Brief Reminder

In 2018, US President Donald Trump initiated a trade war update with sanctions against China. Economic disagreement between the United States and China began in 2018 when United States President Donald Trump imposed tariffs and other trade restrictions on China in an attempt to force changes to what he called the United States' "unfair trade practices." These practices include a growing trade deficit, theft of intellectual property, and the forced transfer of American technology to China.

With Trump assuming the presidency again in 2025, the second season of trade wars has officially begun. US President Donald Trump declared 'tax' the 'most beautiful word' in the dictionary before the elections held last year. Trump added a new message to his first term, opposing 'foreign' influence in the US and defending the 'America First' approach. The cornerstone of his trade policy is supporting US companies to grow the economy and increase employment. While experts warn that this may not work in practice, Trump has now taken a series of steps to reduce imports.

US President Donald Trump has announced that the first countries he will impose 25% tariffs on are Canada and Mexico. Also, a new 10 percent customs duty on goods from China will come into effect. US President Donald Trump announced that taxes will also be imposed on goods supplied from the European Union. He said,

"They don't buy our cars, they don't buy our agricultural products, they almost don't buy anything, but we buy everything from them," Trump cited these factors as the reason for these taxes.

It was also emphasized that Trump chose this method to support the labor market in America and to deal with the unemployment problem. As is known, Trump criticized the Biden administration's decisions during his election campaign. He also pointed to the Biden administration as the reason for the ongoing Russia-Ukraine crisis and said,

"According to my plan, American workers will no longer lose their jobs to foreigners, and foreigners will be afraid to lose their jobs to US workers."

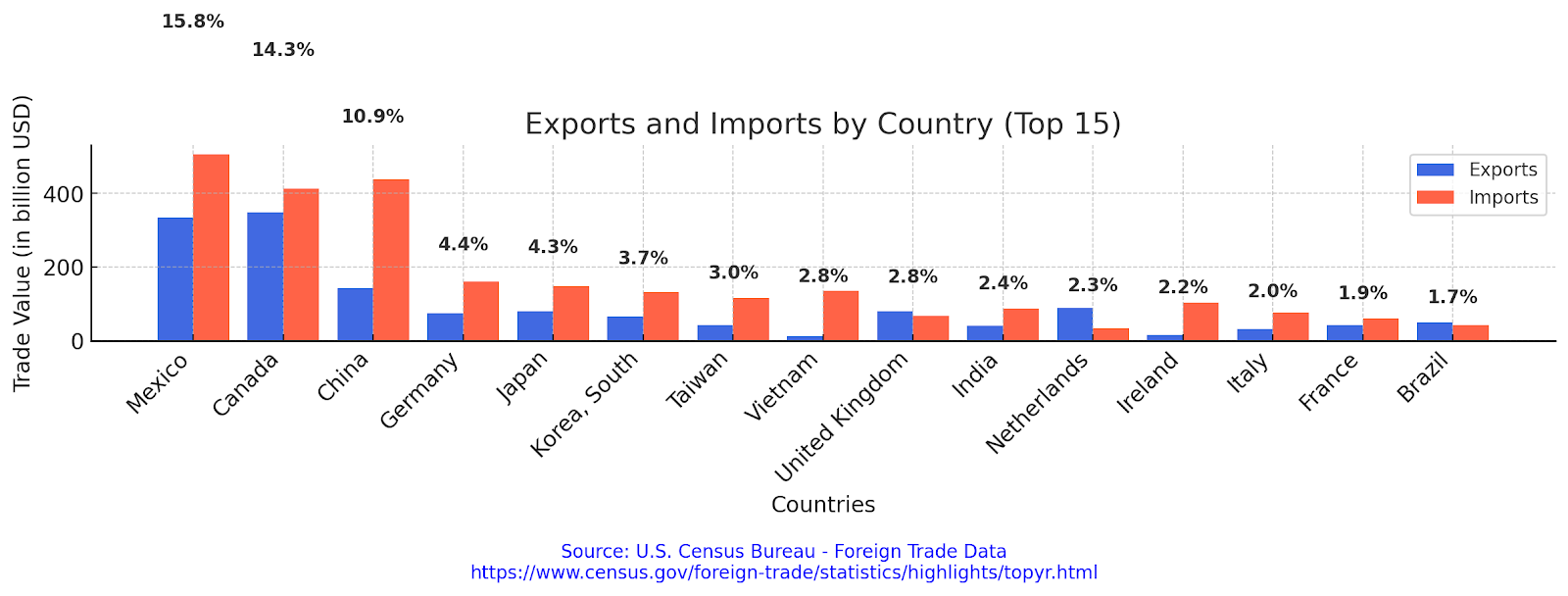

Foreign Trade Partners

Mexico was the main trading partner of the United States with a volume of $839.9 billion the previous year, according to United States Census Bureau data.

