Talking Points

- Dow Jones Industrial Average (DJIA) paused at measured resistance of 18,000

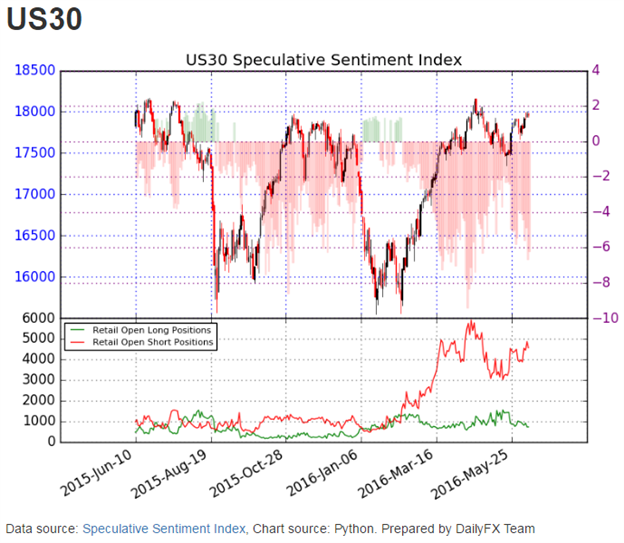

-Use Sentiment to confirm a successful break higher as SSI sits at -6.2

-Considering buy the dip strategy on moves back towards 17,600 and 17,300

Dow Jones Industrial Average (DJIA) rejected at the 18,000-18,075 resistance level cited yesterday . In the report, we mentioned “we are beginning to reach a cross roads where prices could accelerate higher or provide a little shake out lower prior to another bull run.”

It is too early to tell if US30, a CFD which tracks the DJIA , is simply gathering strength for a punch higher or if this rejection will dig deeper into lower levels.

On the one hand, sentiment as measured through the Speculative Sentiment Index (SSI) suggests a burst higher may happen sooner than later. The SSI reading has dropped from -5.2 yesterday to -6.2 as we write. Long positions have shrunk 14% versus yesterday's reading.

However, the technical picture allows for a shakeout lower. Therefore, we will let the market dictate to us as we focus on some key levels.

First, the ii-iv channel crosses near 17,880 (red line on chart below). A break below this level does indicate some type of correction is at hand. Above this level we need to keep the door open for a break higher…especially if SSI continues to drop.

If DJIA does break below 17,880, then look for potential support near 17,600 or possibly a retest towards 17,300.

The bigger picture bias continues to be to the bull side and that we are looking to buy dips or buy a breakout higher.

Interested in a longer forecast for equities? Download our quarterly equities guide .

Suggested Reading:

S&P 500: Short-term Chart Weakening

Surge in Silver Prices Pushes Momentum Readings into Rare Territory

---Written by Jeremy Wagner, Head Trading Instructor, EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy's recent articles at his Bio Page .