According to a footnote in a Sept. 12 court filing, the United States Securities and Exchange Commission has retracted its longstanding characterization of cryptocurrencies as “securities” and intends to use more careful language in the future.

The retraction arose from the SEC’s ongoing lawsuit against crypto exchange Binance for allegedly offering and selling unregistered securities. In a 2023 complaint, the SEC identified 10 crypto assets on the Binance platform as “securities,” including the native tokens of Solana

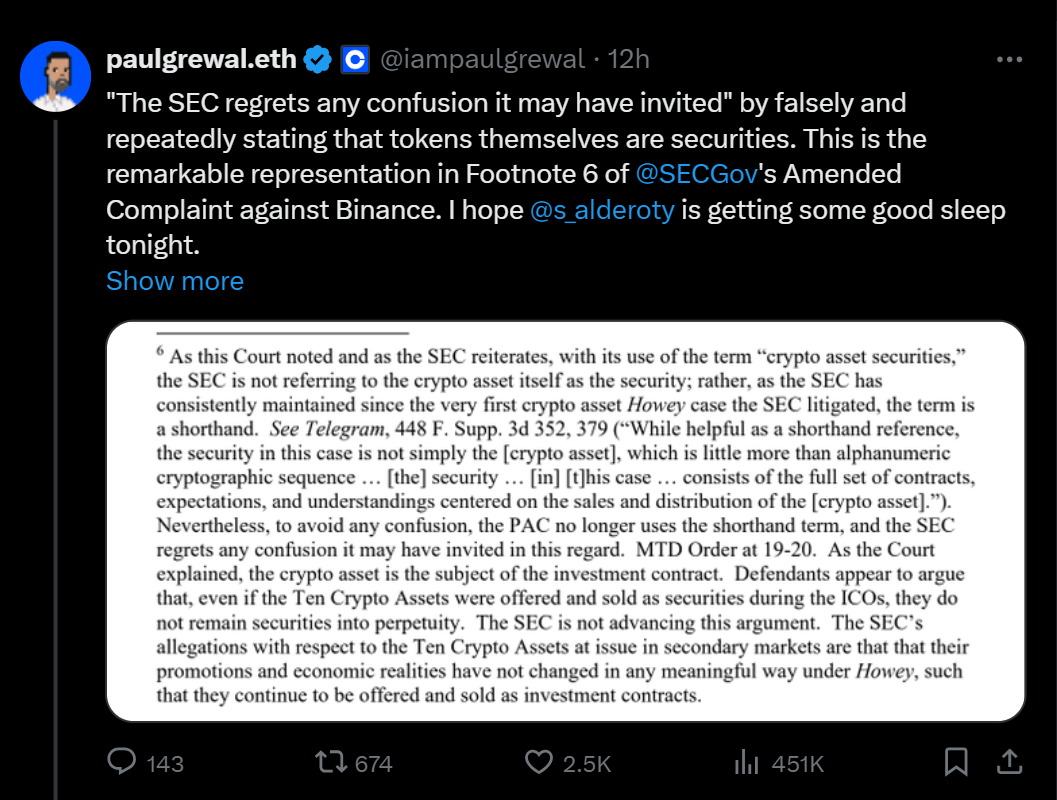

The SEC “regrets any confusion” caused by its characterization of these tokens as “crypto asset securities” and “no longer uses the shorthand term,” according to the Sept. 12 filing.

“With its use of the term ‘crypto asset securities,’ the SEC is not referring to the crypto asset itself as the security,” the agency said. Instead, a token’s status as a security “consists of the full set of contracts, expectations, and understandings centered on the sales and distribution of the [crypto asset],” it said, citing language from an earlier filing.

Related: Court denies Kraken’s motion to dismiss SEC lawsuit

The SEC asserts that even by this narrower definition, Binance remains at fault for unlawful securities offerings because the exchange’s tokens “continue to be offered and sold as investment contracts.”

The securities regulator is advancing a similar argument against crypto exchange Kraken, which the agency charged in November with “operating [a] crypto trading platform as an unregistered securities exchange, broker, dealer, and clearing agency.”

The regulator’s emphasis on the context around which virtual assets are sold follows its 2024 approval of Bitcoin

“I’ll say it again: somehow ETH transaction[s] HAVE changed [in] a meaningful way that the Ten Crypto Assets [referenced in the SEC’s Binance lawsuit] have not so as to avoid the agency’s clutches,” Paul Grewal, Coinbase’s chief legal officer, said in a Sept. 13 post on the X platform.

“How? That’s apparently for the [SEC] to know, and the rest of us to find out only if and when we are sued,” Grewal said. Coinbase is also being sued by the SEC for alleged violations of securities laws.

Pressure is mounting on US financial regulators, including the SEC and Commodity Futures Trading Commission (CFTC), to abandon what critics describe as a high-handed and confusing approach to crypto enforcement.

In a Sept. 4 statement, Summer Mersinger, one of the CFTC’s five commissioners, chastized the CFTC for engaging in “regulation through enforcement” and called for clearer guidance for crypto exchanges.

“It [is] my hope that one day soon the commission would consider rulemaking, or at the very least guidance, making clear how DeFi protocols could comply with them,” Mersinger said.

Magazine:

China’s ‘point running’ crypto scams, pig butchers kidnap kids: Asia Express