Also, Canada's trade volume was announced as $762.1 billion in second place, China's trade volume was announced as $582.5 billion in third place, and Germany's trade volume was announced as $236.0 billion in fourth place.

On the other hand, the U.S has trade deficits with many countries. That means, they buy more than the product produced. When we look at the top 15 countries, only the USA is on the plus side in trade relations with the Netherlands.

America has quickly begun taking steps to restart trade wars. So is the American economy macroeconomically ready for these trade wars?

USA Gross Domestic Product, Last 8 years

In 2017 and 2018, the U.S. economy experienced steady growth, with GDP increasing by 2.5% and 3.0%, respectively.The year 2019 continued this trend with a 2.6% growth rate. However, 2020 saw a slight contraction of 0.9%, primarily due to the economic impact of the COVID-19 pandemic. The economy rebounded strongly in 2021 with a 10.9% increase, followed by continued growth in 2022 at 9.8%. The growth rates moderated in 2023 and 2024, with increases of 6.6% and 5.2%, respectively.

These figures highlight the resilience of the U.S. economy in the face of challenges, as well as its capacity for recovery and sustained growth.

The continuation of the first trade war was supported between 2021 and 2025, while Biden was president. During this period, the COVID crisis and the Russian-Ukrainian conflict in the global market affected the markets more than the trade wars.

