(I have to preface this because the

data

operates on a one-month lag. So this latest data release this morning is as of the end of January. And we all know a lot has changed since then.)

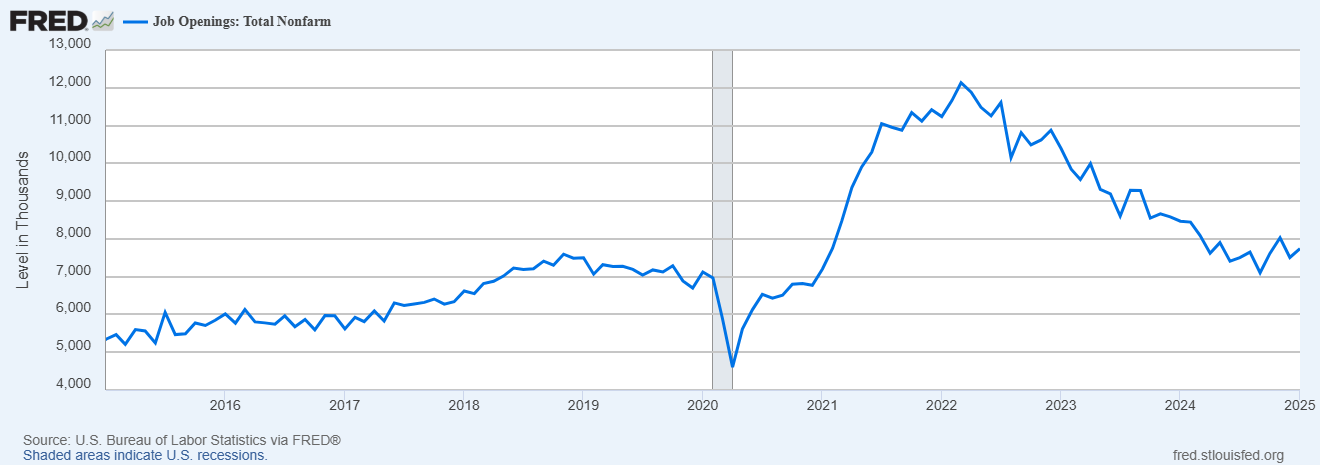

Total job openings increased +232K to 7.740 million in January.

After a spike in openings post-COVID, levels have come down to normal. With the year-over-year growth rate remaining negative since October 2022.

