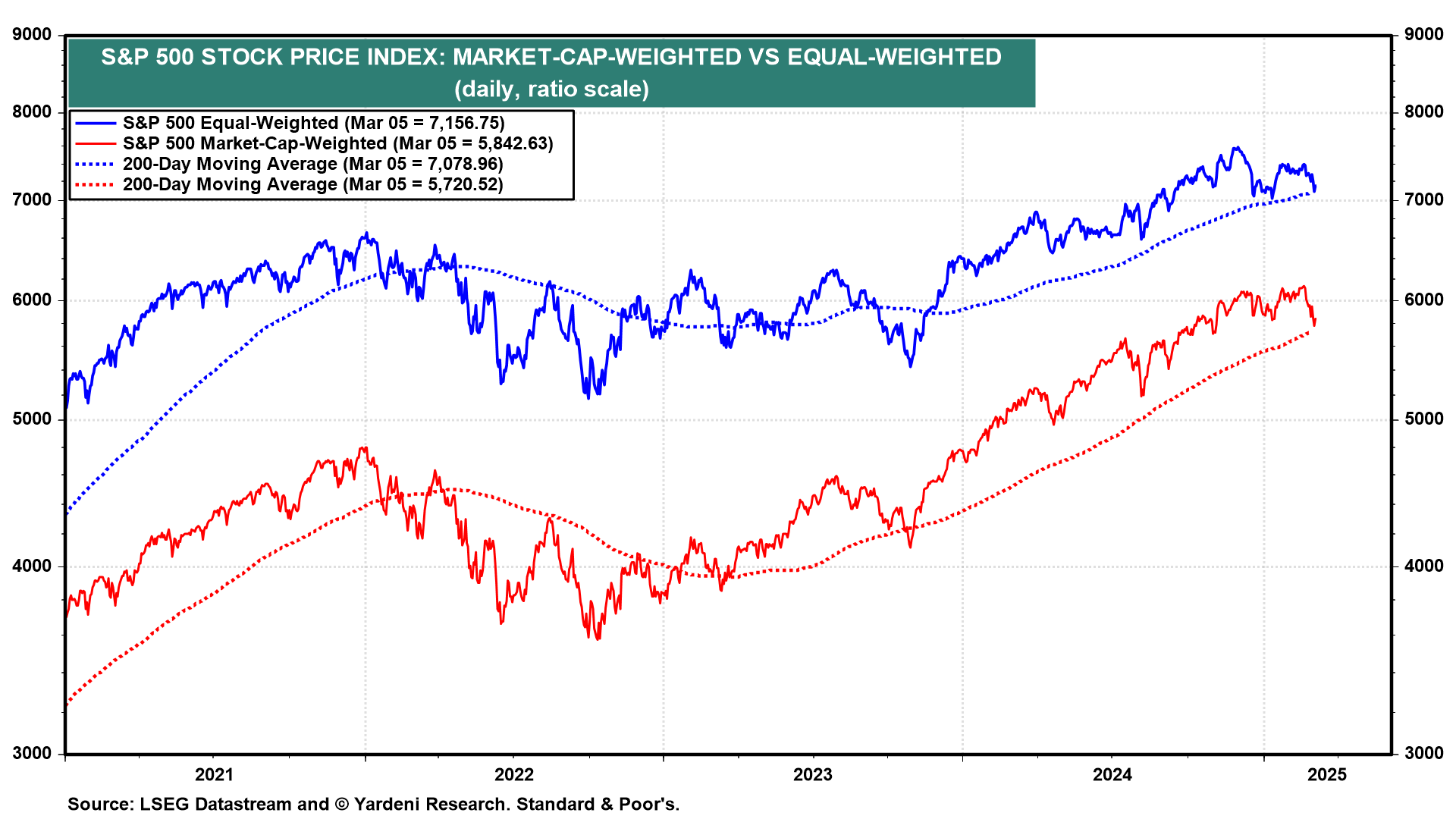

1. S&P 500 Likely to Hold at 200-Day MA

(1) Will

S&P 500

indexes find support at their 200-day moving averages? We think so. Sentiment is quite bearish and the next batch of economic indicators should confirm the economy is growing.

