Solana exchange-traded funds (ETFs) will not see significant demand among United States investors, according to Katalin Tischhauser, head of investment research at crypto bank Sygnum.

Tischhauser told Cointelegraph that “minuscule” investor flows into the Grayscale Solana Trust (GSOL) — asset manager Grayscale’s private SOL

GSOL’s assets under management (AUM) are less than $70 million, according to Grayscale. By comparison, the Grayscale Bitcoin Trust managed almost $30 billion prior to its conversion to an ETF in January, according to Tischhauser.

“The small AUM reflects the relative name recognition of Solana versus Bitcoin,” Tischhauser said.

Related: Crypto ETFs will expand to new asset types, indexes — Grayscale executive

Shares of GSOL trade at an unusually high premium to net asset value (NAV) — upward of 7x as of Aug. 15. NAV is a measure of the underlying value of SOL per share in the fund.

“The high premium suggests some demand, but it’s not the kind of demand that will significantly impact the market,” according to Tischhauser.

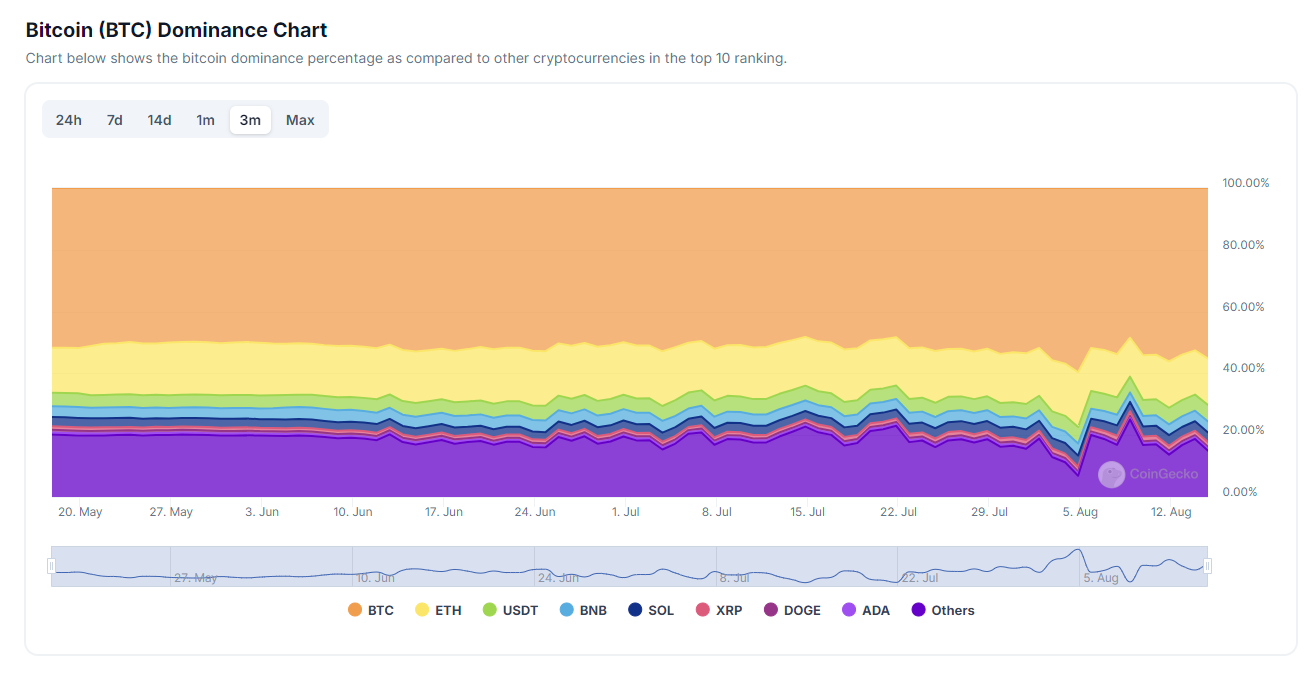

Bitcoin

Since launching in January, BTC ETFs have seen “more than three times the largest one-year inflow of any ETF ever in the history of ETFs,” said Dave LaValle, Grayscale’s global head of ETFs . “So, we’re talking about massive, massive adoption.”

This has sparked a flurry of speculation about which crypto assets are next up for an ETF launch. Asset managers including Franklin Templeton , VanEck , and 21Shares have all expressed an interest in launching SOL ETFs.

BlackRock, the largest ETF manager by AUM, has no plans to launch a SOL ETF, citing “very little interest” from its clients .

“Smaller issuers may make more money than their expenses by launching and running these products,” Tischhauser said. “But it’s not going to be significant for the crypto market—it’s not going to be exciting.”

Magazine: NFT Creator: ThankYouX hits Sotheby’s as his career *literally* blasts into space