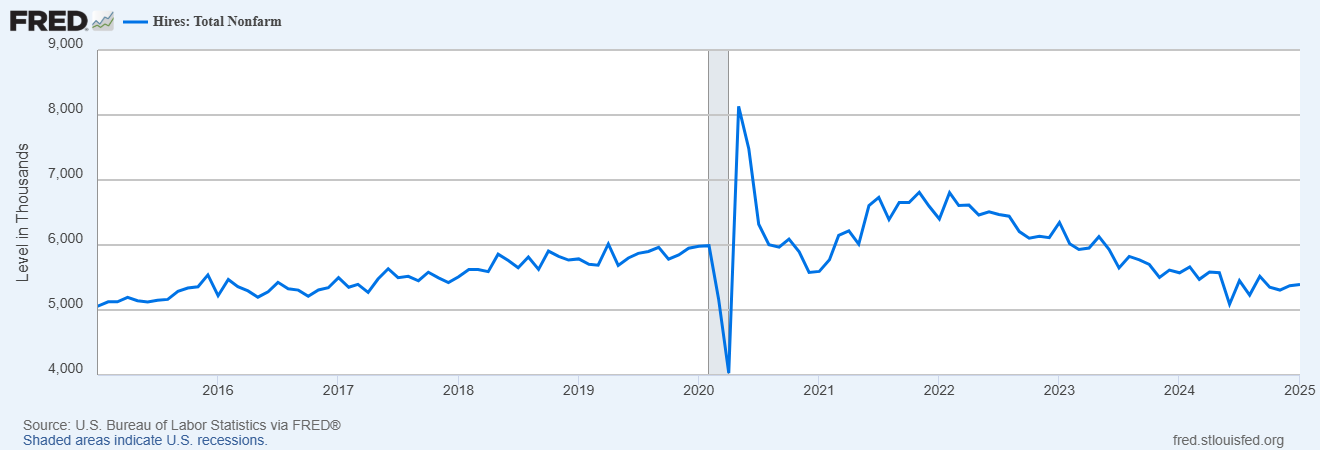

Total hires increased 19K to 5.393 million. Private hires increased +18K while government increased +2K. The industries with the biggest decrease was leisure & hospitality (-50K) and Food & services (-67K).

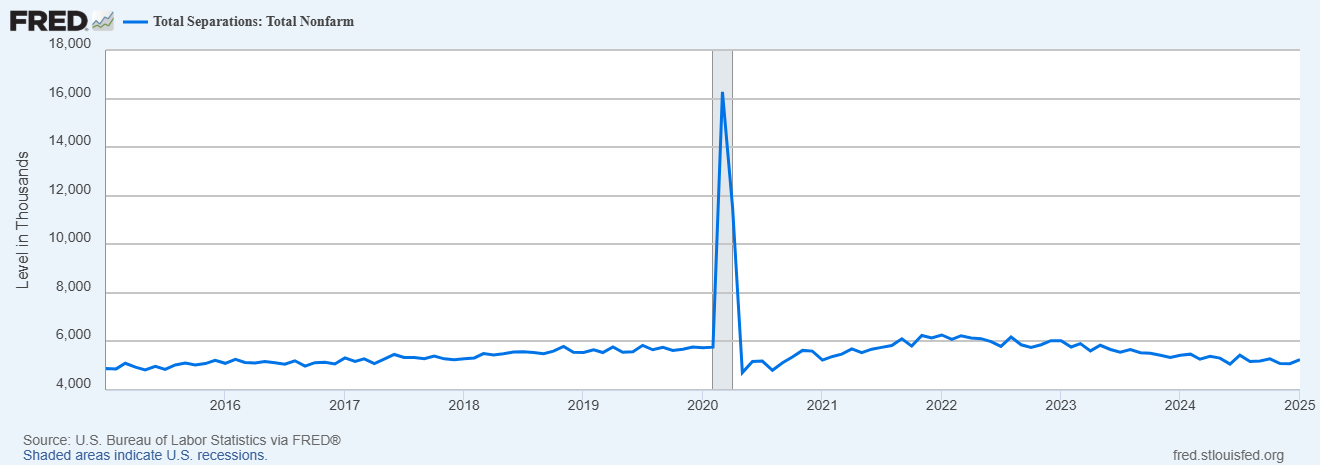

Total separations increased 170K (Total separations include quits, layoffs and discharges, and other separations.) to 5.52 million. Professional & business services being the hardest hit industry with 106K more separations than the prior month.