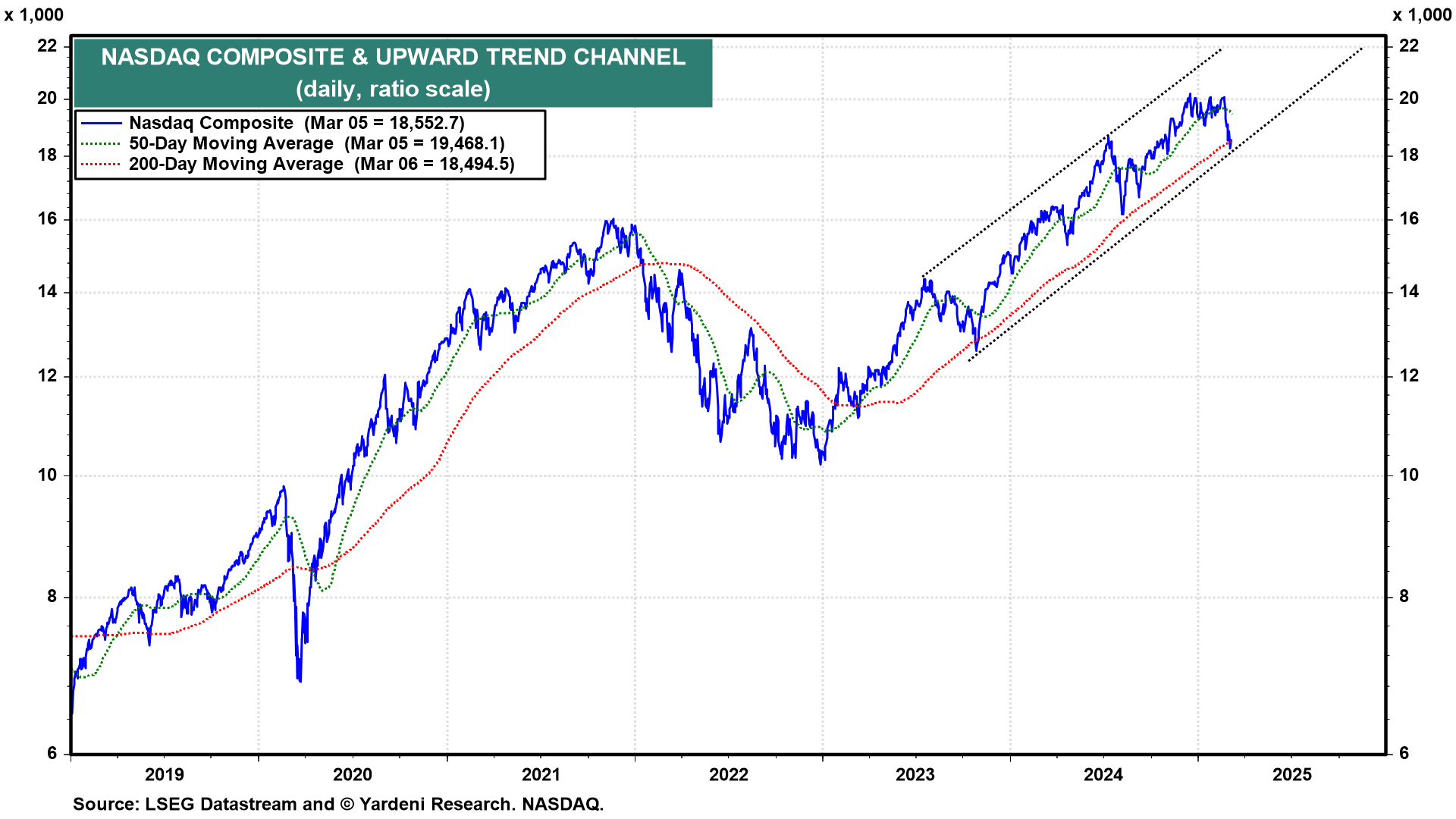

2. Nasdaq Poised for Dip-Buying After Selloff

(2) Will the

Nasdaq

remain in its bullish channel? We expect to see some dip-buying following the rapid selloff.

