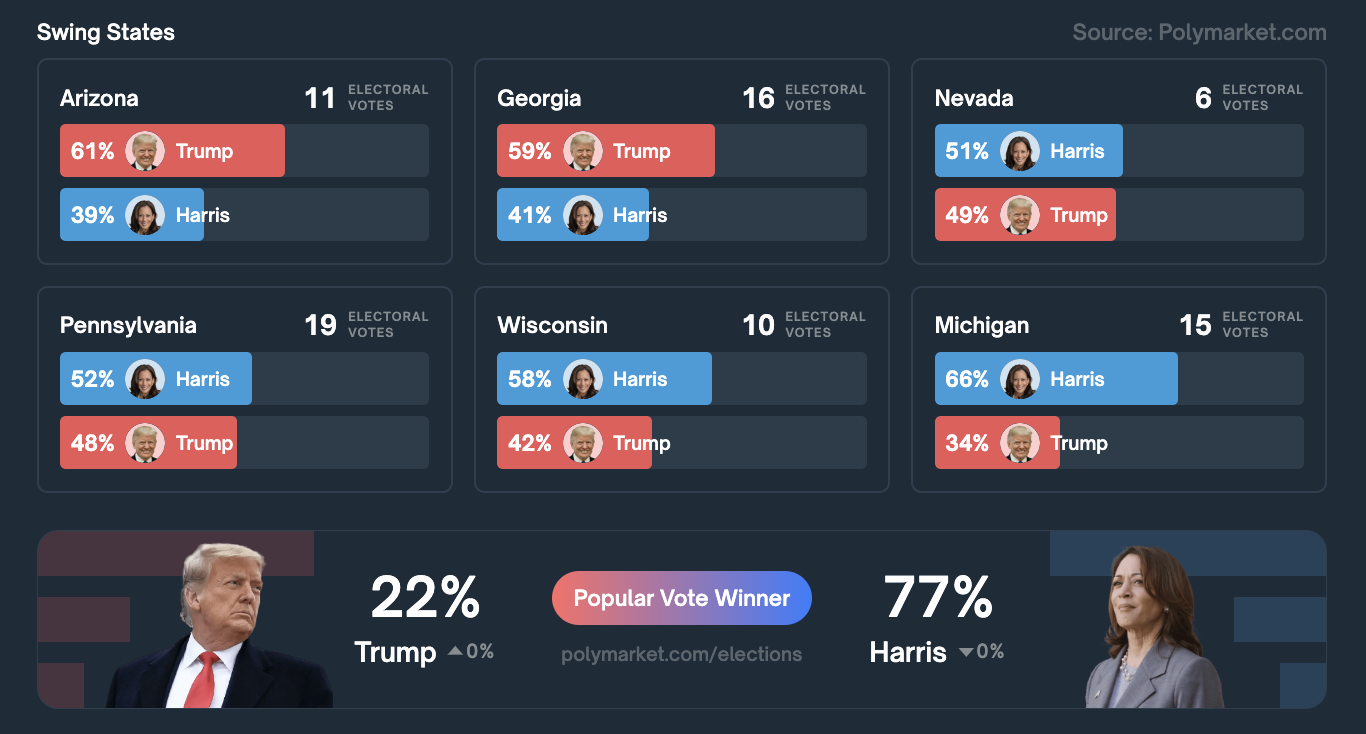

As the 2024 United States presidential election draws closer, Vice President Kamala Harris has flipped four out of the six swing states on Polymarket. Harris now leads her Republican Party opponent, former President Donald Trump, in Wisconsin, Pennsylvania, Michigan and Nevada.

The vice president’s lead is widest in Michigan, where her odds are 66%, followed by Wisconsin at 58% and razor-thin margins in Pennsylvania and Nevada at 52% and 51%, respectively.