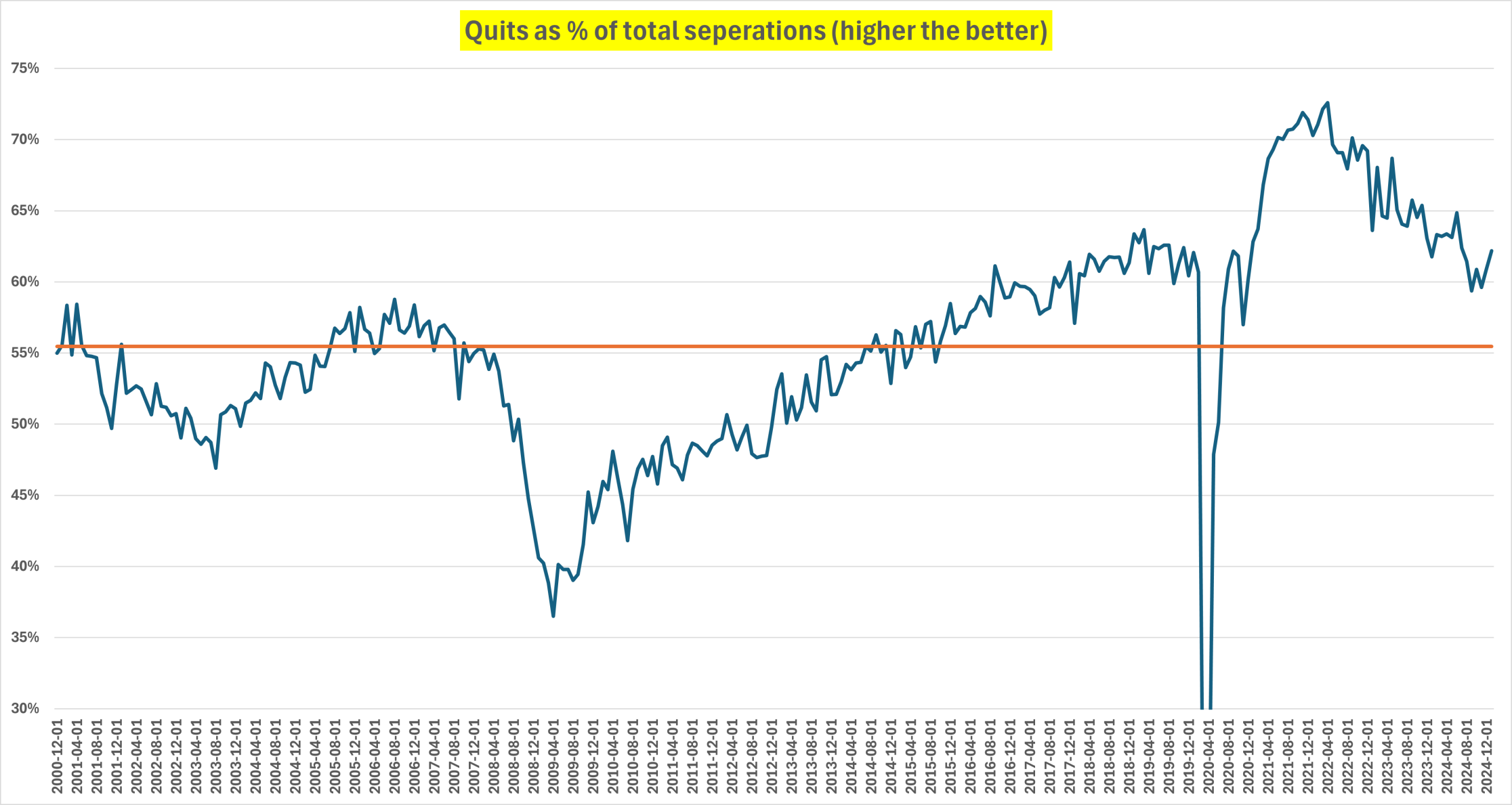

Of those 5.252 million separations, 3.266 million of them were people quitting their jobs.

With quits making up 62% of total separations (above the historical average of 55%), it means more people are voluntarily leaving their jobs. Which is a sign of a stable job market, since in many cases you don't quit your job unless you have another lined up.

