- Dollar suffers from tariff talk and growth concerns

- Wednesday’s aluminum and steel tariff deadline in the spotlight

- US equities in need of a risk-positive sentiment boost

- Oil and cryptos remain under stress

Dollar Suffers From Growth Concerns

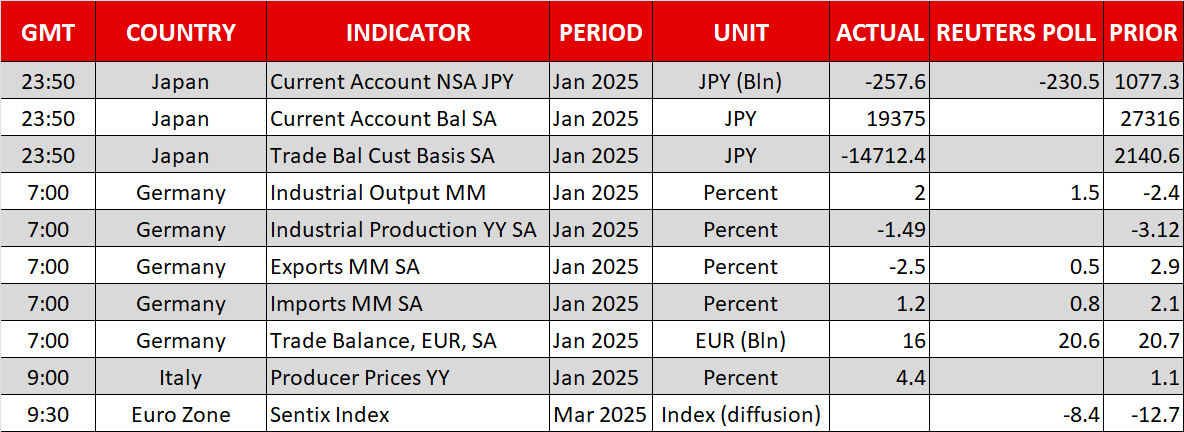

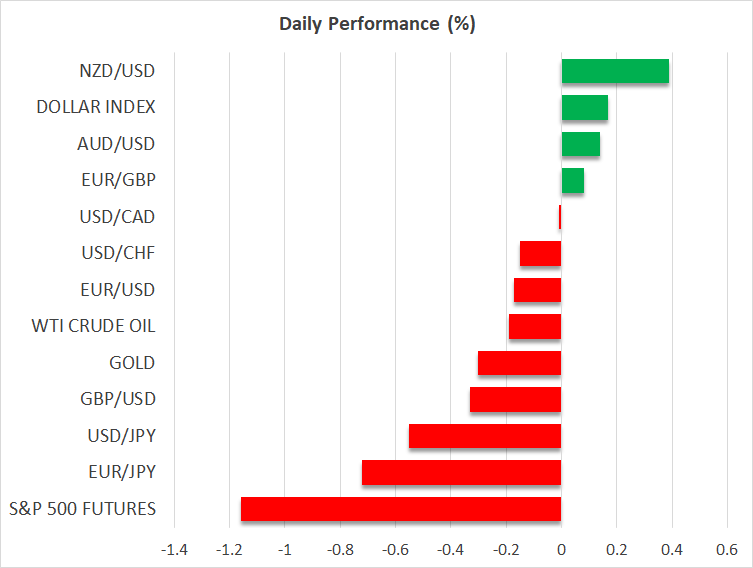

The US dollar is trying to find its footing after shedding almost 4.5% against the euro ( EUR/USD ) last week, with the dollar index recording its worst weekly performance since November 2022. Last Friday’s US jobs market data did not hold any major surprises and, along with the key ISM surveys , continue to point to a US economy growing respectably but gradually losing a bit of steam due to US President Trump’s strategy.

Various Fed speakers, after the nonfarm payroll release, focused mostly on the apparent loss of economic momentum, but also on the recent jump in short-term inflation expectations.

Fed Chair Powell repeated the current "wait-and-see" mode of the

Fed

, but it is evident that tariffs are fueling concerns about both the growth and inflation outlook.

Tariffs Are Expected to Generate Headlines Again

Following Trump’s back-and-forth about tariffs on both Canada and Mexico, the focus has shifted to the aluminum and steel tariffs that are expected to start on March 12. Secretary of Commerce Lutnick has downplayed the possibility of exemptions being enacted on Wednesday, but Trump could easily change his stance. He has an array of options, from imposing these tariffs on all imports to deferring action until April 2, along with the reciprocal tariffs’ deadline.

Someone could say that Trump has adopted a rather inconsistent strategy to disrupt equity markets and eventually force the Fed to cut rates, despite the latter being less than confident about the inflation outlook. This possible strategy by Trump appears to be working up to now, as the major US equity indices are around 5.5-9.5% below their recent all-time highs. The Nasdaq 100 index is suffering the most, giving back all the gains since the November 2024 US Presidential election.

The situation could become even more critical this week as, given the absence of Fedspeak due to the usual blackout period, the market’s attention will fall squarely on a possible government shutdown and Wednesday’s US CPI report. On Tuesday, the House of Representatives will vote on a continuing resolution to fund the government until September 30.

Meanwhile, a soft inflation report on Wednesday, along with further weakness in US equities, could fuel expectations for a dovish tilt at the March 19 Fed meeting. The market is pricing in 75bps of easing during 2025 and assigning a 40% chance for a rate cut at the May 7 meeting. Interestingly, Sunday’s CPI and PPI prints from China surprised to the downside, with deflation concerns returning to market participants' minds.

Euro Gains but Outlook Remains Clouded

Despite the euro recording one of the strongest weeks on record, the situation remains difficult on the ground. While the ECB announced another rate cut last week and President Lagarde hinted at a pause at the April meeting, stronger data prints are necessary for the current market optimism to become entrenched and act as a basis for the rest of the year.

However, nothing comes easy in the euro area. For example, despite last week’s exuberant rhetoric after the special EU summit, Germany and France are now openly disagreeing about how to spend the €150bn earmarked for common European defense projects. On the positive side, the CDU/CSU and SPD parties have completed the first round of preliminary talks about the formation of the new coalition. The focus now shifts to getting the debt break amendment through the current parliament, which based on the current newsflow appears to be a colossal task.

Oil Tries to Climb Above Key Area; Cryptos Fail to Rally Again

With gold trading sideways a tad above $2,900, the focus remains on oil prices. After trading at the lowest level since May 2023, oil is trying to find a new price balance above the key 66.95-67.80 area. However, the continued negative newsflow and increased concerns about the global growth outlook remain strong headwinds, suppressing demand.

Finally, the cryptocurrency market is a mess. With Trump’s “Strategic Reserve” announcement disappointing, as it did not contain a commitment to gradually build up reserves through direct purchases, Bitcoin is trying to stay above $80k and Ethereum is fighting for the $2,000 level.