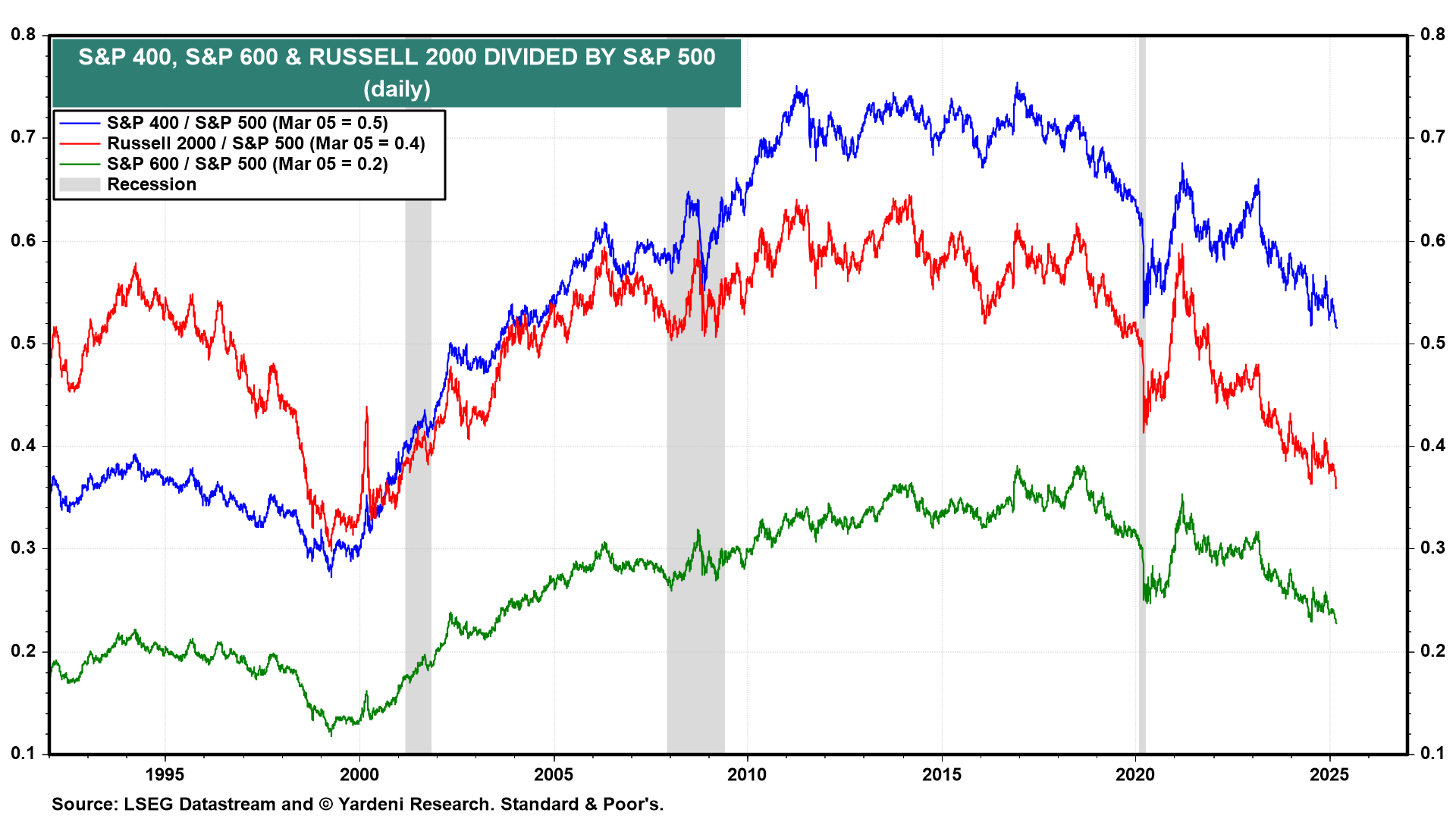

3. LargeCaps and SMidCaps Amid Trump Turmoil 2.0

(3) Will LargeCaps continue to outperform SMidCaps? Trump Turmoil 2.0 is weighing more on the latter than the former.

