Earlier this month, while the US 10-year yield was at 3.9670%, we wrote that it was likely headed towards 5.50% in the months ahead. That prediction was based entirely on our Elliott Wave interpretation of its daily chart, which showed that the decline from just over 5% to just under 3.60% was corrective.

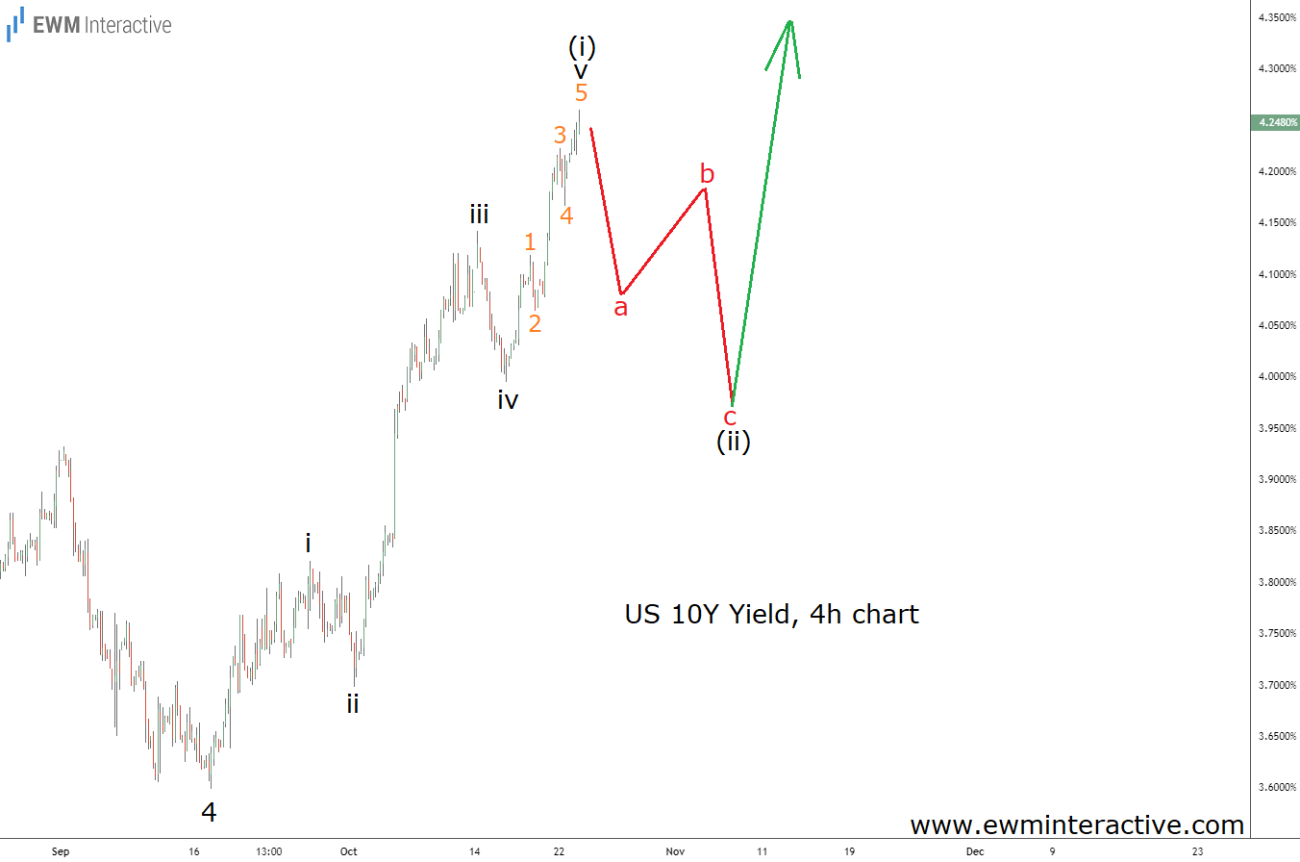

Therefore, the preceding uptrend was still in progress and likely to resume. Today, the yield on the 10-year US government bond reached 4.26%, so it is fair to say that things are so far going to plan. In fact, the structure of the rally from 3.5990% is a very clear five-wave impulse, confirming that the uptrend has resumed.

We’ve labeled the pattern i-ii-iii-iv-v in what should be wave (i) of the bigger wave 5. The five sub-waves of wave ‘v’ are visible, as well. If this count is correct, it makes sense to expect a three-wave decline in wave (ii) to 4.00% – 3.90%, before the bulls return in wave (iii). Even if wave (ii) drags the US10Y yield lower than 3.90%, the positive outlook would remain intact, unless 3.5990% gives up.

Original Post