- As reported yesterday, October inflation rose 0.2% from a month ago, the same monthly pace as July, August, and September as inflation is finding its balance.

- Despite the fairly steady monthly pace of inflation, the annual rate rose to 2.6% and is attributed to abnormal and large declines in gas prices back in October 2023. It does not appear to be signaling a new trend but rather base effects.

- But most importantly, markets seem preoccupied with the inflationary impact of rogue tariffs. From lessons learned during the 2018 tariffs, consumer prices may not reflect the full cost of a tariff, although somebody must bear the burden.

Finding Steady State

Several categories of consumer prices appear to be entering their steady state. Now with October data, we have four consecutive months where headline inflation rose 0.2%. Excluding car prices, core goods prices fell, and services, less shelter, decelerated.

One of the most debated components to measure consumer inflation is Owners’ Equivalent Rent (OER), which has a 27% weight in the Consumer Price Index (CPI). OER is an imputed value of what homeowners would hypothetically have to pay for their homes if they were renters and not owners.

Fed Set to Cut

The cooling of the labor market, the easing of the important components of inflation, and tight monetary policy will incentivize the Federal Open Market Committee (FOMC) to cut rates by 25 basis points (0.25 of a percentage point) at the December meeting but could prepare investors for their inclination to pause in January.

What Really Matters Are Tariffs

Investors are preoccupied — and rightfully so — with inflation risks from tariffs. As the International Trade Administration thoroughly explains, a tariff is a tax on the customs value of an imported product. Who bears the cost of the tax? It’s not always fully borne by end consumers. According to a National Bureau of Economic Research (NBER) paper, foreign countries bore “close to half the cost of the steel tariffs.” Of course, there are two very important considerations to include in the analysis: exclusions and item-specific markets.

During Trump’s first presidency, he granted exclusions for over 2,200 products based on businesses’ defense that the tariff causes considerable harm, or the foreign product is not available in the U.S. Ironically, Biden kept most of Trump’s tariffs and put additional tariffs in place in May of this year.

What Happened to Inflation in 2018–2019?

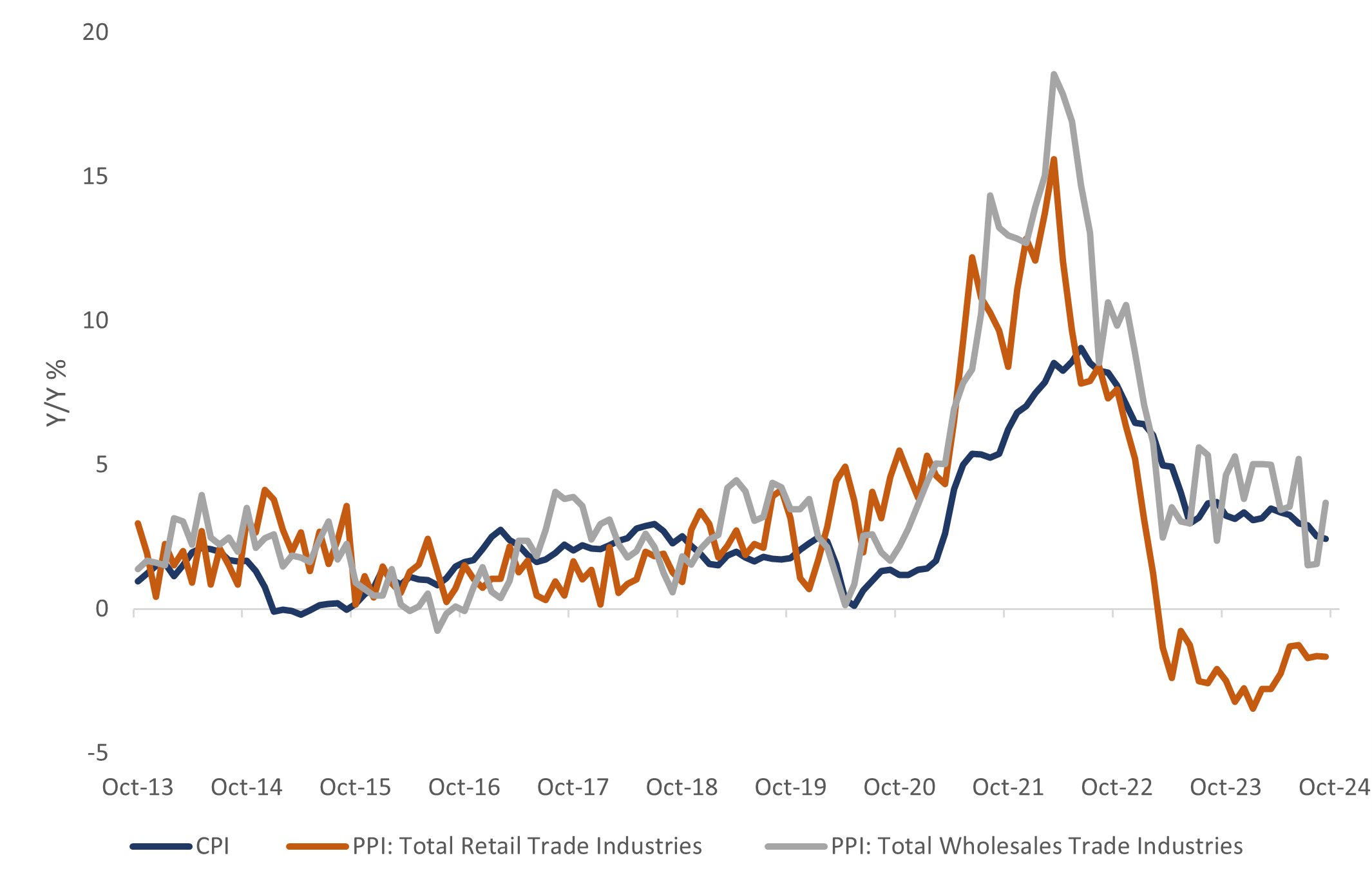

In this blog, we notice that tariffs imposed in early 2018 impacted producer prices more than consumer prices as wholesalers did not fully pass along the cost of importing

Wholesalers Didn't Fully Pass Along Tariffs of 2018–2019

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Summary

In general, a tax from tariffs, or any other policy, creates a deadweight loss to the economy. Businesses and consumers feel the impact; employment typically shrinks, and our foreign trading partners often retaliate. Among the possible positive impacts from these types of trade actions are negotiating opportunities, shifts toward more domestic production, and maybe some humanitarian improvements as well. Maybe trade threats could punish foreign businesses who exploit their workers with inhumane working conditions. We could hope the world becomes a safer and fairer place, even for workers in other parts of the globe.

As it relates to the investment outlook, markets are right to have caution as we enter 2025. There are economic headwinds, but so far, a stable consumer, looser Fed policy, and businesses planning to ramp up capital expenditures may keep supporting this market. Caveat emptor.