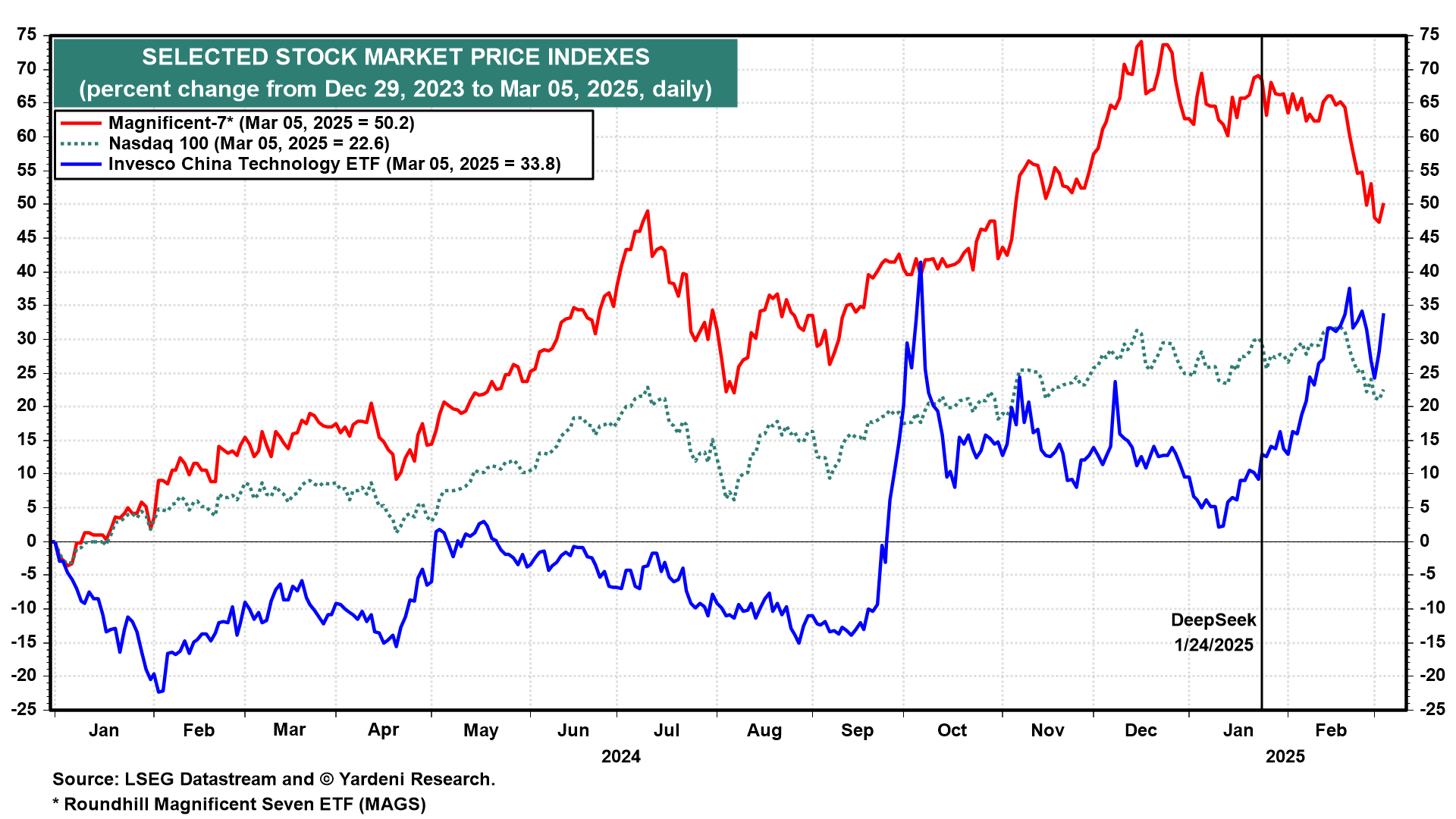

4. China Tech Rally Boosted by Government Stimulus Amid Tariffs

(4) Will Chinese stocks continue to rally led by technology stocks? The Chinese government is responding to Trump Tariffs 2.0 with more stimulative measures. US technology stocks, including the Magnificent-7, might be bottoming.

