NFP Key Points

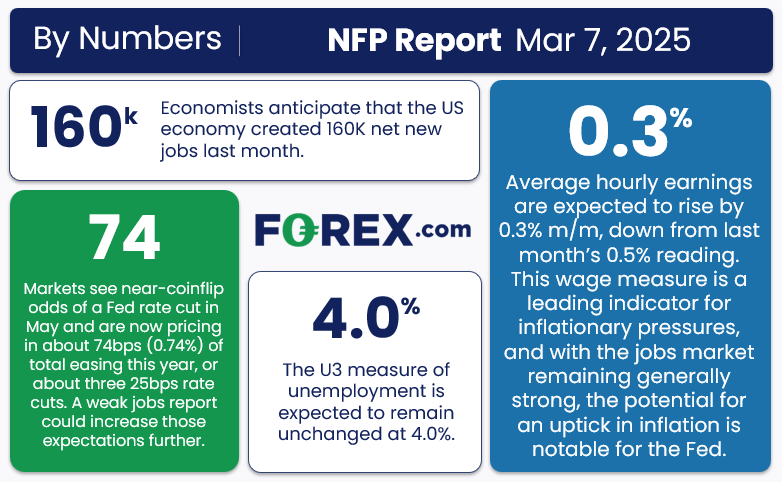

- NFP report expectations: +160K jobs , +0.3% m/m earnings, unemployment at 4.0%

- Leading indicators point to near-expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 150-175K range.

- With the greenback at support and deeply oversold, the risks may be tilted to an upside reaction in the US Dollar Index if the jobs report is at or above expectations, though that may be a high hurdle to clear given the headwinds from DOGE and tariff threats.

When is the February NFP Report?

The February NFP report will be released on Friday, March 7, at 8:30 ET.

NFP Report Expectations

Traders and economists expect the NFP report to show that the US created 160K net new jobs , with average hourly earnings rising 0.3% m/m (4.1% y/y) and the U3 unemployment rate holding steady at 4.0%.

NFP Overview

The Trump 2.0 Administration has shaken things up in more ways than one for the economy and Federal Reserve.

After a fitful stop-and-go start, tariffs on Canada, Mexico, and China went into effect earlier this week, a development which won’t directly impact Friday’s jobs report (which of course relates to the month of February), but the looming uncertainty from last month’s temporary delay may have impacted marginal hiring decisions at US companies.

More significantly, the impact of Elon Musk’s Department of Government Efficiency (DOGE) may start to be seen in the jobs report for the first time this month. While federal employees comprise only about 1.5% of the total workforce (and most of them will remain employed regardless), employment reductions may ripple out to state and local governments, as well as government contractors. If we ultimately see layoffs/buyouts of 300K federal employees as some analysts expect over the next 12 months, that could ultimately result in over 1M fewer jobs (~80K/mo) considering contractors and downstream effects presenting a potential near-term headwind for the labor market.

Despite that risk, expectations for this month’s report are essentially unchanged from last month with economists expecting 160K net new jobs and the unemployment rate to hold steady at 4.0% .

One key area to watch will be the average hourly earnings measure, which ticked up to a 1-year high of 0.5% m/m in the last jobs report.

As the lower left box below suggests, traders now expect nearly a full three interest rate cuts from the Federal Reserve this year, albeit with only a de minimis chance of a cut next month (

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component fell to 47.6 from 50.3 last month.

- The ISM Services PMI Employment component ticked up to 53.9 from 52.3 last month.

- The ADP Employment report showed 77K net new jobs, down from last month’s 186K reading.

- Finally, the 4-week moving average of initial unemployment claims rose to 224K from 217K last month, hitting the highest level of the year so far early in 2025.

Weighing the data and our internal models, the leading indicators point to a near-expectations reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 150-175K range , albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.5% m/m in the most recent NFP report.

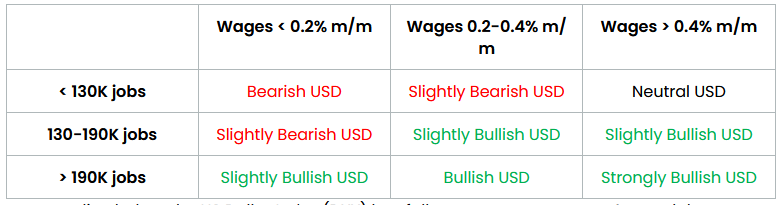

Potential NFP Market Reaction

As we outline below, the US Dollar Index (DXY) has fallen to test support at a 4-month low near 104.00, potentially skewing the odds slightly in favor of a bullish reaction if the jobs report is decent.

US Dollar Technical Analysis – DXY Daily Chart

TradingView , StoneX

The US Dollar Index (DXY) has had a rough month, and as of writing, is sitting at 4-month lows near the 61.8% Fibonacci retracement at the 104.00 handle. With the greenback at support and deeply oversold by any near- or medium-term measures, the risks may be tilted to an upside reaction in the US Dollar Index if the jobs report is at or above expectations.

To the topside, the 200-day MA around the 105.00 handle is a logical area to watch if we do see an oversold bounce. Meanwhile, a soft report would likely compound the Federal Reserve’s worries about the economy and prompt traders to increase their odds of a US recession in 2025, potentially opening the door for a drop to 103.00 or lower next.

Original Post