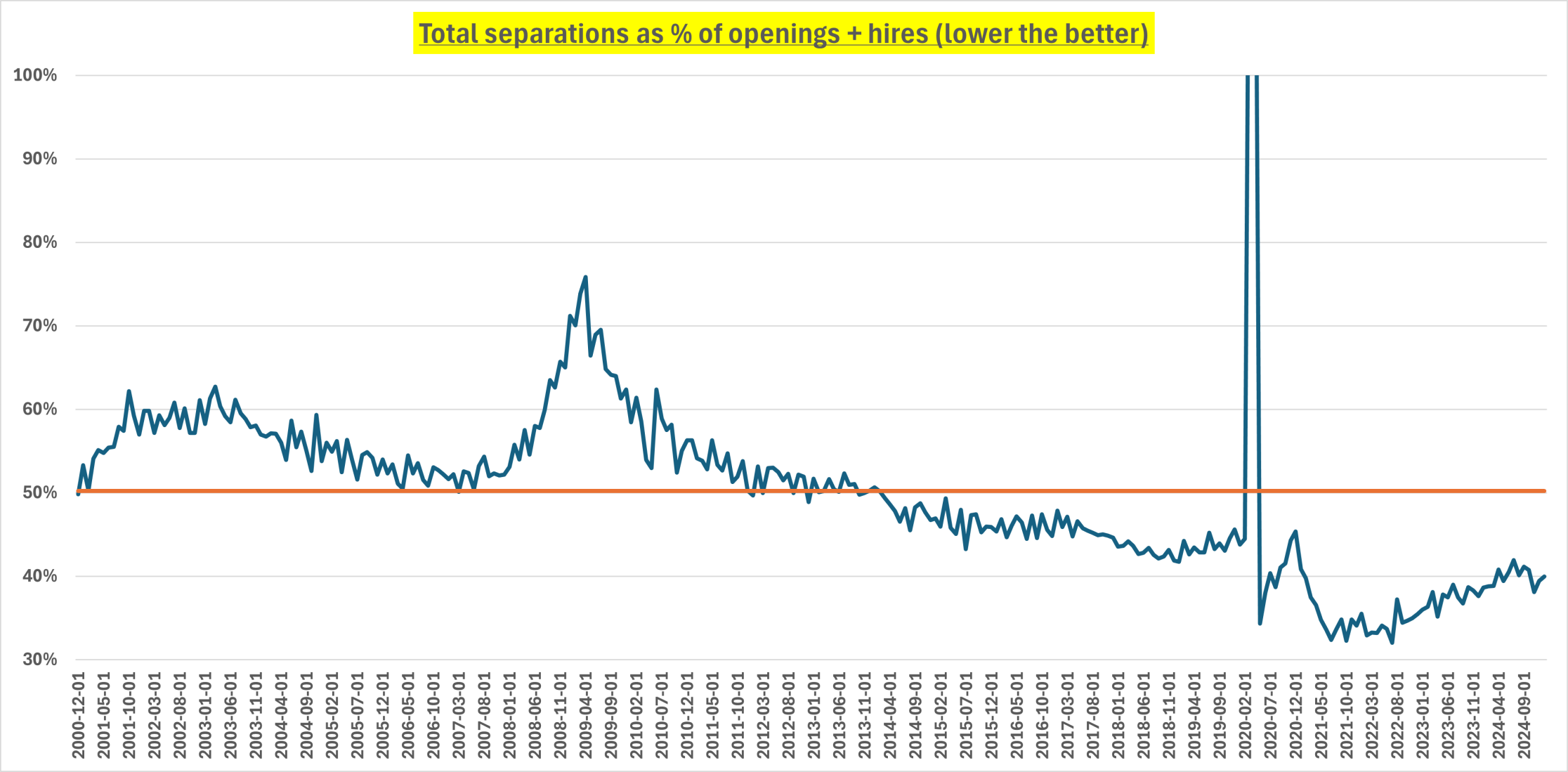

Total separations came to 40% of hires plus job openings. Well below the historical average of 50%, and indicative of a healthy job market.