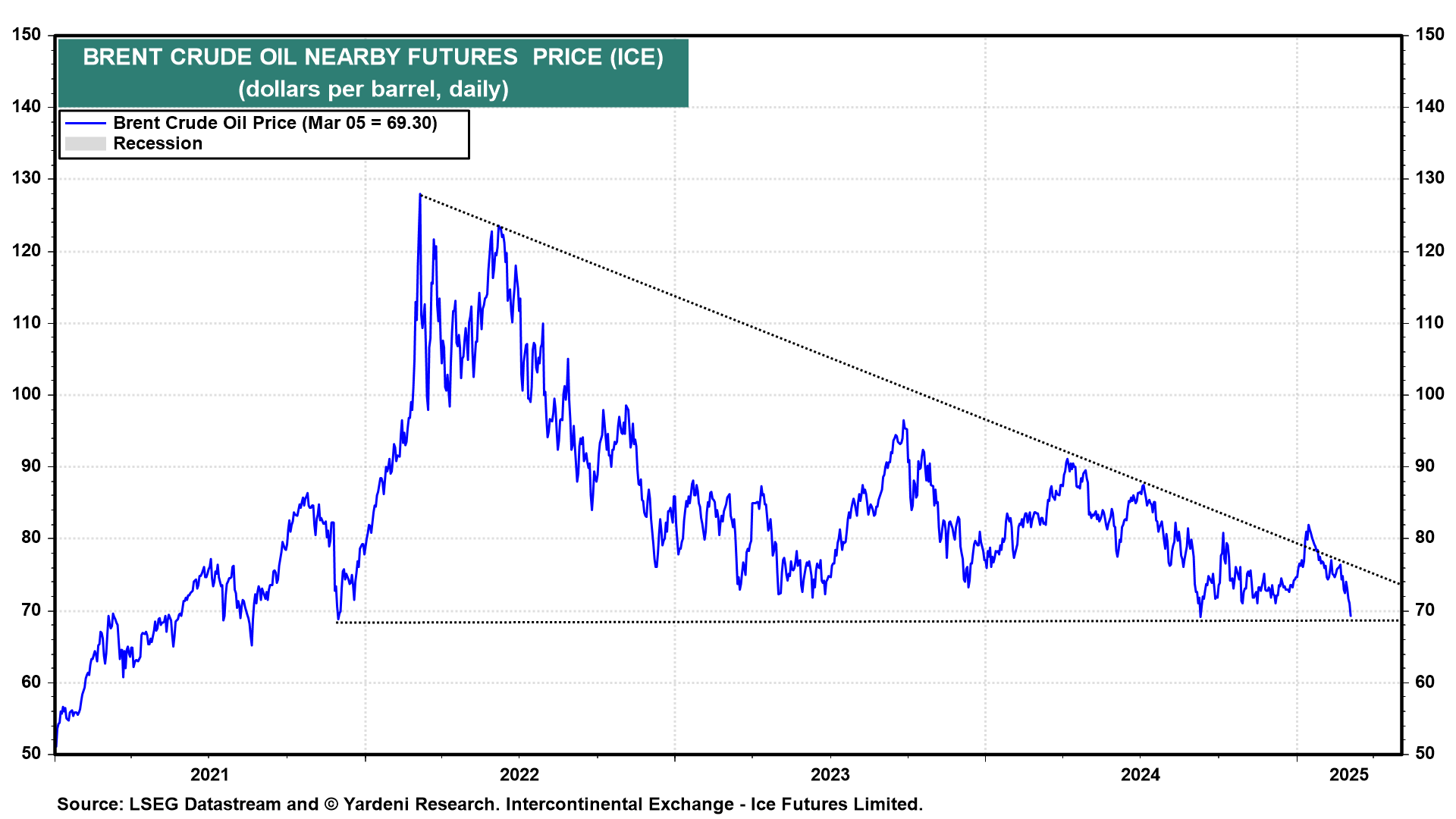

5. Brent to Maintain Support Amid Global Stimulus

(5) Will the price of a barrel of

Brent crude oil

hold support around $69? It might given recent stimulus measures in China and Germany. Lower oil prices should stimulate more global economic growth and oil demand. Then again, oil supplies are plentiful.

