Genesis, an institutional lending platform that filed for bankruptcy in 2023, announced the completion of its Chapter 11 restructuring plan on Aug. 2 and the disbursement of approximately $4 billion in funds to the injured parties.

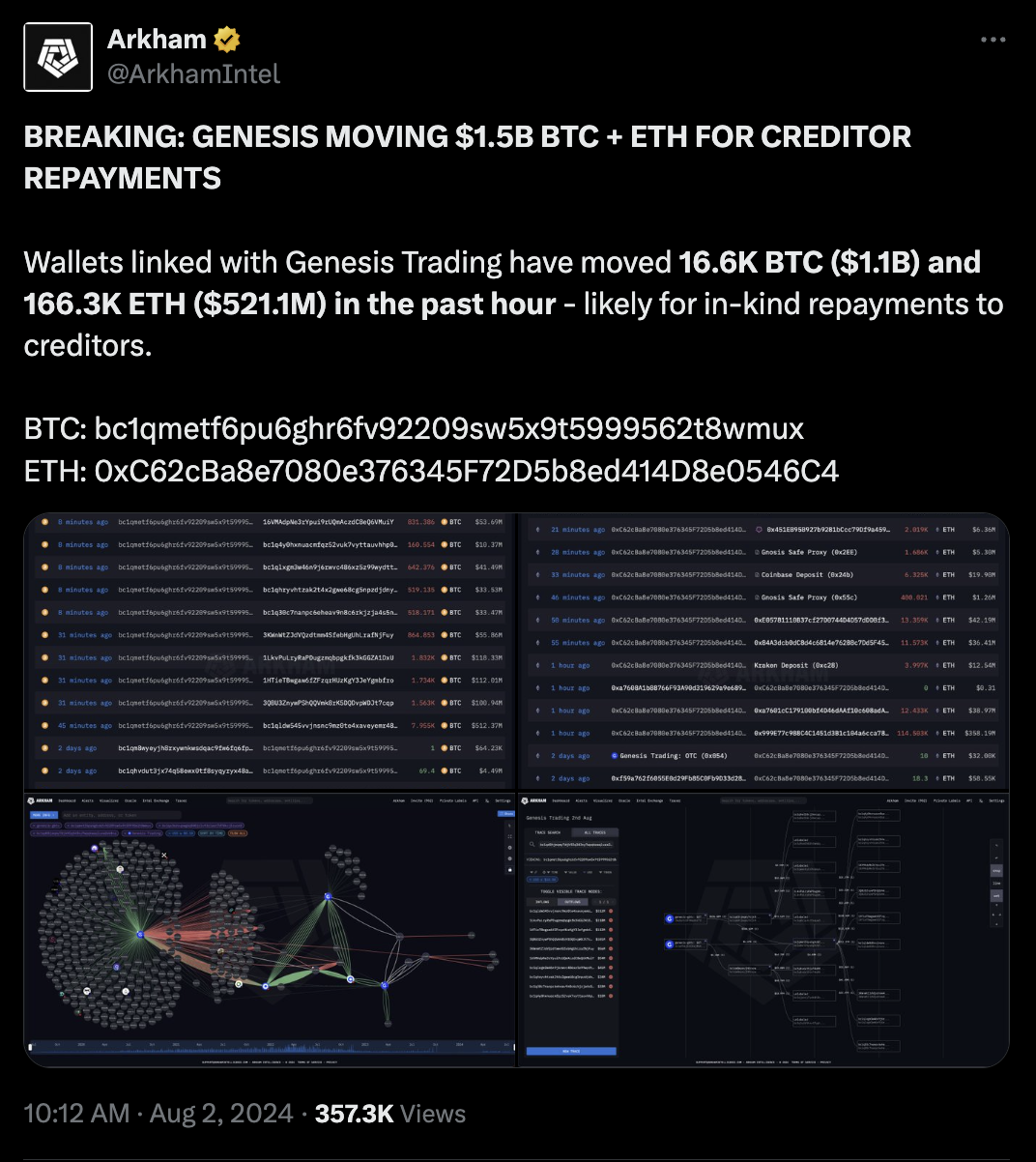

As part of the plan, Bitcoin

Most altcoin creditors will receive 87.65% recoveries of their digital assets, with Solana

A $70 million litigation fund for creditors seeking further legal action against any third parties to the bankruptcy, such as Genesis’ parent company Digital Currency Group (DCG), has also been established

The fallout from the 2022 crypto contagion

Genesis engaged in institutional lending, borrowing funds from firms like the Winklevoss twins’ Gemini and lending it to firms like Three Arrows Capital.

Related: Genesis-labelled address moves $720M BTC to Coinbase, pointing to start of asset liquidations

The fallout from the Three Arrows Capital default drove a wedge between Gemini co-founder Cameron Winklevoss and Digital Currency Group CEO Barry Silbert. Winklevoss has publicly slammed the DCG CEO on several occasions, accusing him of fraud and an inability to run the corporate conglomerate, which is the parent company of Grayscale, Foundry, Luno and Genesis.

Genesis settles with the Securities and Exchange Commission

More recently, Genesis agreed to a $21 million settlement with the Securities and Exchange Commission for allegedly selling unregistered securities alongside the Geminin Earn program.

Following the settlement, SEC chief Gary Gensler remarked that all cryptocurrency lending providers and other digital asset services need to comply with existing securities laws.

Magazine: WazirX hackers prepped 8 days before attack, swindlers fake fiat for USDT: Asia Express