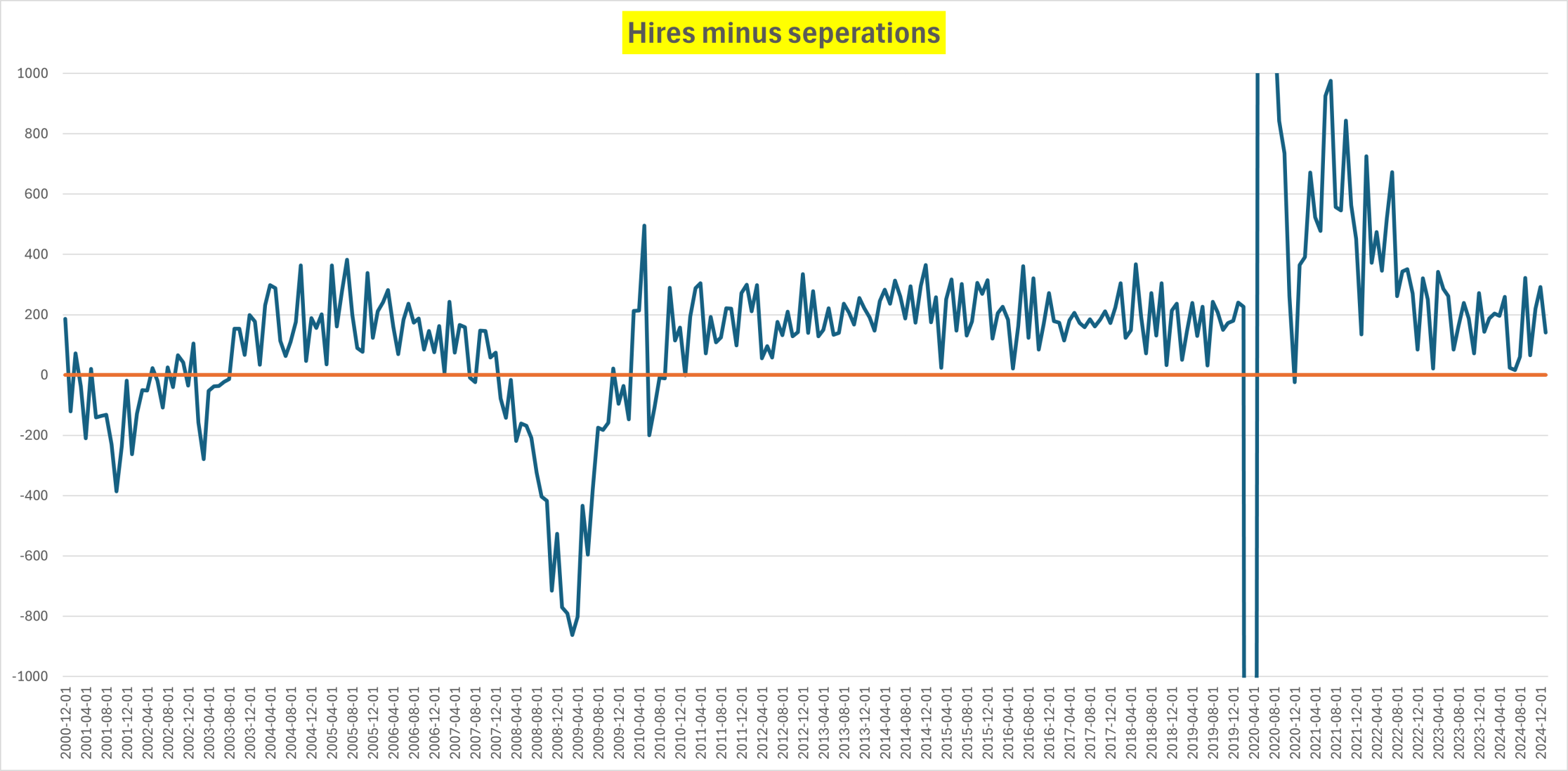

But anyone who has looked for work in recent times knows the frustration of seeing job listings that aren't legitimate. Openings can be manipulated, while hires can not. So, another data point I follow is the number of hires minus the total number of separations. And this is also signaling a stable job market, with hires easily exceeding separations.

So companies are hiring at a rate above total separations, while the total number of people voluntarily quitting remains at levels that have been associated with a stable job market.

Once again, its a lagging indicator so take what you will from any of this. Personally I don't put a lot of weight on these data points but the market and the Fed seem to.