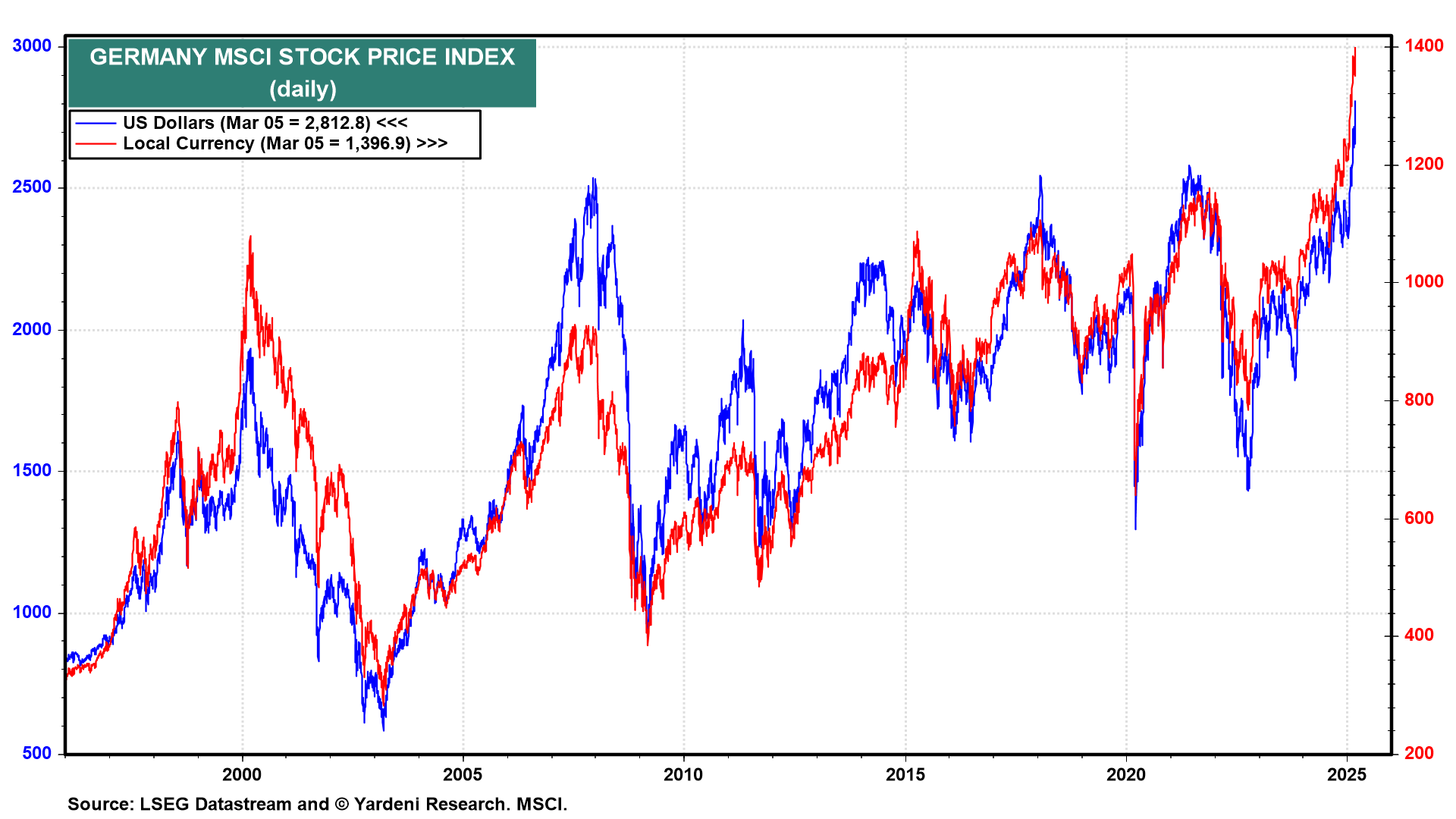

6. Germany’s Fiscal Shift Set to Lift European Stocks

(6) Will Germany's fiscal U-turn drive German and European stock prices still higher? That seems likely.