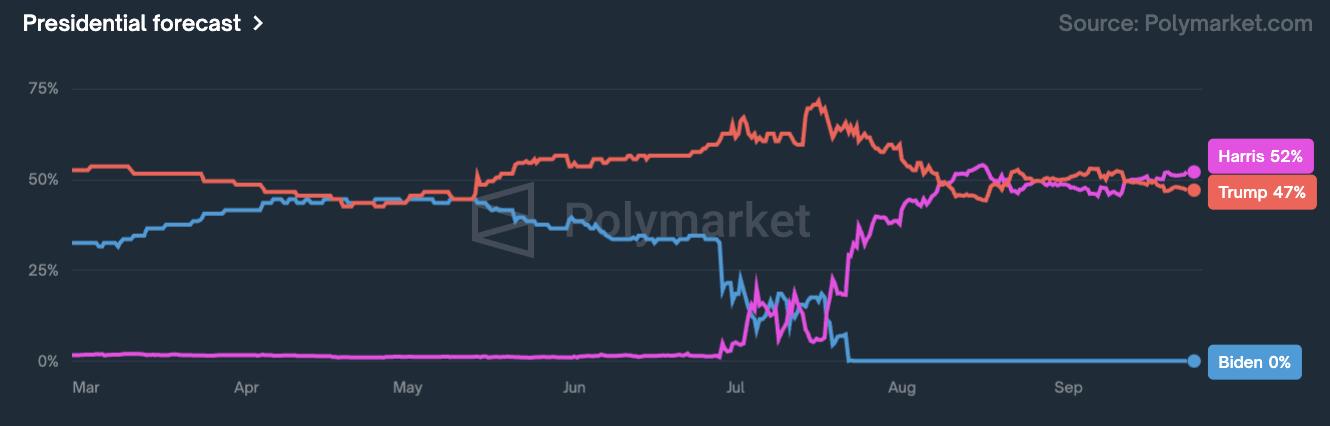

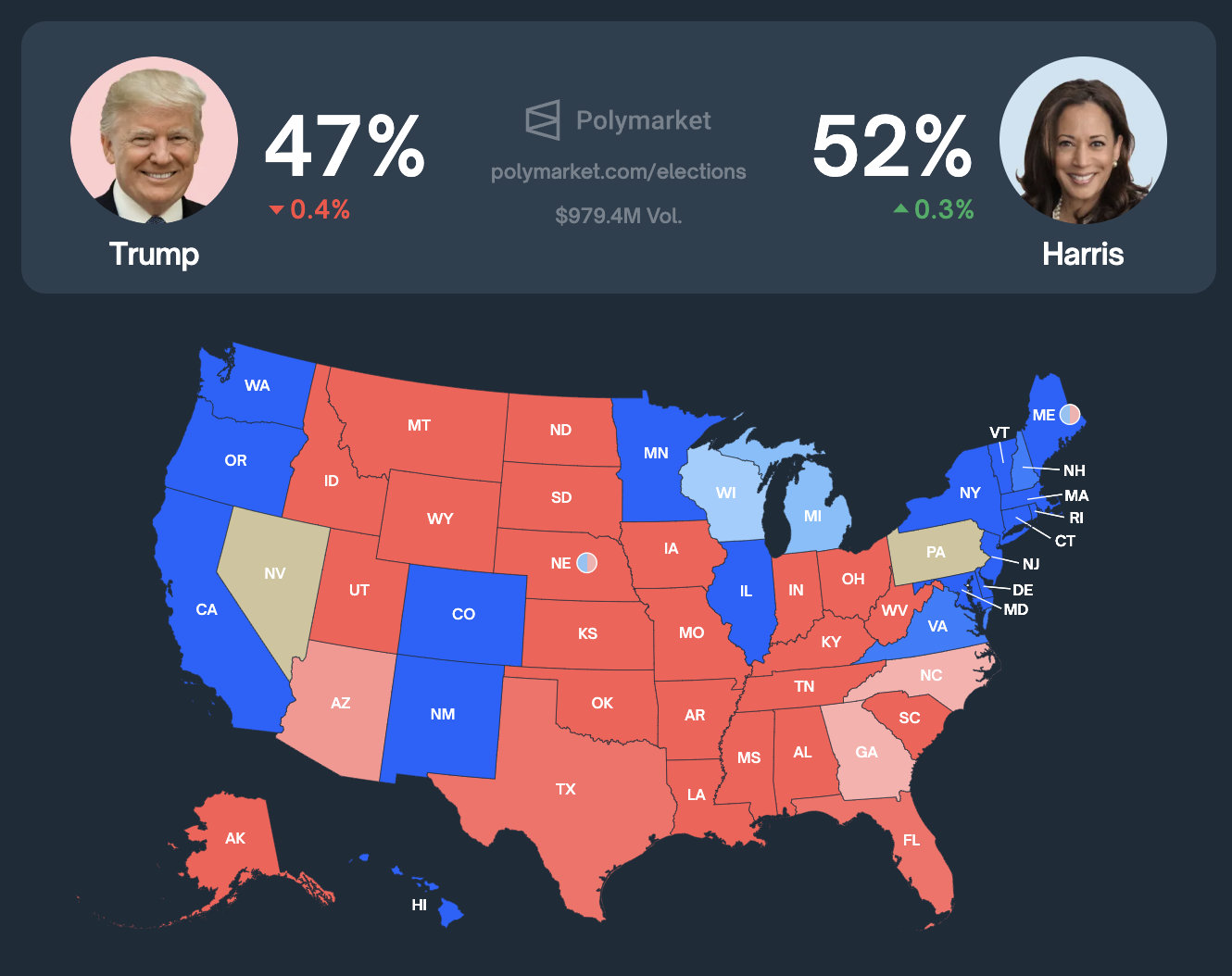

Harris’ odds of victory in the 2024 Presidential election on the prediction market have shot up to 52% vs. Trump’s 47%, giving her a five-point lead.

Trump’s odds fall after debate and token launch

Trump dominated the Polymarket betting odds early on in the race. Still, the margins have considerably narrowed since then, and the race now appears to be a toss-up between the two candidates.

Trump’s odds on the prediction platform slid by as much as 3% during his first debate with Harris due to what some perceived as a poor performance. However, he managed to recover shortly after the debate, leveling the odds with Harris.

The Republican candidate also reportedly lost sway with some crypto voters after the former President announced a token launch for his family’s decentralized finance project, World Liberty Financial. While some viewed the development as positive and said it did not affect their vote, other pro-crypto voters found the token launch distasteful and characterized it as a grift .

Related: Kamala Harris’ campaign isn’t directly accepting crypto — a Super PAC is

Harris still doesn’t have a stated policy position on crypto

Harris’ campaign released its policy platform in early September 2024 but did not mention crypto in the lengthy policy outline. However, the Harris-Walz presidential campaign included a slew of policy proposals that would increase government spending, including strengthening social security and entitlement programs, student loan debt relief, and a $25,000 down payment assistance for first-time homebuyers.

Investors, speculators and industry executives in the crypto space have been closely involved in this election cycle, hoping to prop up perceived pro-crypto candidates through public pressure campaigns, community outreach, and political donations.

Current market sentiment believes a Trump Presidency would be positive for crypto prices and a Harris presidency would be negative. However, Geoff Kendrick, global head of digital assets research at Standard Chartered, a cross-border bank, believes that the price of Bitcoin

Magazine: Crypto voters are already disrupting the 2024 election — and it’s set to continue