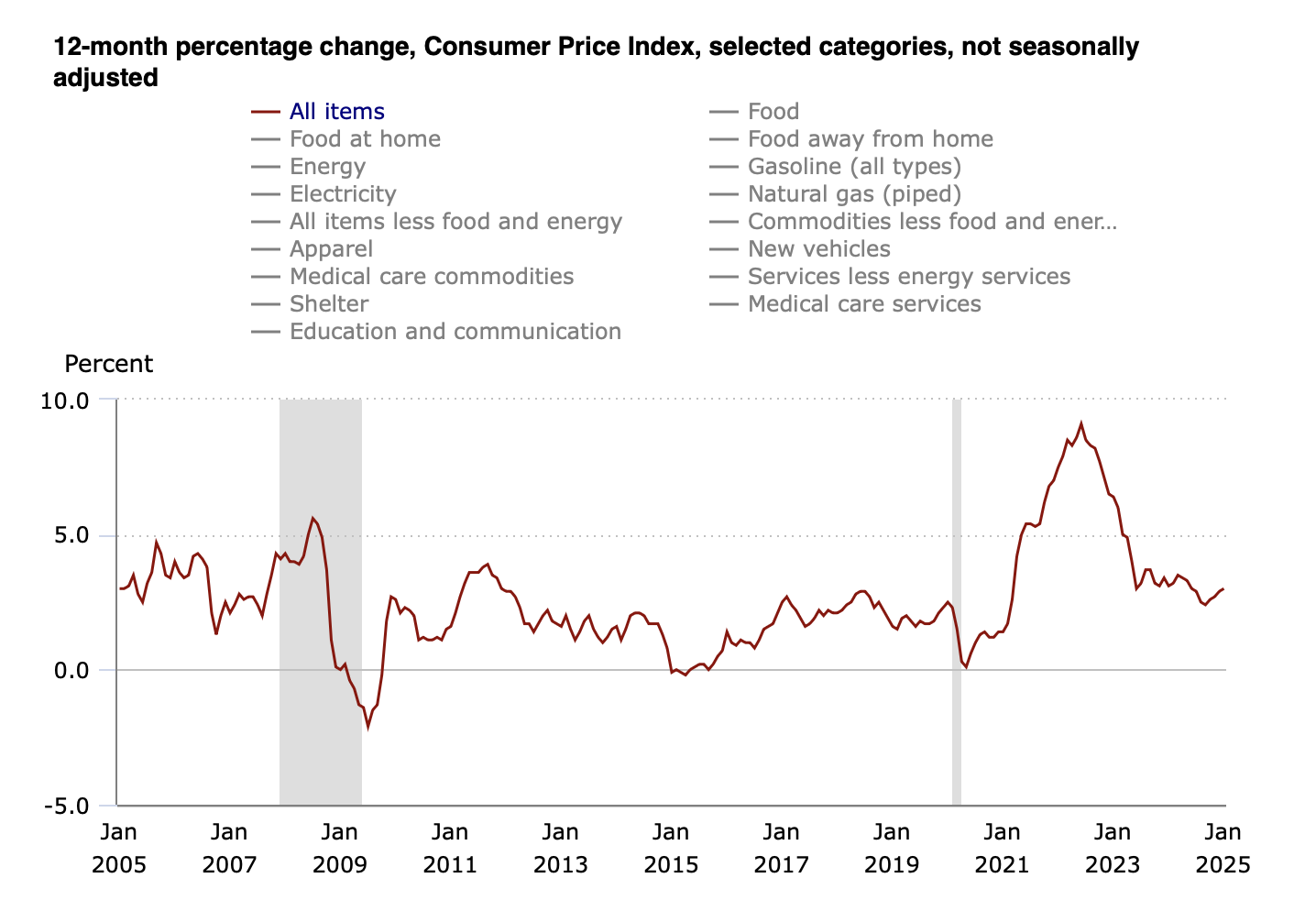

USA Consumer Price Index, Last 8 Years

In 2017 and 2018, inflation remained relatively stable, aligning closely with the Federal Reserve's target of 2%. However, in 2019 and 2020, the rate declined to 1.8% and 1.2% respectively, partly due to subdued economic activity and the onset of the COVID-19 pandemic. The pandemic led to decreased consumer spending and disruptions in supply chains, contributing to lower price pressures.

The year 2021 marked a significant shift, with inflation rising to 4.7%. This surge was driven by factors such as supply chain bottlenecks, increased consumer demand as the economy reopened, and fiscal stimulus measures. The upward trend continued into 2022, with inflation peaking at 8.0%, the highest level in four decades. Contributing factors included persistent supply chain issues, labor shortages, and geopolitical tensions affecting energy prices.

In response to rising inflation, the Federal Reserve implemented monetary tightening measures, including raising interest rates. These actions, along with easing supply chain constraints, led to a moderation in inflation rates to 4.1% in 2023 and further down to 2.9% in 2024, nearing the Federal Reserve's target once again.

It's important to note that these figures are based on historical data up to 2024, and actual inflation rates can be influenced by a multitude of factors, including economic policies, global events, and market dynamics.