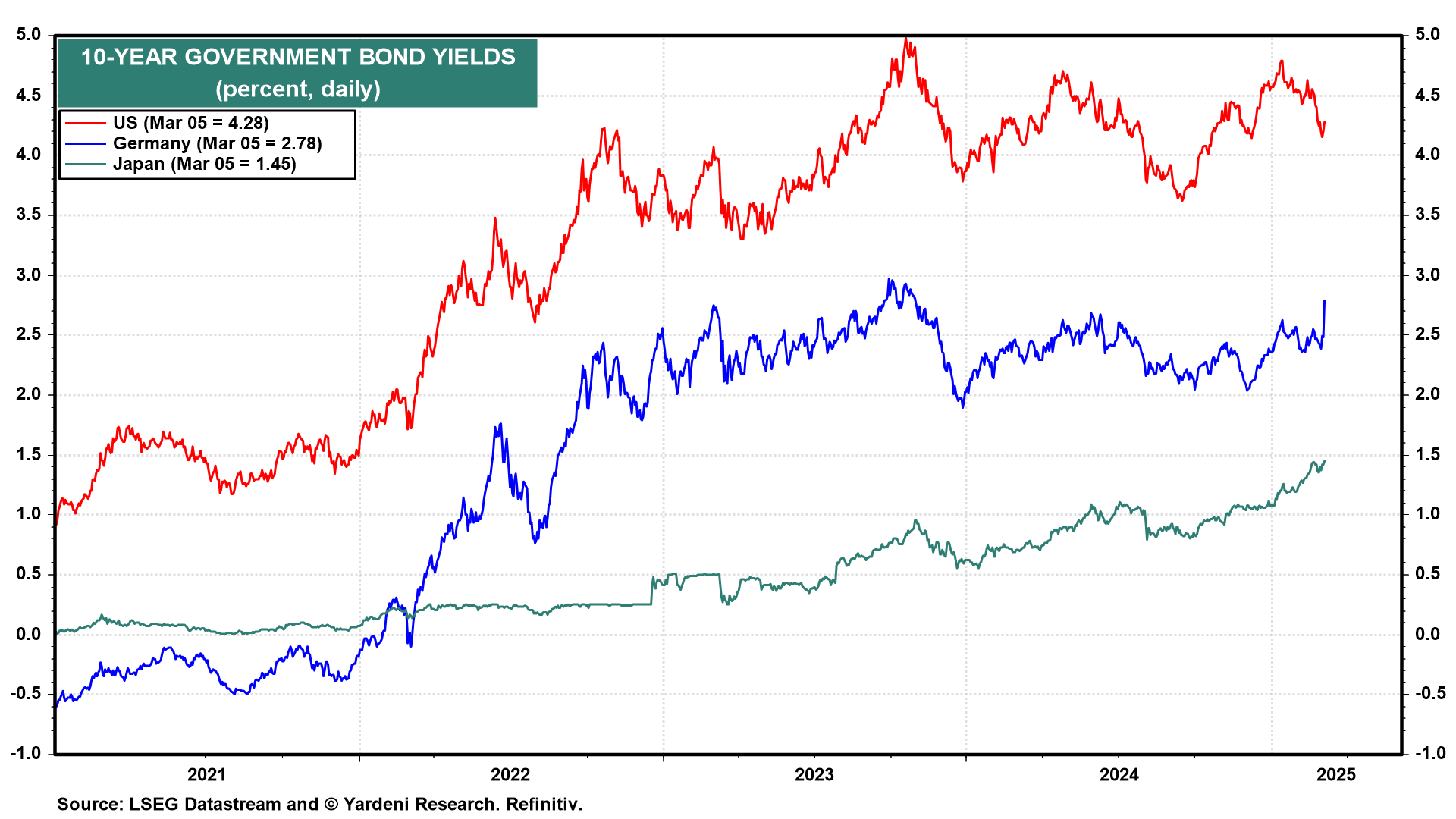

7. German Bond Yields Headed Toward 3.00%

(7) How much higher might the

German government bond yield

go? It's likely to climb to 3.00% soon.

8. Euro Targets 1.10 Resistance

(8) Will the

euro

jump above 1.10? It might find quite a bit of resistance at that level. But if it blasts through that level than 1.20 is conceivable.

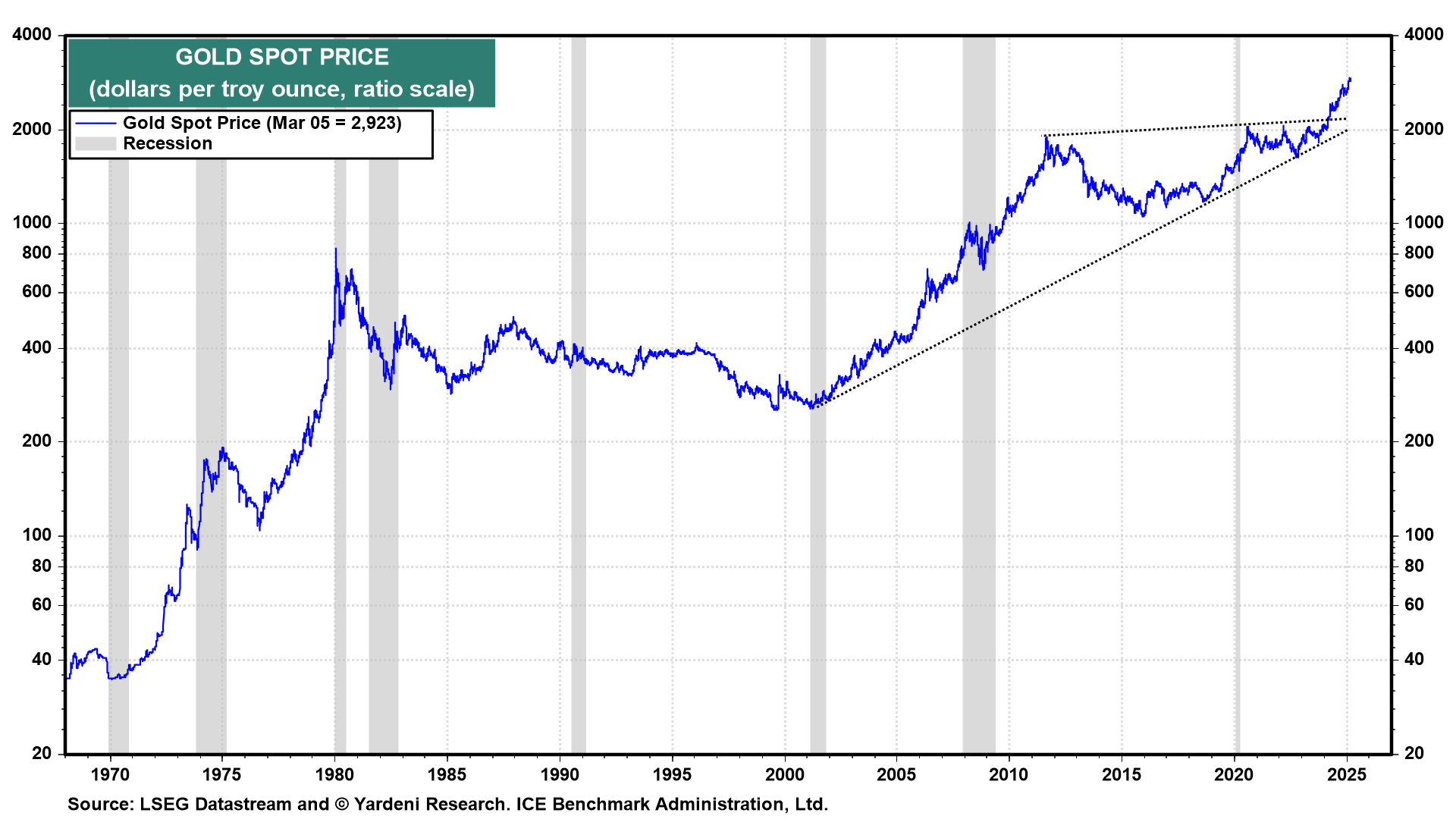

9. Gold Rising as Central Banks Diversify

(9) Why is the price of

gold

rising so steadily? Central banks are continuing to add gold to their reserves as an alternative to the

dollar

.

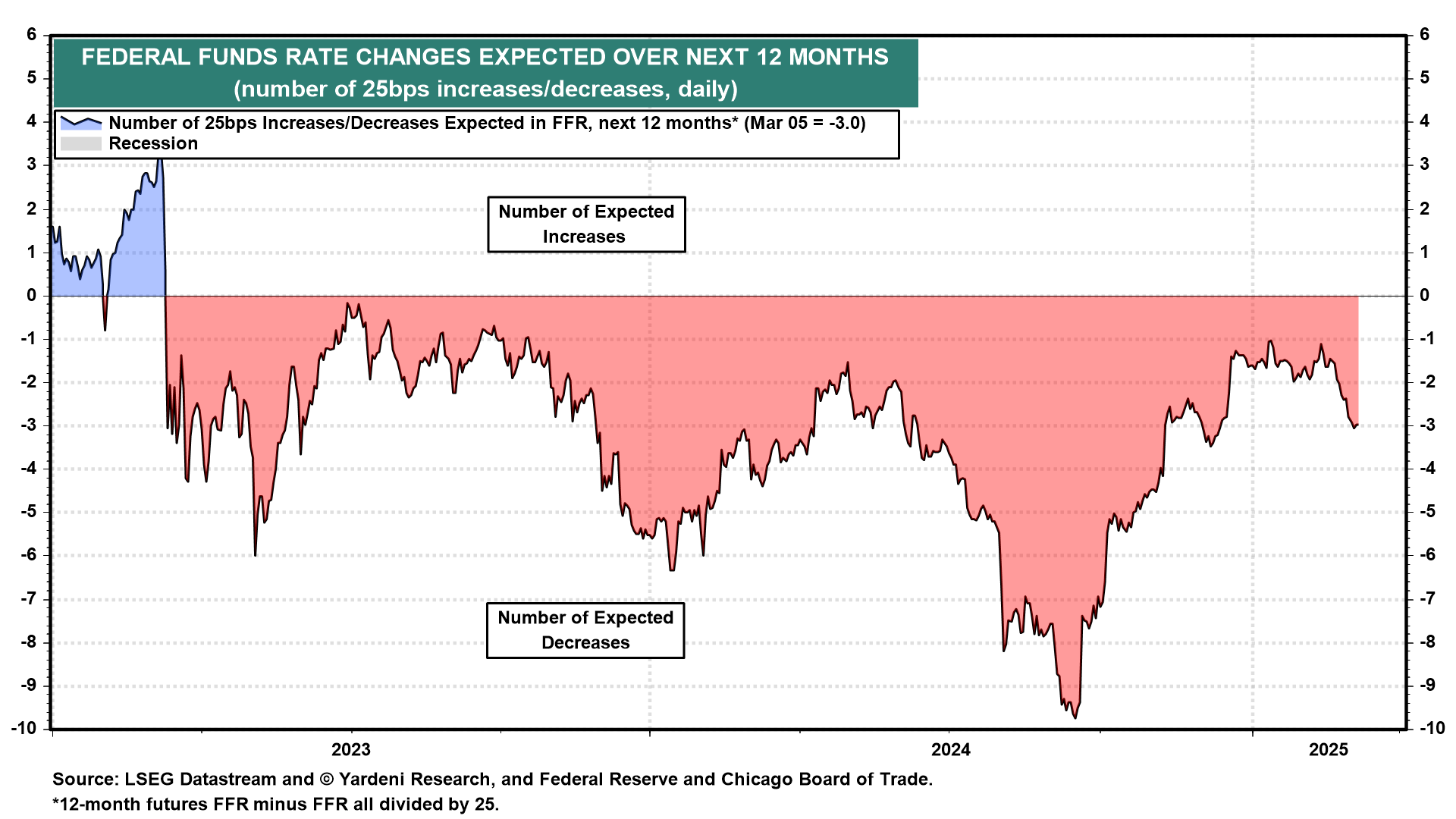

10. Fed Rate Cuts: Market Bets on Three More, but We See None

(10) How many more

25bps fed funds rate cuts

are likely over the next 12 months? The fed funds rate futures market shows three more. We remain in the none-and-done camp.

Original Post