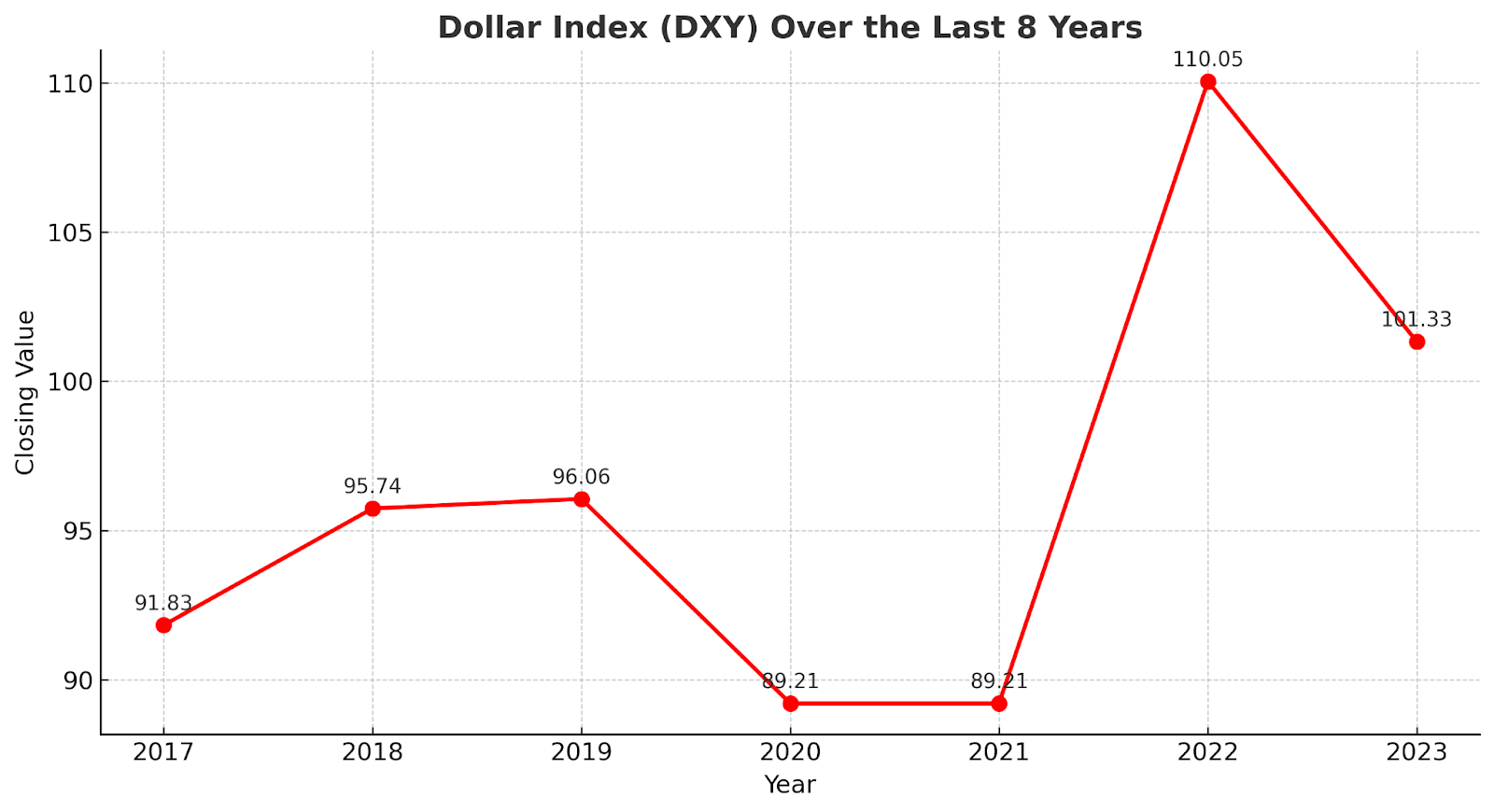

How Changed Is US Dollar Index (DXY)

Over the past eight years, the

US Dollar Index

(DXY) has experienced notable fluctuations, reflecting various economic and geopolitical events. Here's a summary of its annual performance:

In 2022, the DXY reached a peak of 110.05, influenced by Federal Reserve rate hikes and geopolitical tensions, notably the Russian invasion of Ukraine. The subsequent year, 2023, saw a slight decline to 101.33 as inflation stabilized and unemployment remained low. These movements underscore the DXY's sensitivity to global events, monetary policies, and market sentiment.

Technical Analysis

The Dollar Index, Daily

The strong value of the Dollar towards the end of last year in the daily time series can be attributed to foreign policy and the promises of the new President. Failure to fully meet investors' expectations led to value losses. The head and shoulders pattern seen on the chart has reached its downward targets. Depending on China's response to the new tariffs, the decline may continue.

Weekly

In the weekly time series, the bull market continues to dominate. However, the possibility of new tariffs coming into force is increasing pressure. In the Dollar Index, where graphical analysis is dominant, declines may reach the level of 100.450 if there are strong responses to the sanctions imposed by President Trump.

EUR/USD, Weekly

EUR/USD weekly chart reflects a consolidation phase with key resistance at 1.0850 and support at 1.0700. Traders should monitor these levels closely, as a breakout in either direction could set the tone for the pair's next significant move.

Technical analysis indicates that the pair is in a consolidation phase, with strong resistance expected around the 1.12570 level, corresponding to the 50% Fibonacci retracement. Conversely, a decline below the 1.0700 support may resume the downward trend towards the 1.023/0.958 support zone than the minimums.

US100, Weekly

The US100 index, also known as the NASDAQ-100 (NDX), is a stock market index that includes 100 of the largest non-financial and technology-focused companies listed on the NASDAQ Stock Exchange. The index is heavily weighted towards tech giants like Apple (NASDAQ: AAPL ), Microsoft (NASDAQ: MSFT ), Amazon (NASDAQ: AMZN ), Google (Alphabet (NASDAQ: GOOGL )), and Tesla (NASDAQ: TSLA ), making it highly sensitive to trends in the tech industry.

If China responds to US sanctions, the Nasdaq index could be the most affected by the trade war. After the price reaches maximum levels, rebounds are seen. When the price is rising and the RSI oscillator is falling, disagreements arise.

If the trend line is broken and the price continues to fall, the target is seen as 18450.

Ongoing Crises

The problems awaiting solution include the Russia-Ukraine crisis. To end this crisis, US and Russian officials held talks in Saudi Arabia. If the embargoes on Russia are lifted when the crisis ends, it will allow Russia to regain global markets. Russia has a significant share of world trade with its underground resources, gas, and trade volume. Russia's re-emergence in global markets will directly affect commodities in particular. The strengthening of large companies such as Gazprom and Lukoil will also be inevitable.

Conclusion

The US economy continues to develop stably and remain loyal to the determined inflation and interest rates. New tariffs imposed on trading partners will force large companies to invest in the US, which will stimulate the US labor market and make the economy more active. However, new tariffs will not go unanswered. Countries with large economies like China can show that this war is not one-sided. The US's desire to prove once again that it is the speaker and decision-maker among countries goes through the tariffs. On the other hand, it is no longer right to talk about a single big economy concept. Many countries in the world have declared their economic and all-around freedom.